As December 2025 unfolds, global markets are closely watching the Federal Reserve's final meeting of the year, with hopes for an interest rate cut buoying major U.S. stock indexes to new heights. Amidst this backdrop of cautious optimism and mixed economic signals—such as a contracting manufacturing sector and expanding services—investors are increasingly turning their attention to small-cap stocks that may be undervalued or overlooked in the broader market rally. In this environment, a good stock often possesses strong fundamentals, resilient business models, and potential for growth despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| HG Metal Manufacturing | 3.31% | 8.63% | 5.71% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Taiyo KagakuLtd | 0.66% | 6.12% | 4.54% | ★★★★★☆ |

| C. Mer Industries | 76.92% | 13.56% | 68.93% | ★★★★★☆ |

| Xinya Electronic | 51.57% | 28.63% | 3.77% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| Suzhou Fengbei Biotech Stock | 42.33% | 18.50% | 13.12% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shareate Tools (SHSE:688257)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shareate Tools Ltd. manufactures and sells cemented carbide products and drilling tools both in China and internationally, with a market cap of CN¥7.13 billion.

Operations: Shareate Tools generates revenue primarily from the sale of cemented carbide products and drilling tools. The company has a market cap of CN¥7.13 billion.

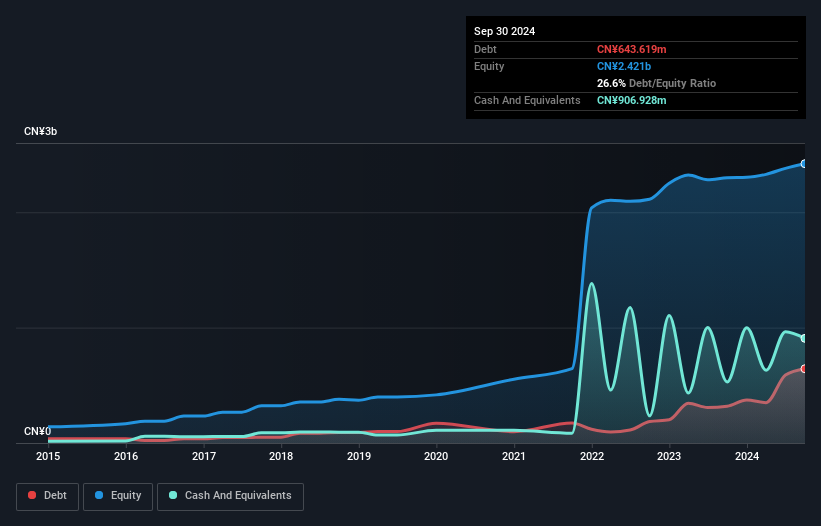

Shareate Tools has shown impressive growth, with earnings rising 23.9% over the past year, outpacing the Machinery industry average of 6.1%. Over five years, its debt to equity ratio increased from 22.6% to 38.2%, yet interest payments are well covered by EBIT at a solid 44.2 times coverage. The company reported sales of CNY 1,788 million for the first nine months of 2025, up from CNY 1,354 million last year and net income grew to CNY 165 million from CNY 135 million in the same period. Its price-to-earnings ratio stands at an attractive level compared to the broader CN market average.

Union Semiconductor (Hefei) (SHSE:688403)

Simply Wall St Value Rating: ★★★★★★

Overview: Union Semiconductor (Hefei) Co., Ltd. specializes in high-end advanced packaging and testing services for display driver chips in China, with a market cap of approximately CN¥12.87 billion.

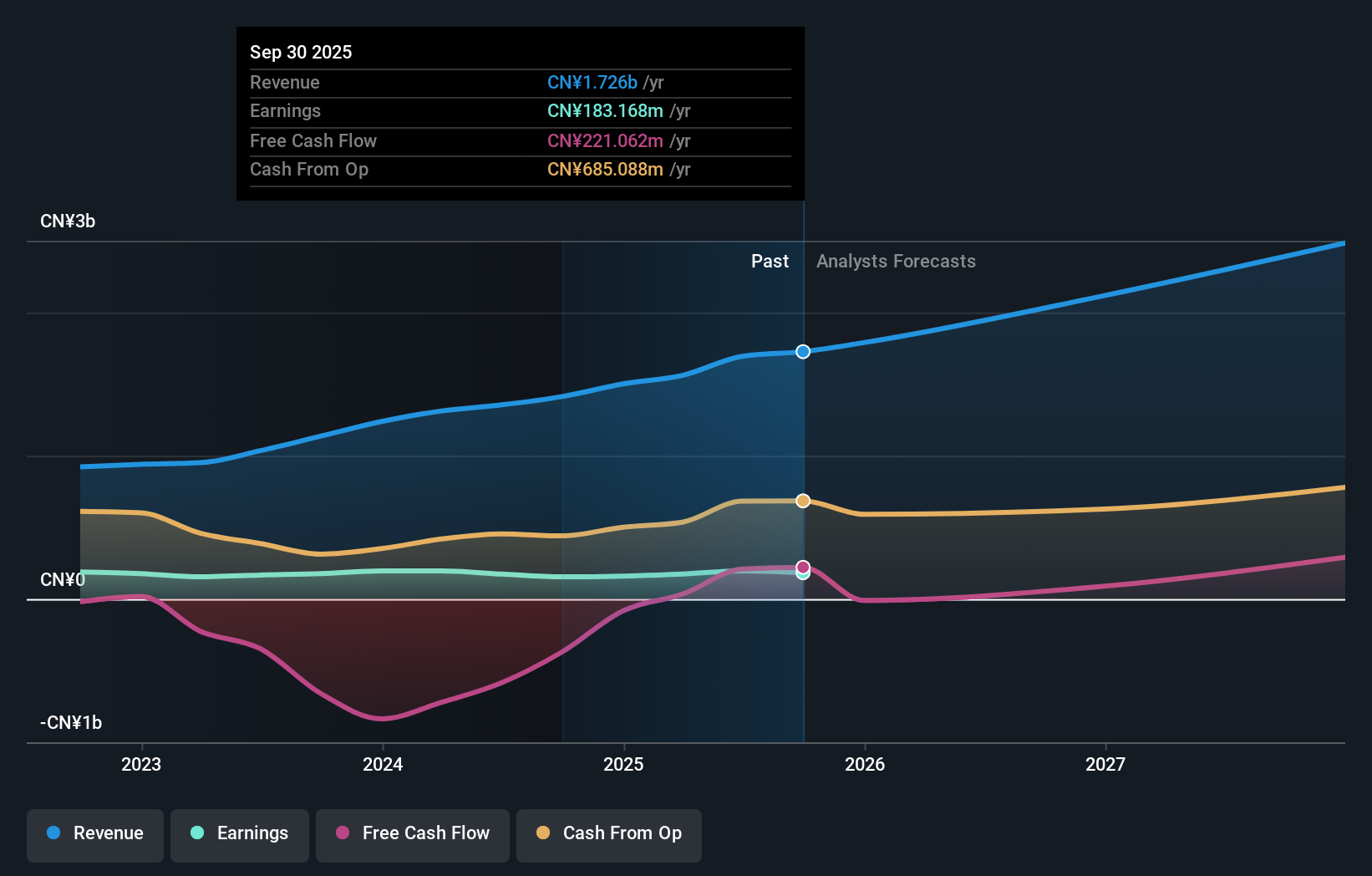

Operations: Union Semiconductor generates revenue primarily from its semiconductor segment, amounting to CN¥1.73 billion.

Union Semiconductor's recent performance showcases its potential as a noteworthy player in the semiconductor industry. Over the past year, earnings surged by 18.4%, outpacing the industry average of 11.4%. The company has successfully reduced its debt to equity ratio from 65% to 29.5% over five years, demonstrating prudent financial management with a satisfactory net debt to equity ratio of 3.9%. Revenue for the nine months ending September was CNY 1,295 million, up from CNY 1,070 million last year, while net income rose to CNY 124 million from CNY 101 million, reflecting strong operational efficiency and growth prospects in a competitive market space.

Shandong Dawn PolymerLtd (SZSE:002838)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shandong Dawn Polymer Co., Ltd. is engaged in the development, production, sale, and servicing of thermoplastic elastomers, modified plastics, and master batches both in China and internationally with a market capitalization of CN¥10.90 billion.

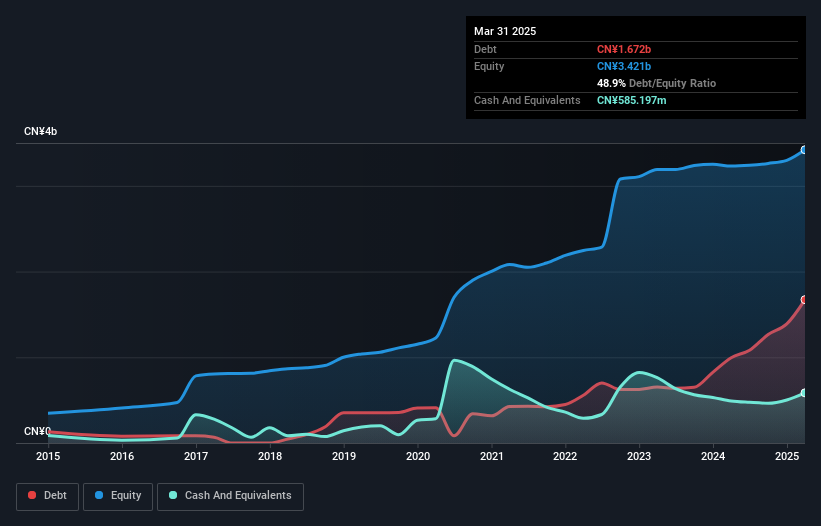

Operations: Dawn Polymer generates revenue primarily from the sale of thermoplastic elastomers, modified plastics, and master batches. The company's net profit margin shows notable fluctuations over recent periods, reflecting variations in operational efficiency and market conditions.

Dawn Polymer seems to be navigating its niche with a mix of strategic adjustments and financial resilience. Over the past year, earnings rose by 23.5%, outpacing the industry’s 7.5% growth, indicating strong operational performance. Despite a debt to equity ratio climbing from 18% to 37.5% over five years, interest payments are well covered at 6.1 times EBIT, reflecting sound financial management. Recent changes in company bylaws and an increase in registered capital may signal strategic shifts aimed at future growth prospects, supported by high-quality earnings and satisfactory net debt levels at 28.7%.

- Delve into the full analysis health report here for a deeper understanding of Shandong Dawn PolymerLtd.

Gain insights into Shandong Dawn PolymerLtd's past trends and performance with our Past report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 3010 Global Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002838

Shandong Dawn PolymerLtd

Develops, produces, sells, and services thermoplastic elastomer, modified plastic, master batch, and other products in China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026