As global markets show signs of optimism with easing core U.S. inflation and strong bank earnings, major indices like the S&P 500 and Russell 2000 have rebounded, reflecting a positive shift in investor sentiment. Amidst this backdrop, identifying promising small-cap stocks can be crucial as they often offer unique growth opportunities that are less influenced by broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Commercial Bank International P.S.C | 0.33% | 5.59% | 28.69% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shareate Tools (SHSE:688257)

Simply Wall St Value Rating: ★★★★★★

Overview: Shareate Tools Ltd. is a company that manufactures and sells cemented carbide products and drilling tools in China, with a market capitalization of CN¥3.22 billion.

Operations: Shareate Tools generates revenue primarily from the sale of cemented carbide products and drilling tools. The company's financial performance is influenced by its ability to manage production costs and optimize pricing strategies in a competitive market.

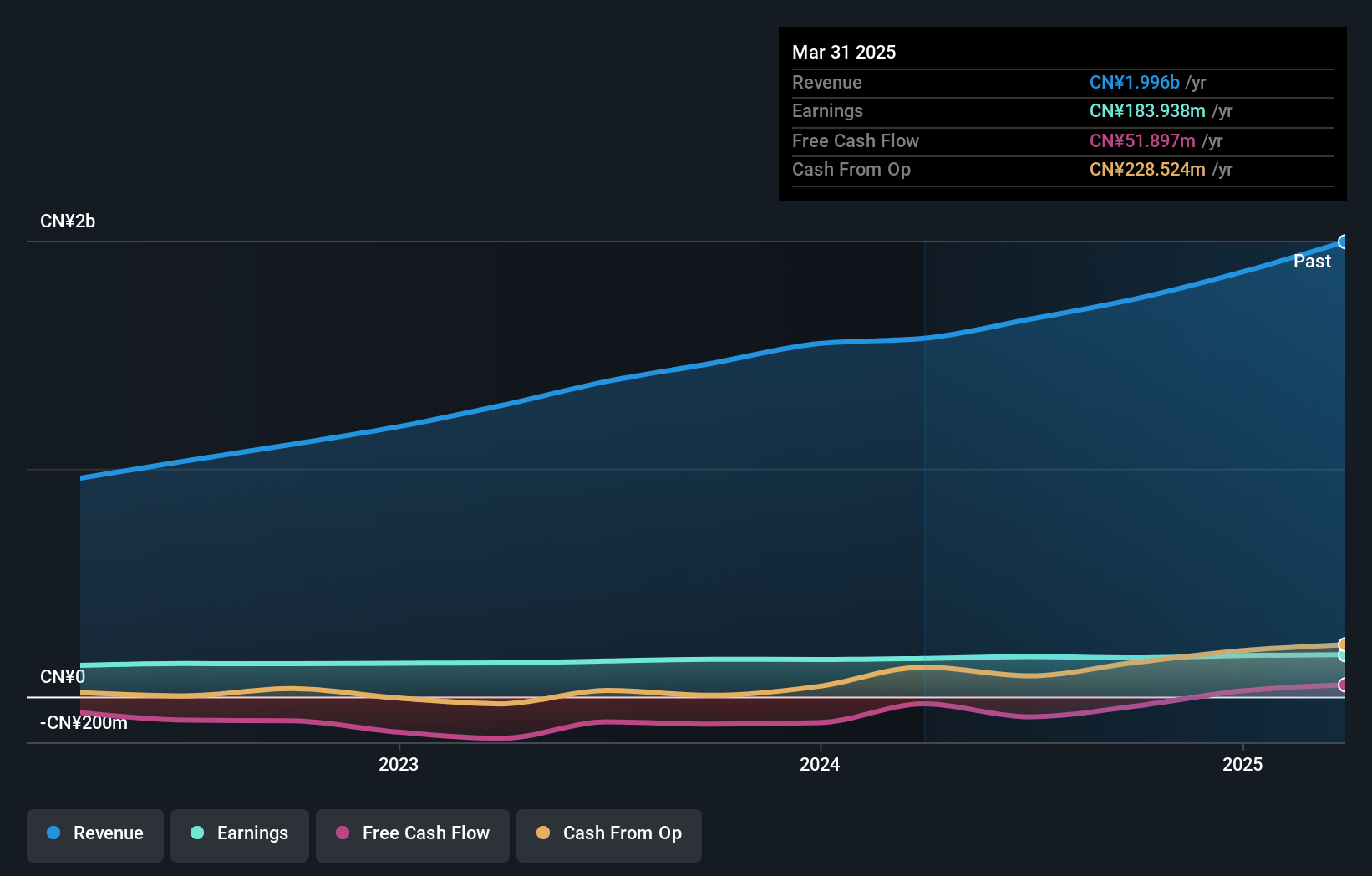

With a knack for outperforming its industry, Shareate Tools has seen earnings grow by 3.8% over the past year, eclipsing the Machinery industry's -0.2%. The company's net income rose to CNY 134.81 million from CNY 127.31 million, reflecting robust performance in a competitive market. Despite not being free cash flow positive, its debt-to-equity ratio improved from 33.2% to 26.6% over five years, suggesting prudent financial management with more cash than total debt on hand—a comforting sign for stakeholders eyeing stability and growth potential in this dynamic sector.

- Take a closer look at Shareate Tools' potential here in our health report.

Gain insights into Shareate Tools' past trends and performance with our Past report.

MLS (SZSE:002745)

Simply Wall St Value Rating: ★★★★★★

Overview: MLS Co., Ltd. is involved in the research and development, production, and sale of LED package and application products with a market cap of CN¥12.36 billion.

Operations: Revenue for MLS primarily stems from its LED package and application products. The company has a market cap of CN¥12.36 billion, indicating its significant presence in the industry.

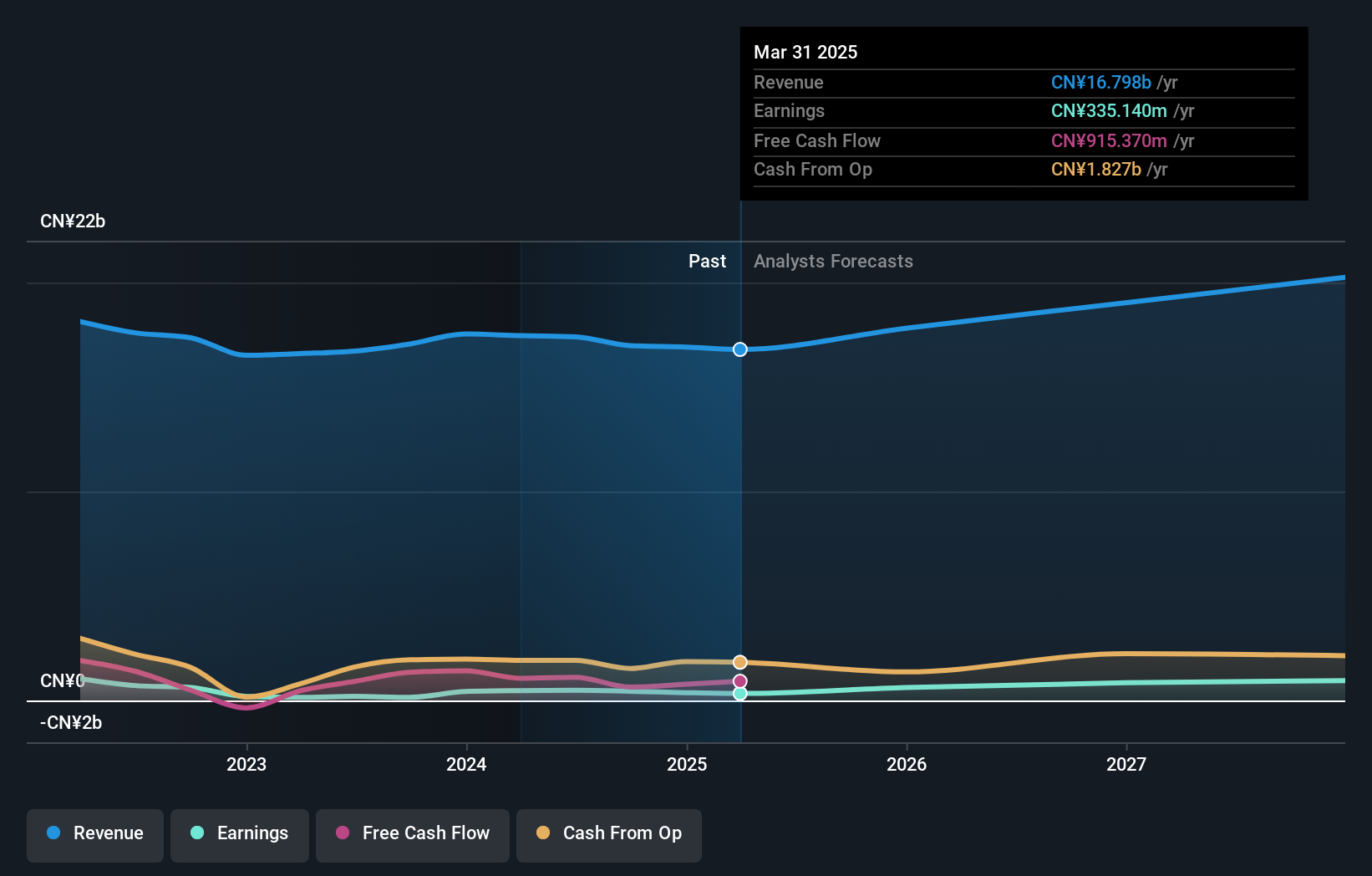

MLS, a small player in the semiconductor industry, has demonstrated impressive earnings growth of 194.3% over the past year, outpacing the industry's 12.1%. The company is trading at a price-to-earnings ratio of 28x, which is below the CN market average of 34.8x, suggesting it offers good value relative to peers. Over five years, MLS has significantly reduced its debt-to-equity ratio from 103.8% to just 3.4%, indicating improved financial stability. Recent events include a special shareholders meeting and dividend affirmations for A shares at CNY 3.60 per share in November last year.

- Dive into the specifics of MLS here with our thorough health report.

Review our historical performance report to gain insights into MLS''s past performance.

artience (TSE:4634)

Simply Wall St Value Rating: ★★★★★☆

Overview: Artience Co., Ltd. operates in the colorants and functional materials, polymers and coatings, printing and information, and packaging materials sectors across Japan, China, Europe, Africa, Asia, the Americas, and internationally with a market cap of ¥156.56 billion.

Operations: Artience Co., Ltd. generates revenue primarily from four segments: packaging materials (¥89.02 billion), polymers and coatings (¥85.51 billion), printing and information (¥82.75 billion), and colorants and functional materials (¥85.52 billion).

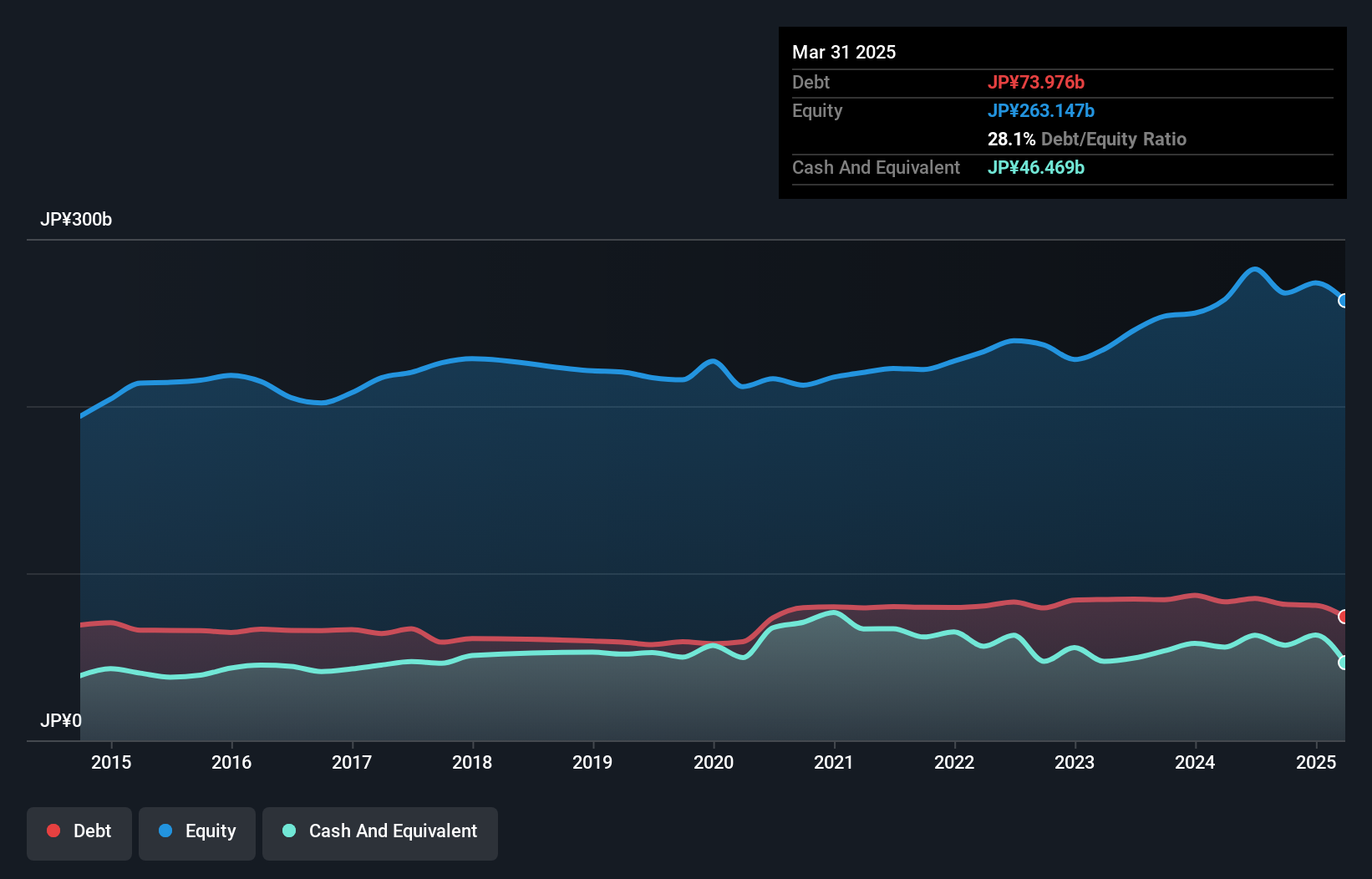

Artience, a nimble player in its sector, has shown impressive financial strength with earnings surging by 94.9% over the past year, outpacing the Chemicals industry average of 13.7%. The company is trading at a significant discount to its estimated fair value, offering potential upside for investors. Its debt management appears prudent with a net debt to equity ratio of 9.1%, deemed satisfactory and well covered by EBIT at 38.8x interest payments. Recent buybacks saw Artience repurchase over 4% of shares for ¥7,498 million, signaling confidence in its market position and future growth prospects.

- Click to explore a detailed breakdown of our findings in artience's health report.

Evaluate artience's historical performance by accessing our past performance report.

Summing It All Up

- Access the full spectrum of 4655 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4634

artience

Engages in the colorants and functional materials, polymers and coatings, printing and information, and packaging materials businesses in Japan, China, Europe, Africa, Asia, the Americas, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives