- Taiwan

- /

- Communications

- /

- TWSE:6442

Undiscovered Gems with Potential for February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and cooling labor market data, small-cap stocks have shown resilience amidst broader economic fluctuations. With the S&P 600 Index reflecting varied investor sentiment, identifying promising small-cap opportunities requires a focus on companies with strong fundamentals and potential for growth despite current market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Hangzhou Kaierda Welding RobotLtd (SHSE:688255)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Kaierda Welding Robot Co., Ltd. specializes in the research, development, manufacture, and sale of industrial welding equipment and welding robots in China with a market cap of CN¥4.26 billion.

Operations: Kaierda generates revenue primarily from the sale of industrial welding equipment and welding robots. The company's financial performance is influenced by its ability to manage costs associated with manufacturing and development activities. Notably, Kaierda's gross profit margin has shown variability, reflecting changes in production efficiency and cost management strategies.

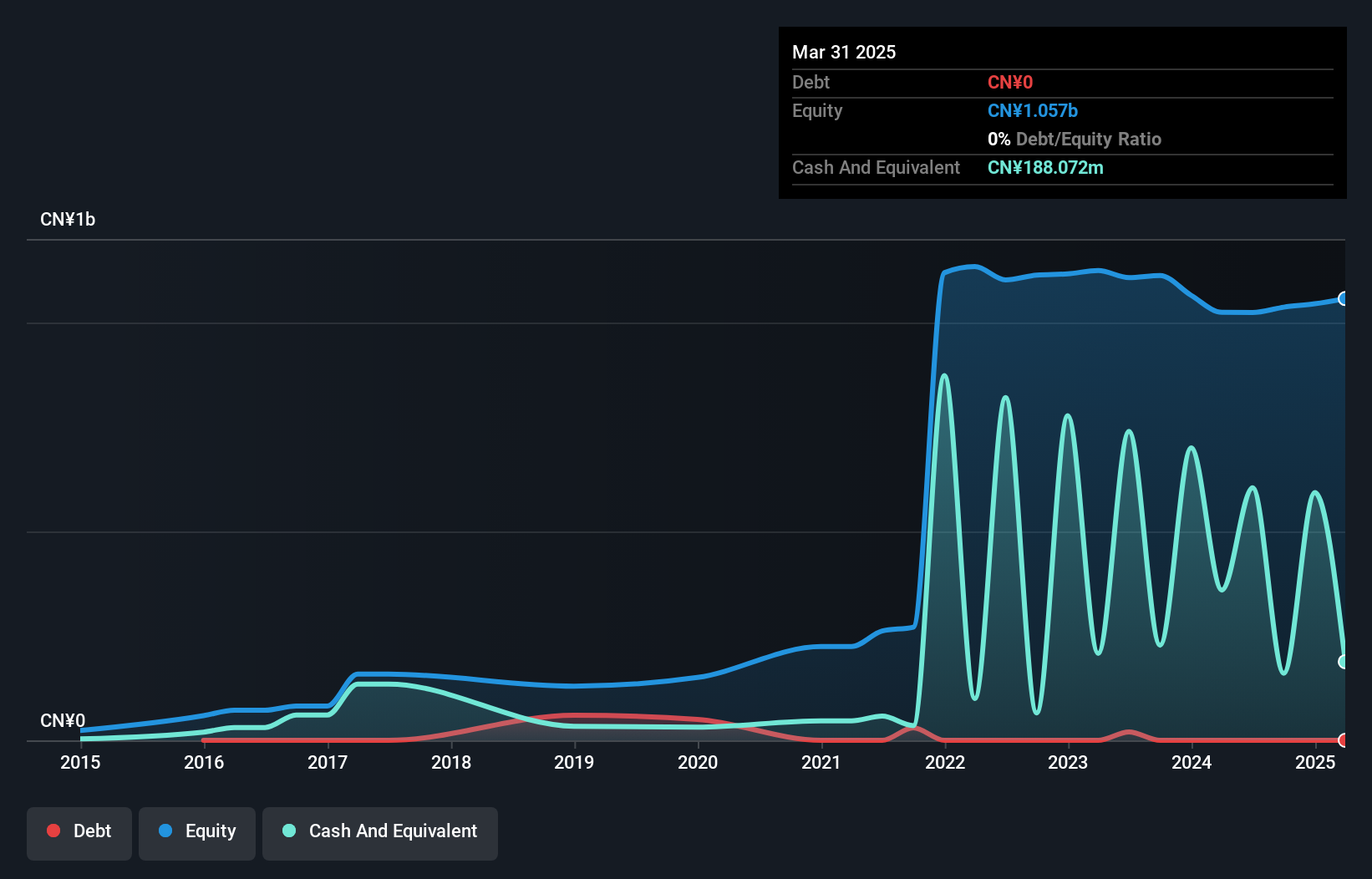

Hangzhou Kaierda, a small player in the welding robot sector, shows intriguing potential with its recent earnings growth of 95.7% outpacing the machinery industry's -0.06%. This company is debt-free, a significant improvement from five years ago when it had a debt-to-equity ratio of 36.2%, indicating prudent financial management. Despite high volatility in share price over the past three months, its high-quality earnings and positive free cash flow suggest resilience. While historical earnings have seen an annual decline of 19.3% over five years, current profitability and industry-leading growth rate offer promising prospects for future performance.

ASROCK Incorporation (TWSE:3515)

Simply Wall St Value Rating: ★★★★★★

Overview: ASROCK Incorporation designs, develops, and sells motherboards in Taiwan with a market capitalization of NT$28.24 billion.

Operations: ASROCK's primary revenue stream is from the sale of motherboards, generating NT$22.05 billion.

ASROCK Incorporation, a tech player with a compact market cap, has shown impressive earnings growth of 95.8% over the past year, outpacing the broader tech industry's 12.9%. Trading at approximately 67.7% below its estimated fair value suggests potential undervaluation in the market. The company operates without debt, eliminating concerns about interest coverage and reflecting financial stability. With high-quality past earnings and positive free cash flow, ASROCK seems well-positioned for continued performance strength. Recent special calls indicate active management engagement with stakeholders, possibly hinting at strategic moves or updates on future prospects within its industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of ASROCK Incorporation.

Evaluate ASROCK Incorporation's historical performance by accessing our past performance report.

EZconn (TWSE:6442)

Simply Wall St Value Rating: ★★★★★★

Overview: EZconn Corporation, along with its subsidiaries, is engaged in the manufacturing and sale of precision metal components and optical fiber components for electronic products across Taiwan, Asia, the United States, and Europe, with a market cap of NT$41.65 billion.

Operations: The primary revenue streams for EZconn Corporation are optical fiber components and high-frequency connectors, generating NT$4.06 billion and NT$469.51 million, respectively.

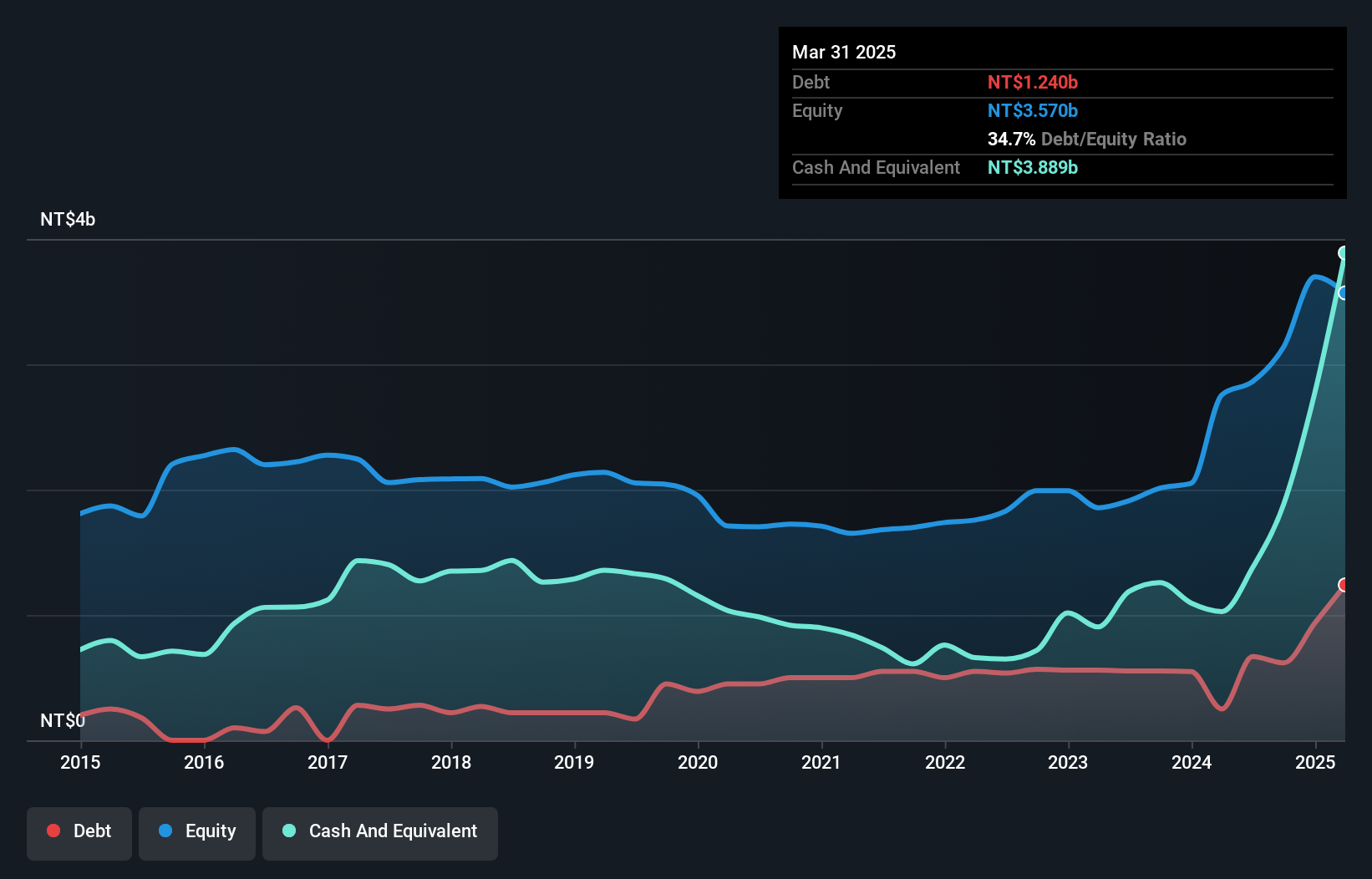

EZconn, a smaller player in the communications sector, has shown impressive earnings growth of 331.9% over the past year, outpacing the industry average of -9.2%. This achievement is bolstered by a reduced debt-to-equity ratio from 22% to 19.7% over five years and strong interest coverage, indicating financial resilience. Despite recent share price volatility, EZconn's profitability and positive free cash flow suggest it is well-positioned for future stability. The company's participation in events like the Taishin Securities Investment Forum underscores its proactive engagement with investors and potential for continued visibility in the market.

Next Steps

- Explore the 4705 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EZconn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6442

EZconn

Manufactures and sells precision metal components and optical fiber components of various electronic products in Taiwan, Asia, the United States, and Europe.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives