- China

- /

- Aerospace & Defense

- /

- SHSE:688239

Investors Aren't Entirely Convinced By Guizhou Aviation Technical Development Co., Ltd's (SHSE:688239) Earnings

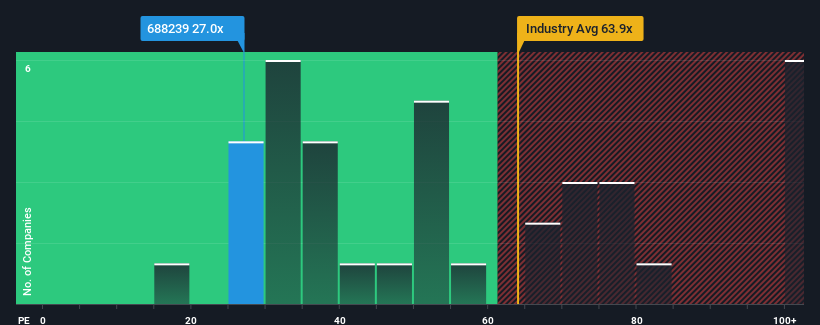

With a median price-to-earnings (or "P/E") ratio of close to 29x in China, you could be forgiven for feeling indifferent about Guizhou Aviation Technical Development Co., Ltd's (SHSE:688239) P/E ratio of 27x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings that are retreating more than the market's of late, Guizhou Aviation Technical Development has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for Guizhou Aviation Technical Development

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Guizhou Aviation Technical Development's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 38% per year during the coming three years according to the five analysts following the company. With the market only predicted to deliver 19% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Guizhou Aviation Technical Development's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Guizhou Aviation Technical Development's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Guizhou Aviation Technical Development currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Guizhou Aviation Technical Development, and understanding them should be part of your investment process.

If you're unsure about the strength of Guizhou Aviation Technical Development's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688239

Guizhou Aviation Technical Development

Develops, manufactures, and sells aviation military ring forgings.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives