- China

- /

- Electronic Equipment and Components

- /

- SZSE:002384

Asian Growth Companies Insiders Are Investing In

Reviewed by Simply Wall St

As global markets navigate a landscape of interest rate adjustments and economic slowdowns, Asia's growth companies continue to capture attention, particularly those with significant insider ownership signaling confidence in their future potential. In this environment, stocks that combine robust growth prospects with high insider investment can be appealing, as they may offer insights into the company's long-term vision and stability amidst broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Techwing (KOSDAQ:A089030) | 19.1% | 122.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 84.7% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| M31 Technology (TPEX:6643) | 30.7% | 96.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Underneath we present a selection of stocks filtered out by our screen.

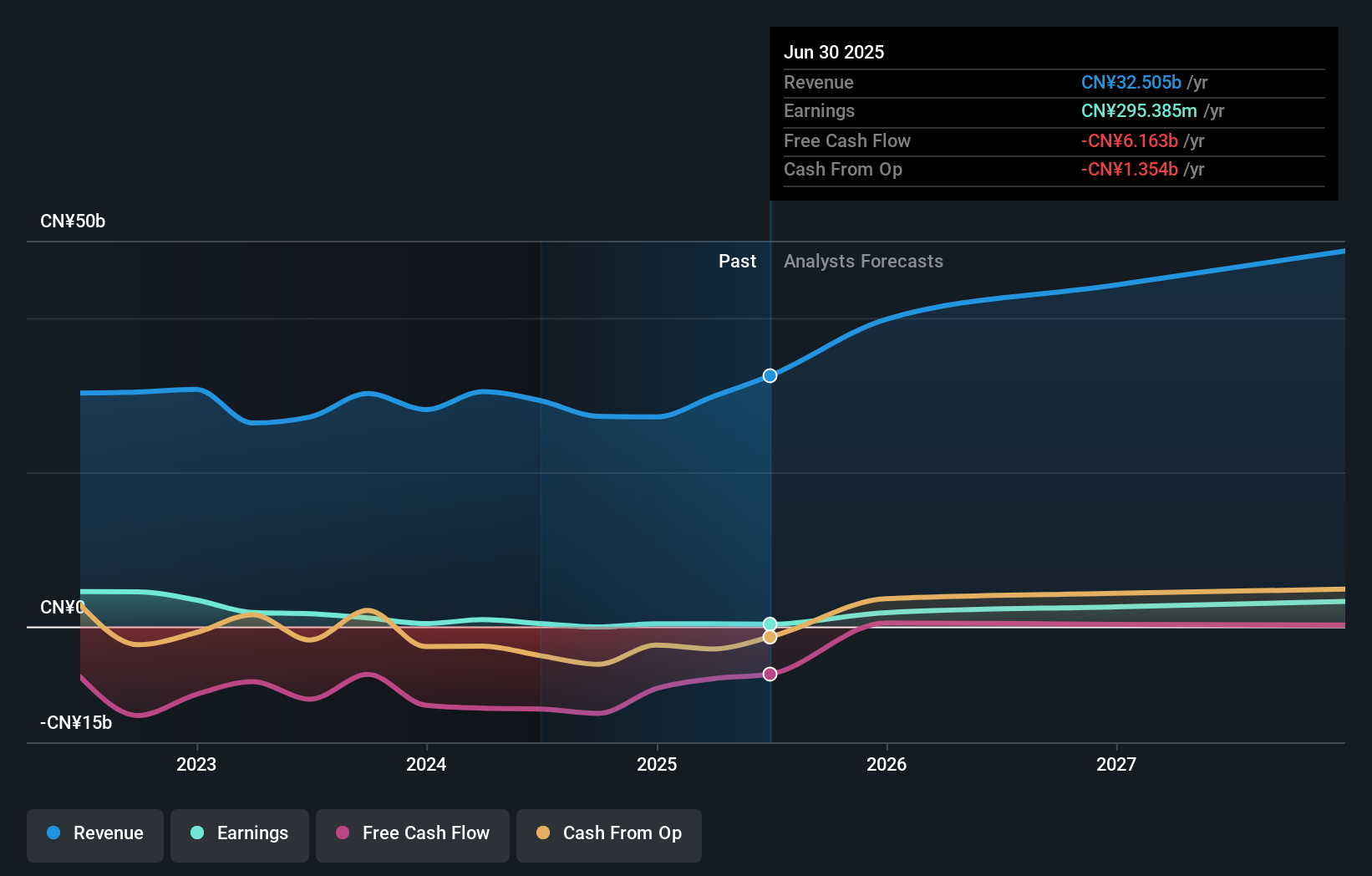

Ming Yang Smart Energy Group (SHSE:601615)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ming Yang Smart Energy Group Limited focuses on the R&D, design, manufacture, sale, maintenance, and operation of energy equipment and wind turbines in China with a market cap of CN¥29.61 billion.

Operations: Ming Yang Smart Energy Group Limited generates revenue primarily through its activities in the research and development, design, manufacture, sale, maintenance, and operation of energy equipment and wind turbines within China.

Insider Ownership: 15.7%

Earnings Growth Forecast: 55.9% p.a.

Ming Yang Smart Energy Group is experiencing significant earnings growth, forecasted at 55.9% annually, outpacing the Chinese market average. However, its net profit margin has declined from 1.3% to 0.9%, and its dividend yield of 2.21% is not well-supported by earnings or cash flow. Recent board changes include the election of Mr. Wang Limin as Employee Representative Director, reflecting active insider involvement but with no substantial insider trading activity reported recently.

- Dive into the specifics of Ming Yang Smart Energy Group here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Ming Yang Smart Energy Group is priced higher than what may be justified by its financials.

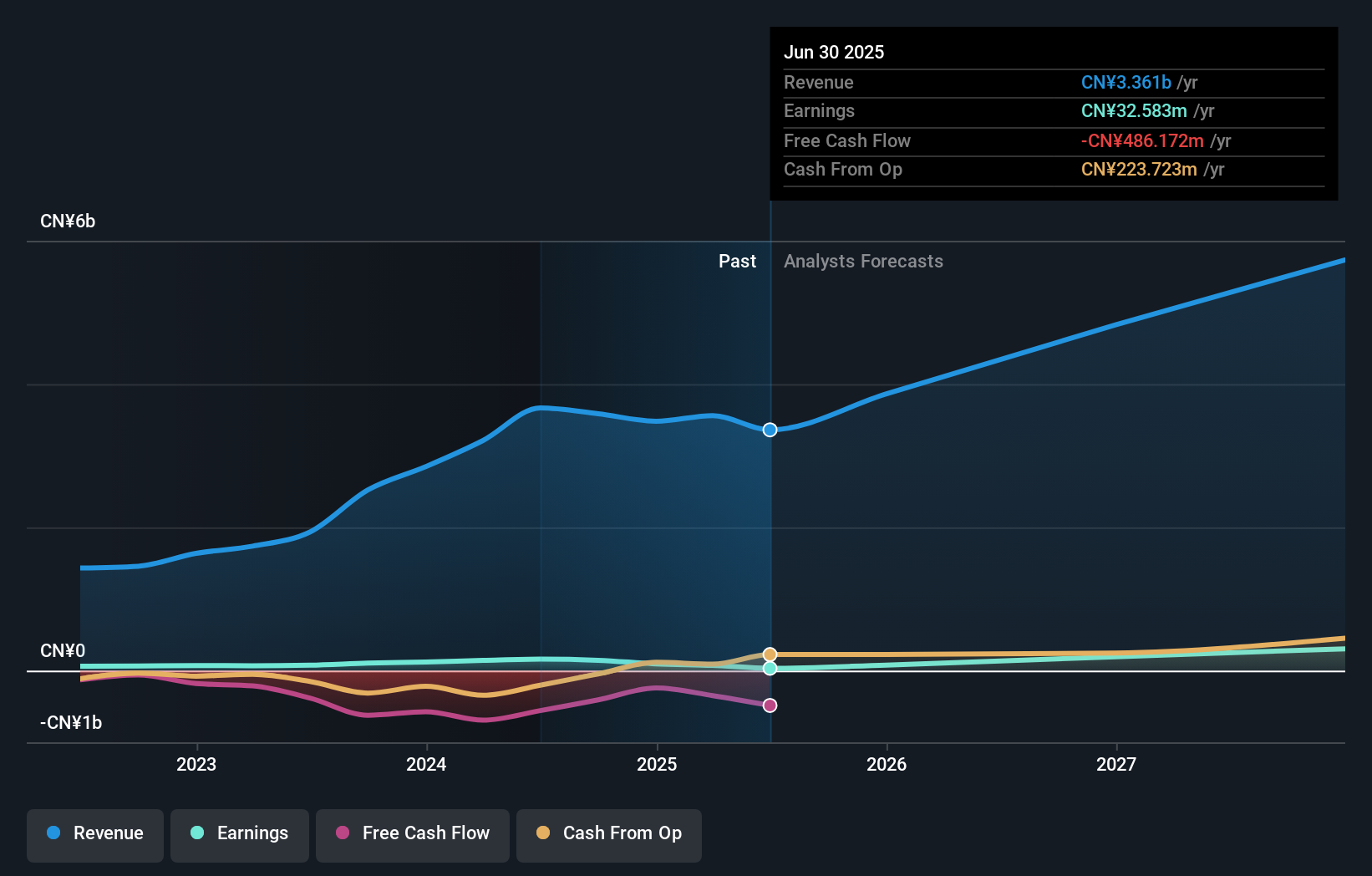

Wetown Electric Group (SHSE:688226)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wetown Electric Group Co., Ltd. is involved in the research, development, production, and sale of electrical products both in China and internationally, with a market cap of CN¥10.18 billion.

Operations: Wetown Electric Group Co., Ltd. generates revenue through its involvement in the research, development, production, and sale of electrical products across domestic and international markets.

Insider Ownership: 18.9%

Earnings Growth Forecast: 72.6% p.a.

Wetown Electric Group is poised for substantial earnings growth, projected at 72.6% annually, surpassing the broader Chinese market. Despite this, recent financial results show a decline in net income to CNY 16.49 million and reduced profit margins from 4.4% to 1%. Revenue growth is expected at 21.3% annually; however, interest payments are not well-covered by earnings. Insider ownership remains significant with no substantial insider trading activity reported recently, reflecting stable internal confidence amidst high share price volatility.

- Navigate through the intricacies of Wetown Electric Group with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Wetown Electric Group is trading beyond its estimated value.

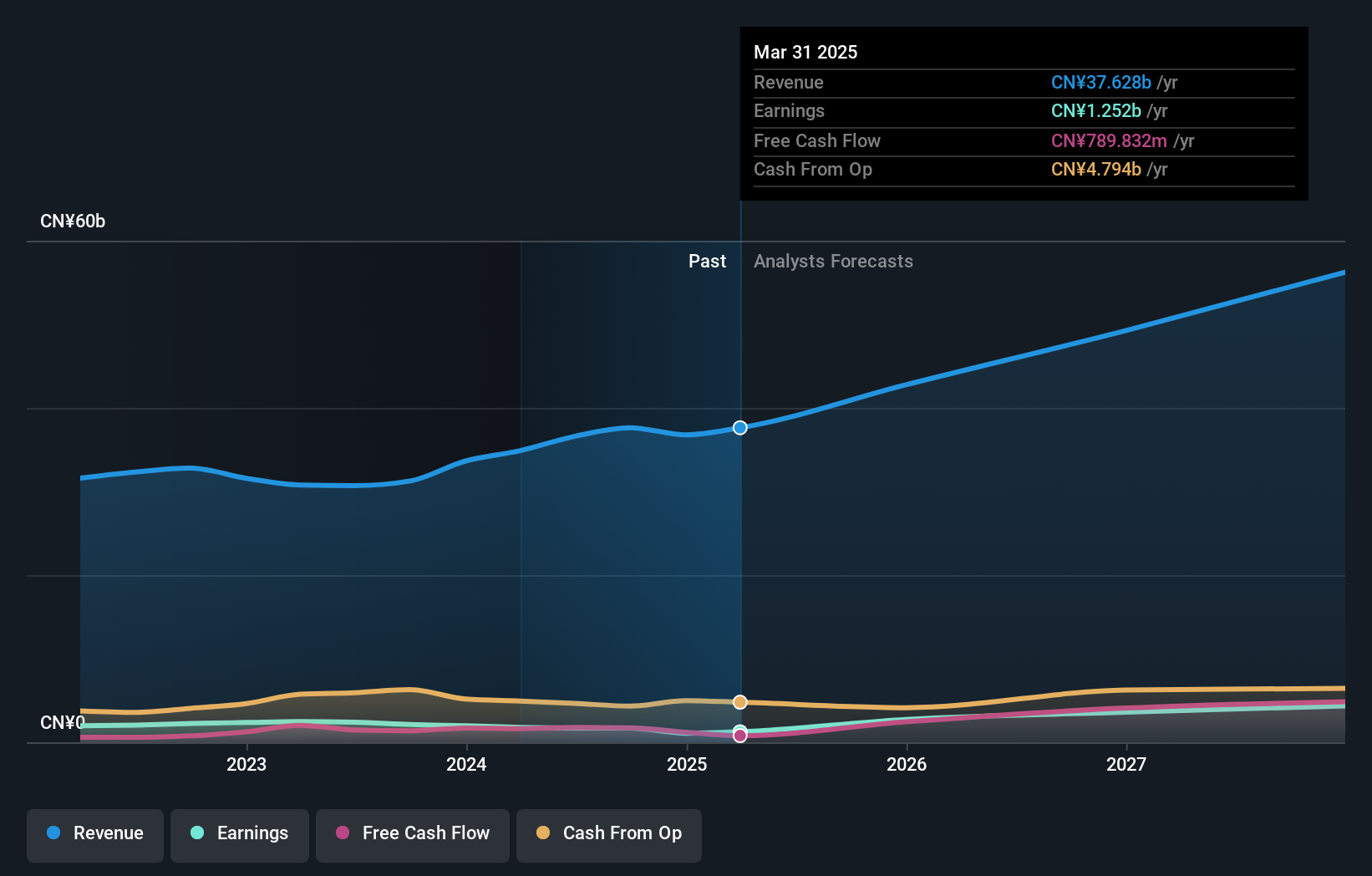

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. operates in the precision manufacturing industry and has a market cap of CN¥142.72 billion.

Operations: The company generates revenue from several segments, including LED Display Device (CN¥616.03 million), Touch Panel and LCD Module (CN¥6.30 billion), Electronic Circuit Products (CN¥25.01 billion), and Precision Component Products (CN¥4.79 billion).

Insider Ownership: 26.6%

Earnings Growth Forecast: 41.4% p.a.

Suzhou Dongshan Precision Manufacturing exhibits promising growth potential, with earnings forecasted to grow significantly above the Chinese market average at 41.4% annually. Recent financial results show increased net income of CNY 758.01 million for H1 2025, up from CNY 560.6 million a year ago, while revenue also rose slightly to CNY 16,955.16 million. Despite high share price volatility and no recent insider trading activity, insider ownership remains substantial, indicating strong internal confidence in future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Suzhou Dongshan Precision Manufacturing.

- Upon reviewing our latest valuation report, Suzhou Dongshan Precision Manufacturing's share price might be too optimistic.

Taking Advantage

- Reveal the 617 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Searching for a Fresh Perspective? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002384

Suzhou Dongshan Precision Manufacturing

Suzhou Dongshan Precision Manufacturing Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives