As global markets navigate a complex landscape marked by cautious monetary policies and fluctuating economic indicators, Asia's small-cap sector presents intriguing opportunities for investors seeking growth potential. In this environment, identifying stocks with strong fundamentals and resilience to broader market sentiments becomes crucial, as these qualities can help uncover hidden gems within the dynamic Asian markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jiangsu Lianfa TextileLtd | 14.81% | 1.37% | -20.31% | ★★★★★★ |

| Chongqing Chuanyi Automation | 3.94% | 12.66% | 15.09% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | NA | -13.99% | -30.38% | ★★★★★★ |

| Zhejiang Yilida VentilatorLtd | 28.27% | -0.09% | 60.03% | ★★★★★★ |

| Shenzhen Keanda Electronic Technology | 3.22% | -6.05% | -14.83% | ★★★★★☆ |

| Tianjin Lisheng PharmaceuticalLtd | 0.20% | 1.81% | 33.92% | ★★★★★☆ |

| Qingdao CHOHO IndustrialLtd | 38.36% | 12.96% | 8.25% | ★★★★★☆ |

| Zhejiang Jinghua Laser TechnologyLtd | 13.40% | 3.88% | -2.51% | ★★★★★☆ |

| Nanfang Black Sesame GroupLtd | 46.47% | -12.88% | 19.25% | ★★★★☆☆ |

| ShenZhen QiangRui Precision Technology | 37.71% | 45.22% | 15.86% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

CNNC International (SEHK:2302)

Simply Wall St Value Rating: ★★★★★★

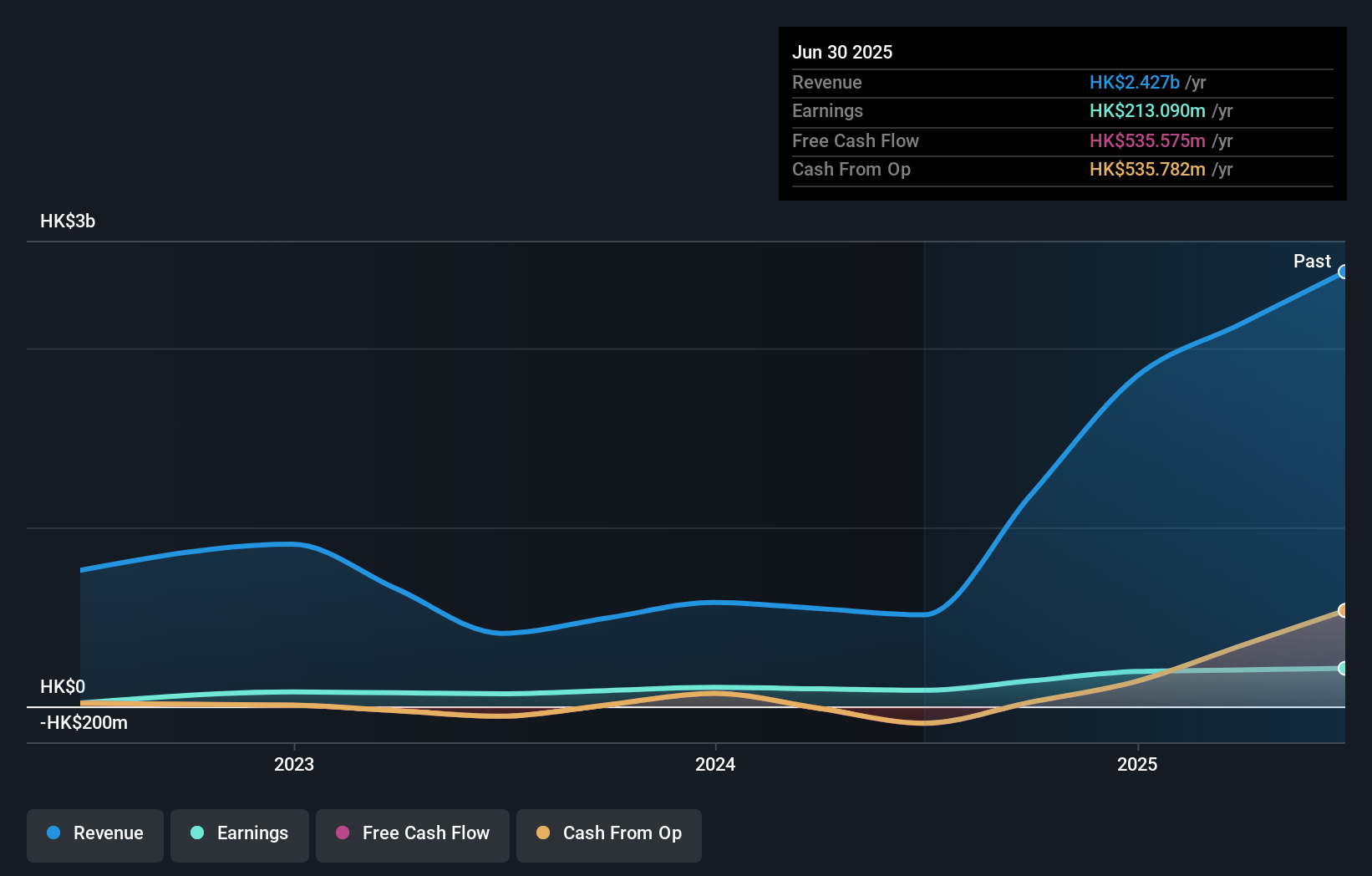

Overview: CNNC International Limited is an investment holding company involved in the exploration, sale, and trading of uranium across several countries including China, Hong Kong, Japan, the United States, the United Kingdom, Netherlands, and Canada with a market capitalization of approximately HK$2.64 billion.

Operations: The company generates revenue primarily from the trading of mineral properties, amounting to approximately HK$2.43 billion.

CNNC International, a relatively small player in the market, has shown impressive financial strides recently. For the half-year ending June 2025, sales skyrocketed to HK$592.11 million from just HK$6.4 million a year earlier, and net income turned positive at HK$10.36 million compared to a loss of HK$7.73 million previously. Basic earnings per share improved to HK$0.0212 from a loss of HK$0.0158 last year, reflecting strong operational performance and strategic execution that seems aligned with industry trends and growth opportunities in trade distribution sectors across Asia.

- Click here to discover the nuances of CNNC International with our detailed analytical health report.

Evaluate CNNC International's historical performance by accessing our past performance report.

Shuangdeng Group (SEHK:6960)

Simply Wall St Value Rating: ★★★★★☆

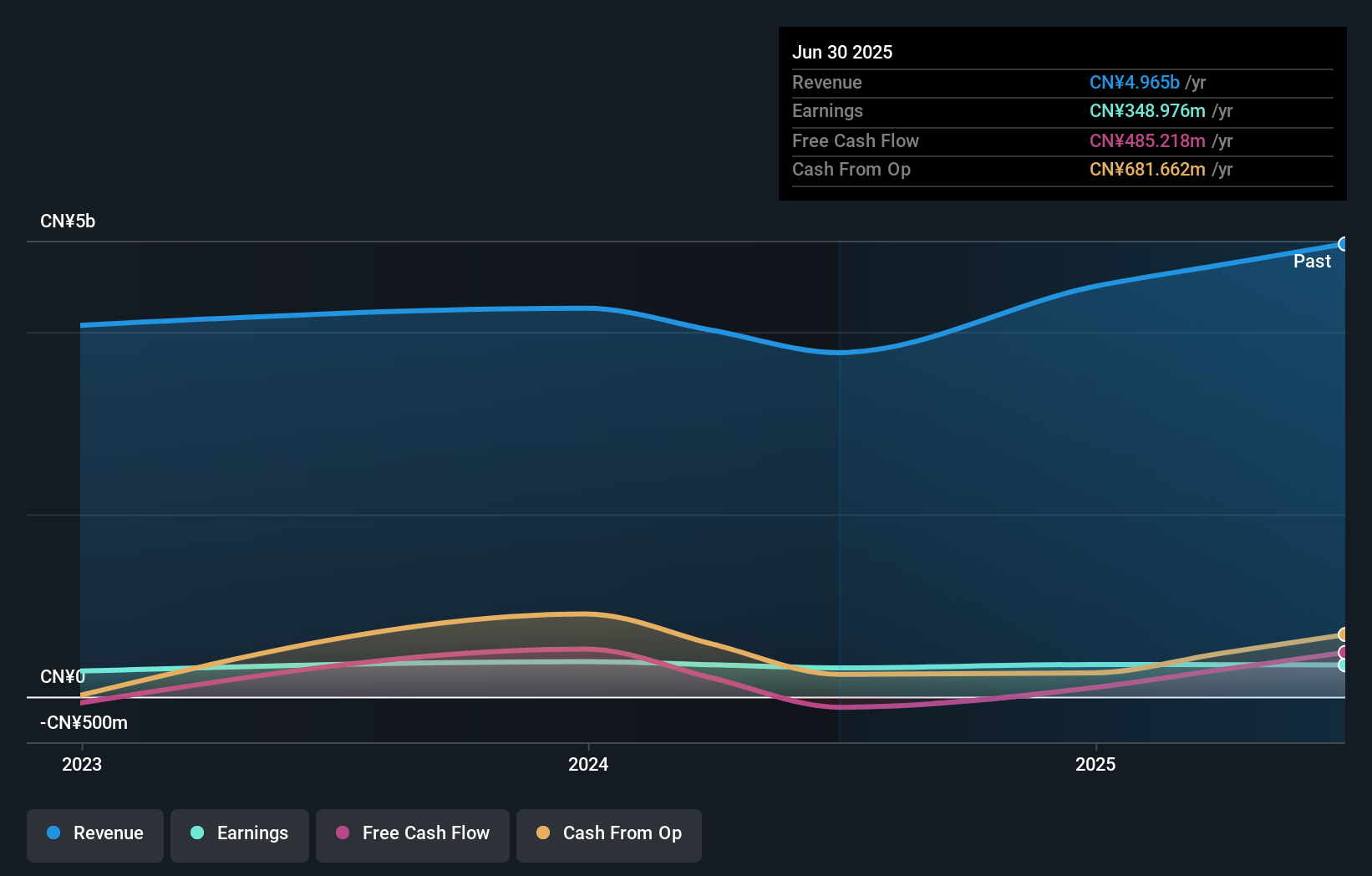

Overview: Shuangdeng Group Co., Ltd. is a company that offers energy storage solutions in China, with a market capitalization of approximately HK$8.51 billion.

Operations: Shuangdeng Group generates revenue primarily from its batteries segment, which reported CN¥4.96 billion. The company's gross profit margin is a notable aspect of its financial profile, reflecting the efficiency of its core operations.

Shuangdeng Group, a promising player in the Asian market, recently completed an IPO raising HKD 849.66 million. The company reported sales of CNY 2.25 billion for the half year ending June 2025, up from CNY 1.78 billion a year prior, though net income slightly dipped to CNY 160.63 million from CNY 164.99 million. With earnings growth of 10.5% over the past year and trading at approximately 34% below its estimated fair value, Shuangdeng seems undervalued with potential upside in valuation terms while maintaining a satisfactory net debt to equity ratio of just 21%.

- Unlock comprehensive insights into our analysis of Shuangdeng Group stock in this health report.

Examine Shuangdeng Group's past performance report to understand how it has performed in the past.

Zhejiang Risun Intelligent TechnologyLtd (SHSE:688215)

Simply Wall St Value Rating: ★★★★☆☆

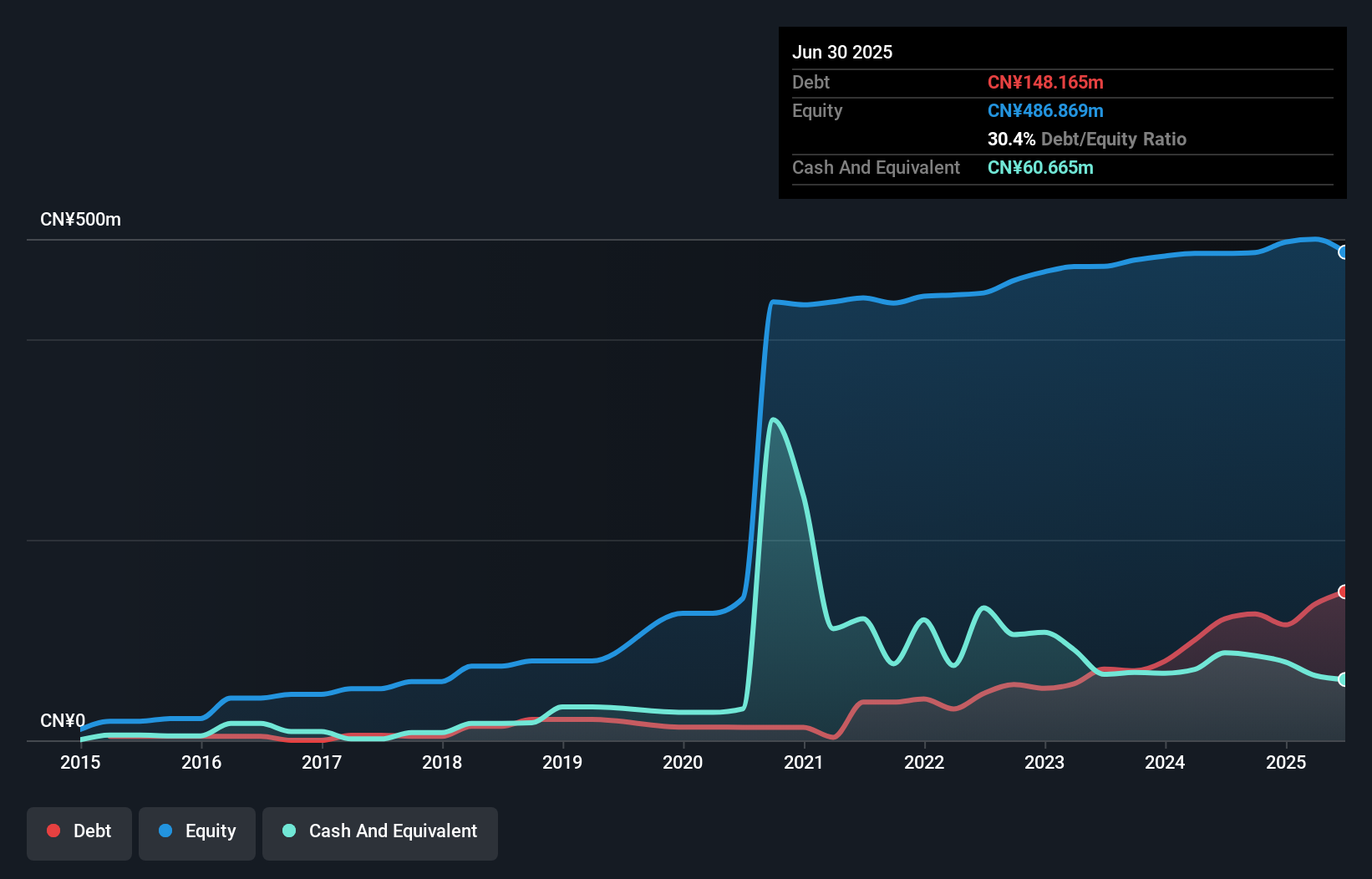

Overview: Zhejiang Risun Intelligent Technology Co., Ltd specializes in material transmission, warehousing, logistics, and sorting systems within industrial production in China, with a market cap of CN¥5.13 billion.

Operations: Risun Intelligent Technology generates revenue primarily from its material transmission, warehousing, logistics, and sorting systems. The company has a market cap of CN¥5.13 billion.

Zhejiang Risun Intelligent Technology has experienced a mixed financial performance recently. Earnings have grown by 55% over the past year, outpacing the Machinery industry's 4% growth, yet earnings declined by an average of 18.7% annually over five years. The debt to equity ratio rose from 9.2% to 30.4%, while net income for the half-year ending June 2025 fell to CN¥3.74M from CN¥5.14M a year prior, with basic earnings per share dropping to CN¥0.07 from CN¥0.13 in the same period last year. Additionally, a buyback completed in July saw repurchase of shares worth CN¥10M, indicating confidence despite volatile share prices recently observed.

- Click here and access our complete health analysis report to understand the dynamics of Zhejiang Risun Intelligent TechnologyLtd.

Learn about Zhejiang Risun Intelligent TechnologyLtd's historical performance.

Summing It All Up

- Click through to start exploring the rest of the 2377 Asian Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Risun Intelligent TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688215

Zhejiang Risun Intelligent TechnologyLtd

Engages in the material transmission, warehousing, logistics, and sorting systems in industrial production in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives