- China

- /

- Aerospace & Defense

- /

- SHSE:688132

Bangyan Technology Co., Ltd.'s (SHSE:688132) 29% Jump Shows Its Popularity With Investors

Bangyan Technology Co., Ltd. (SHSE:688132) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

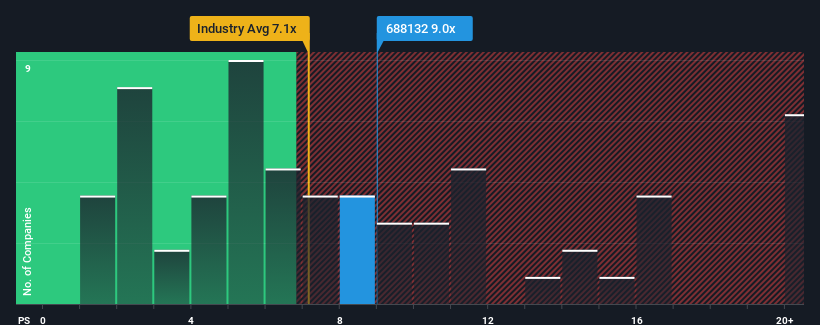

After such a large jump in price, given close to half the companies operating in China's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 7.1x, you may consider Bangyan Technology as a stock to potentially avoid with its 9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Bangyan Technology

How Bangyan Technology Has Been Performing

Bangyan Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bangyan Technology.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Bangyan Technology would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 4.4% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 118% as estimated by the two analysts watching the company. With the industry only predicted to deliver 39%, the company is positioned for a stronger revenue result.

With this information, we can see why Bangyan Technology is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The large bounce in Bangyan Technology's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Bangyan Technology shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Bangyan Technology with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bangyan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688132

Bangyan Technology

Engages in the research, development, manufacture, sale, and service of information communication and security equipment for the military industry in China.

High growth potential with excellent balance sheet.