- China

- /

- Metals and Mining

- /

- SHSE:600961

Undiscovered Gems In Asia To Explore March 2025

Reviewed by Simply Wall St

As global markets grapple with trade policy uncertainties and inflation concerns, Asian stock markets present a unique landscape where opportunities may arise amidst broader market volatility. In such an environment, identifying stocks with strong fundamentals and resilience to economic fluctuations can be key to uncovering potential gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mildef Crete | NA | 0.93% | 9.96% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| NS United Kaiun Kaisha | 55.99% | 13.51% | 20.23% | ★★★★★★ |

| Maxigen Biotech | NA | 8.77% | 24.99% | ★★★★★★ |

| Saison Technology | NA | 0.96% | -11.65% | ★★★★★★ |

| Sonix TechnologyLtd | NA | -10.07% | -16.54% | ★★★★★★ |

| Power HF | 2.91% | -6.25% | -22.13% | ★★★★★★ |

| AzureWave Technologies | NA | 3.00% | 29.49% | ★★★★★★ |

| Neosem | 2.52% | 27.62% | 27.36% | ★★★★★★ |

| Hollyland (China) Electronics Technology | 3.46% | 13.95% | 11.27% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Zhuzhou Smelter GroupLtd (SHSE:600961)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhuzhou Smelter Group Co., Ltd., operating under the Torch brand, is engaged in the production and sale of lead, zinc, and alloy products in China with a market capitalization of CN¥9.68 billion.

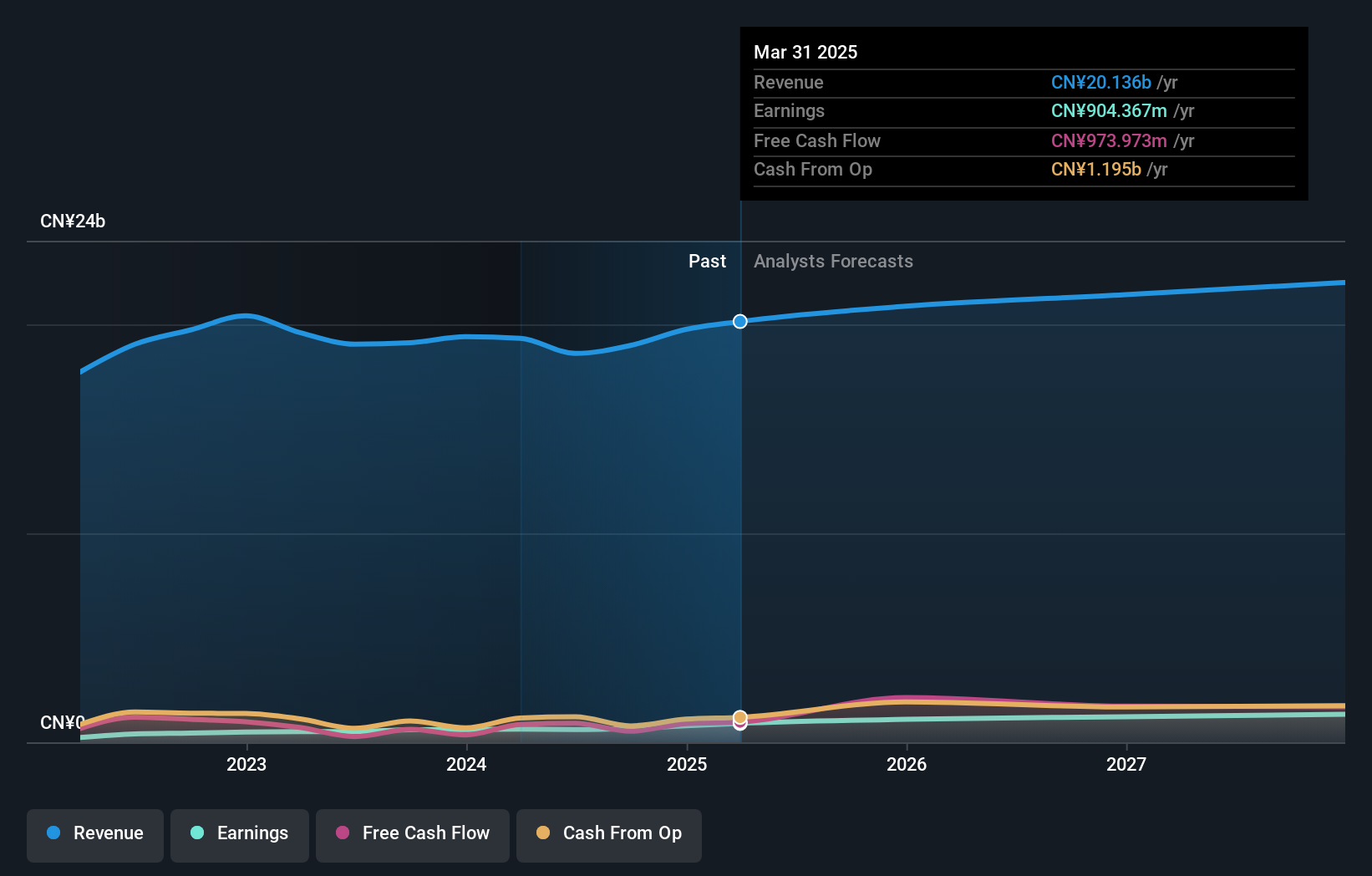

Operations: The primary revenue stream for Zhuzhou Smelter Group Co., Ltd. comes from its lead and zinc products, generating CN¥18.99 billion. The company's net profit margin reflects its financial performance efficiency in converting sales into actual profit.

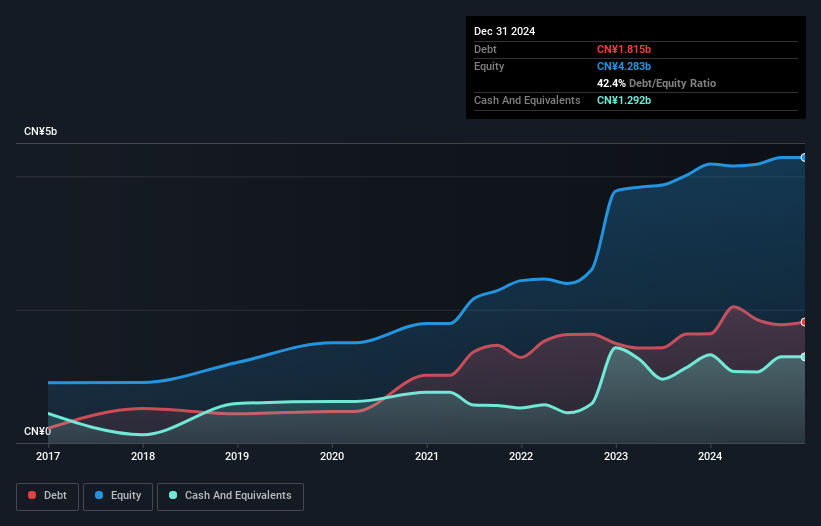

Zhuzhou Smelter Group Ltd., a small player in the metals and mining industry, has shown promising financial metrics. The company's earnings grew by 10% last year, surpassing the industry average of -0.2%, and are forecasted to grow at 17% annually. With a price-to-earnings ratio of 14.6x, it trades below the CN market average of 38.5x, indicating good value relative to peers. Over five years, its debt-to-equity ratio improved significantly from 607% to a more manageable 47%. A satisfactory net debt-to-equity ratio of 36% suggests stable financial health moving forward.

- Take a closer look at Zhuzhou Smelter GroupLtd's potential here in our health report.

Learn about Zhuzhou Smelter GroupLtd's historical performance.

Bozhon Precision Industry TechnologyLtd (SHSE:688097)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bozhon Precision Industry Technology Co., Ltd. is a company that specializes in industrial automation and controls, with a market capitalization of CN¥14.14 billion.

Operations: Bozhon Precision derives its revenue primarily from the industrial automation and controls segment, generating CN¥4.96 billion.

Bozhon Precision Industry Technology, a notable player in the machinery sector, has demonstrated robust financial health with earnings growth of 2.1% over the past year, outpacing the industry average of -0.03%. The company's net debt to equity ratio stands at a satisfactory 12.2%, indicating prudent financial management despite an increase from 31.4% to 42.4% over five years. Interest payments are well covered by EBIT at 8.9x, reflecting solid operational efficiency. Recently, Bozhon reported sales of CNY 4.96 billion and net income of CNY 398 million for the full year ending December 2024, alongside a strategic stake acquisition by Tianjin Xinke Hongchuang Equity Investment Partnership Enterprise valued at CNY 480 million in January 2025.

- Click here and access our complete health analysis report to understand the dynamics of Bozhon Precision Industry TechnologyLtd.

Understand Bozhon Precision Industry TechnologyLtd's track record by examining our Past report.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang ZUCH Technology Co., Ltd. specializes in providing electric connectors in China and has a market capitalization of CN¥7.41 billion.

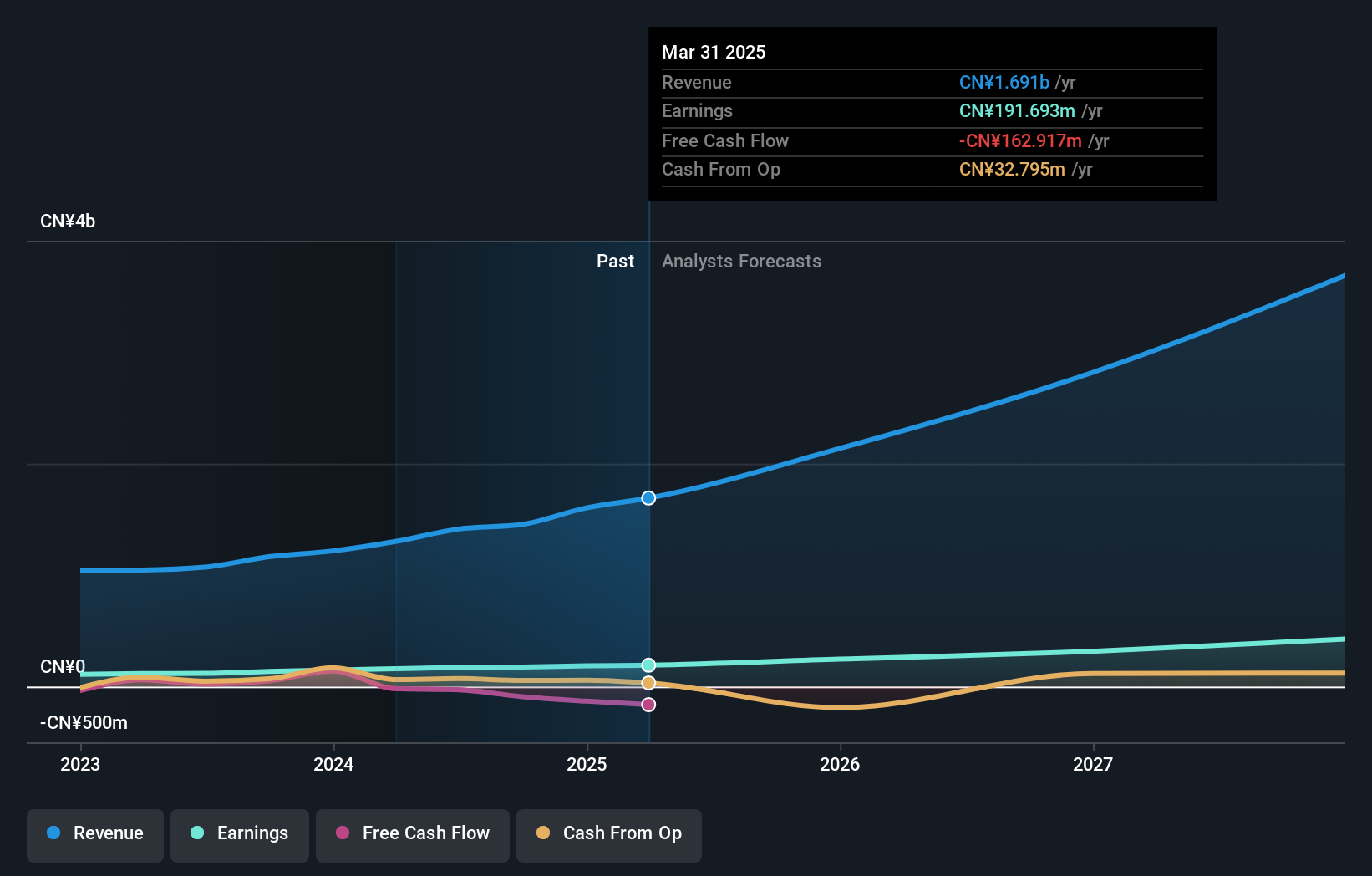

Operations: ZUCH Technology generates revenue primarily from the sale of electric connectors. The company's net profit margin has shown a notable trend, indicating financial efficiency in its operations.

ZUCH Technology, a nimble player in the electronics sector, has seen earnings growth of 28.5% over the past year, outpacing the industry average of 2.6%. The company enjoys a favorable debt position with cash exceeding total debt and has significantly reduced its debt-to-equity ratio from 35.4% to 1.9% in five years. Despite this progress, free cash flow remains negative as recent figures show -US$91 million for March 2025, likely due to high capital expenditures such as US$145 million recorded recently. With earnings forecasted to grow at an impressive rate of 31%, ZUCH's future prospects appear promising amidst ongoing volatility concerns.

- Navigate through the intricacies of Zhejiang ZUCH Technology with our comprehensive health report here.

Assess Zhejiang ZUCH Technology's past performance with our detailed historical performance reports.

Summing It All Up

- Explore the 2591 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Smelter GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600961

Zhuzhou Smelter GroupLtd

Produces and sells lead, zinc, and its alloy products under the Torch brand in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives