Zhuzhou Huarui Precision Cutting Tools Co.,Ltd. (SHSE:688059) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Zhuzhou Huarui Precision Cutting Tools Co.,Ltd. (SHSE:688059) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

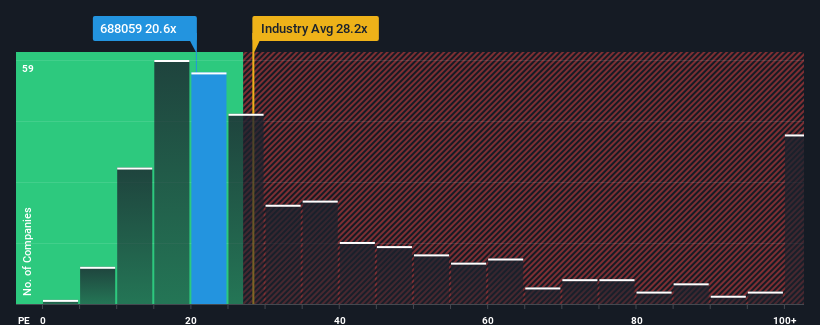

Although its price has dipped substantially, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may still consider Zhuzhou Huarui Precision Cutting ToolsLtd as an attractive investment with its 20.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Zhuzhou Huarui Precision Cutting ToolsLtd's earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

View our latest analysis for Zhuzhou Huarui Precision Cutting ToolsLtd

How Is Zhuzhou Huarui Precision Cutting ToolsLtd's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Zhuzhou Huarui Precision Cutting ToolsLtd's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Looking ahead now, EPS is anticipated to climb by 52% during the coming year according to the five analysts following the company. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Zhuzhou Huarui Precision Cutting ToolsLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Zhuzhou Huarui Precision Cutting ToolsLtd's P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Zhuzhou Huarui Precision Cutting ToolsLtd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zhuzhou Huarui Precision Cutting ToolsLtd (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Huarui Precision Cutting ToolsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688059

Zhuzhou Huarui Precision Cutting ToolsLtd

Zhuzhou Huarui Precision Cutting Tools Co.,Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives