3 Chinese Growth Stocks With High Insider Ownership And Up To 37% Earnings Growth

Reviewed by Simply Wall St

In recent weeks, Chinese stocks have experienced a notable surge, buoyed by optimism surrounding Beijing's comprehensive support measures despite ongoing challenges in manufacturing and real estate sectors. As investors navigate these shifting dynamics, identifying growth companies with high insider ownership can provide valuable insights into potential earnings growth and alignment of interests between company leaders and shareholders.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.9% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's explore several standout options from the results in the screener.

Ningbo Deye Technology Group (SHSE:605117)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningbo Deye Technology Group Co., Ltd. specializes in the production and sales of heat exchangers, inverters, and dehumidifiers across China, the UK, the US, Germany, India, and other international markets with a market cap of approximately CN¥70.09 billion.

Operations: The company's revenue is derived from the production and sales of heat exchangers, inverters, and dehumidifiers across various international markets including China, the UK, the US, Germany, and India.

Insider Ownership: 23.2%

Earnings Growth Forecast: 31% p.a.

Ningbo Deye Technology Group exhibits characteristics of a growth company with high insider ownership, despite recent shareholder dilution. The company's earnings and revenue are forecast to grow significantly faster than the Chinese market, with annual rates of 31% and 31.8%, respectively. However, its share price has been highly volatile recently. For the half-year ending June 2024, Ningbo Deye reported slightly lower sales and net income compared to the previous year, indicating potential challenges amidst its growth trajectory.

- Take a closer look at Ningbo Deye Technology Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Ningbo Deye Technology Group shares in the market.

Hoymiles Power Electronics (SHSE:688032)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hoymiles Power Electronics Inc. manufactures and sells module level power electronics (MLPE) solutions both in China and internationally, with a market cap of CN¥24.68 billion.

Operations: The company's revenue segments focus on the production and distribution of MLPE solutions across domestic and international markets.

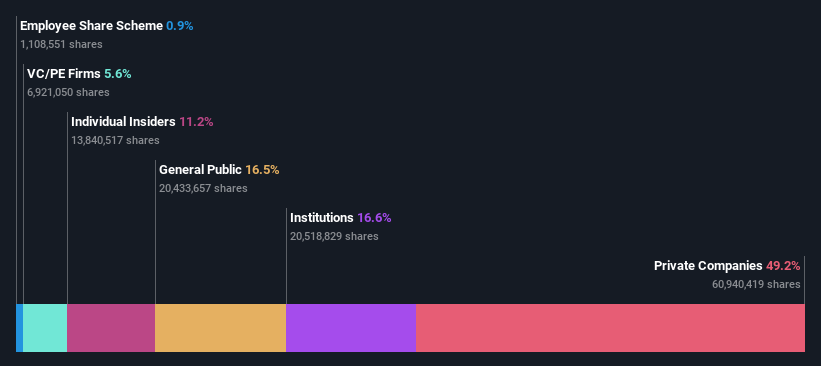

Insider Ownership: 11.2%

Earnings Growth Forecast: 37.7% p.a.

Hoymiles Power Electronics demonstrates strong growth potential with earnings and revenue forecasted to grow significantly faster than the Chinese market at 37.7% and 37.4% annually, respectively. Despite a recent decline in half-year sales (CNY 900.35 million) and net income (CNY 187.62 million), the company announced a CNY 200 million share buyback program, indicating confidence in its future prospects amid high volatility and lower profit margins compared to last year.

- Click to explore a detailed breakdown of our findings in Hoymiles Power Electronics' earnings growth report.

- In light of our recent valuation report, it seems possible that Hoymiles Power Electronics is trading beyond its estimated value.

Konfoong Materials International (SZSE:300666)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Konfoong Materials International Co., Ltd. (SZSE:300666) specializes in the production and supply of advanced materials for the semiconductor industry, with a market cap of CN¥18.96 billion.

Operations: The company's revenue from the Computer, Communications, and other Electronic Equipment Manufacturing segment amounts to CN¥3.03 billion.

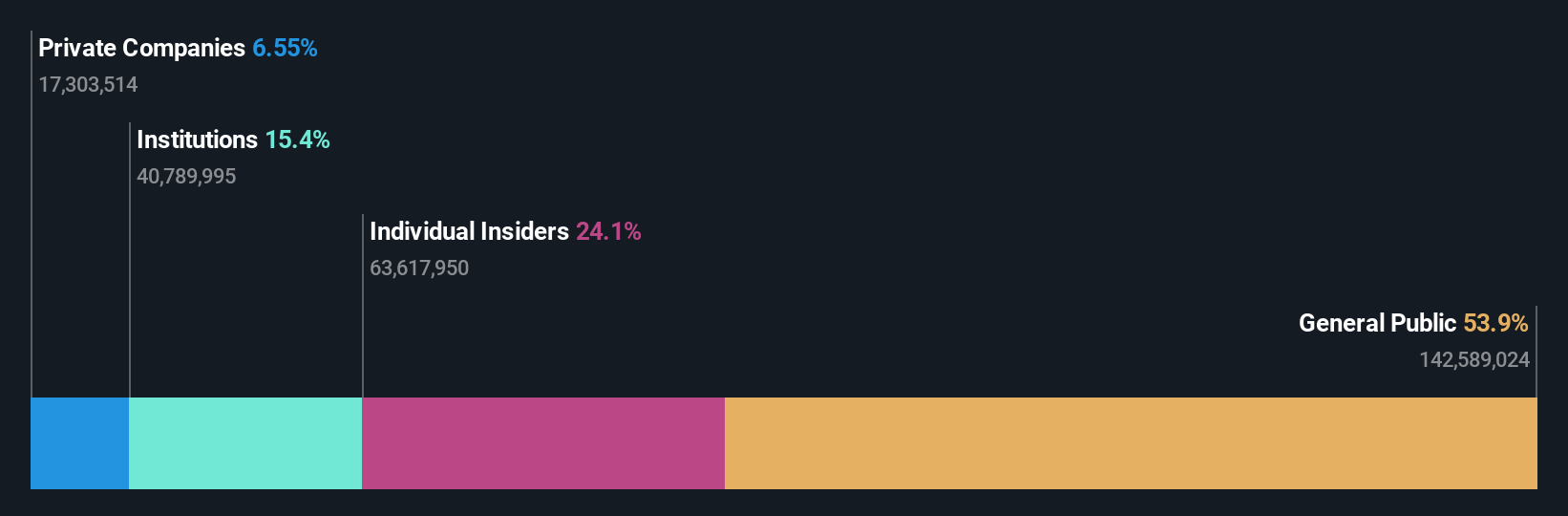

Insider Ownership: 24.1%

Earnings Growth Forecast: 23.1% p.a.

Konfoong Materials International shows growth potential with forecasted revenue growth of 21.8% per year, outpacing the Chinese market. Despite a volatile share price and low expected return on equity (9.2%), recent earnings increased slightly to CNY 161.13 million for H1 2024 from CNY 152.99 million a year ago, while completing a buyback of shares worth CNY 52 million suggests insider confidence in its continued expansion amid high non-cash earnings levels.

- Unlock comprehensive insights into our analysis of Konfoong Materials International stock in this growth report.

- Upon reviewing our latest valuation report, Konfoong Materials International's share price might be too optimistic.

Summing It All Up

- Get an in-depth perspective on all 385 Fast Growing Chinese Companies With High Insider Ownership by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Deye Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605117

Ningbo Deye Technology Group

Engages in the production and sales of heat exchangers, inverters, and dehumidifiers in China, the United Kingdom, the United States, Germany, India, and internationally.

Very undervalued with exceptional growth potential.