- China

- /

- Electrical

- /

- SHSE:688006

3 Stocks That Investors Might Be Undervaluing By Up To 17.7% Estimated Discount

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a complex environment characterized by fluctuating interest rates and competitive pressures in the technology sector. With U.S. stocks experiencing volatility due to AI competition fears and mixed corporate earnings, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on market inefficiencies. A good stock in this context is one that demonstrates strong fundamentals yet is trading below its intrinsic value, potentially offering a margin of safety amidst broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Old National Bancorp (NasdaqGS:ONB) | US$24.45 | US$48.78 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.91 | 50% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.14 | SEK165.53 | 49.8% |

| Solum (KOSE:A248070) | ₩18620.00 | ₩37293.72 | 50.1% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.30 | CN¥41.90 | 49.2% |

| AbbVie (NYSE:ABBV) | US$192.97 | US$385.39 | 49.9% |

| Semiconductor Manufacturing International (SEHK:981) | HK$47.90 | HK$95.26 | 49.7% |

| Verra Mobility (NasdaqCM:VRRM) | US$25.88 | US$51.66 | 49.9% |

| Facephi Biometria (BME:FACE) | €2.24 | €4.46 | 49.7% |

| Sandfire Resources (ASX:SFR) | A$10.60 | A$20.40 | 48% |

Let's review some notable picks from our screened stocks.

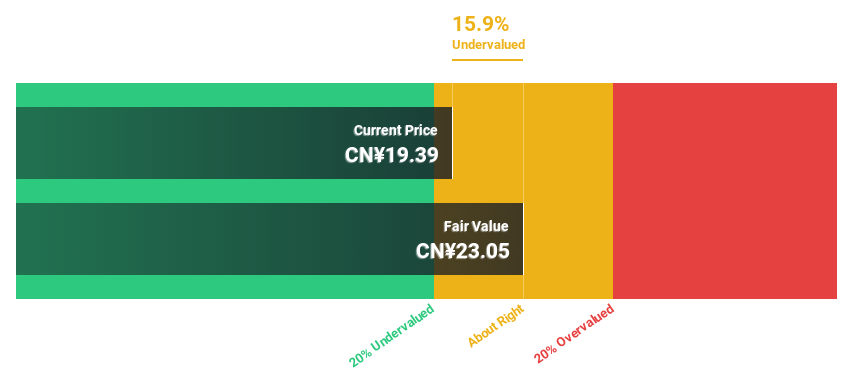

Kunshan Huguang Auto HarnessLtd (SHSE:605333)

Overview: Kunshan Huguang Auto Harness Co., Ltd. specializes in the R&D, production, and sales of automotive high and low voltage wiring harness assemblies both in China and internationally, with a market cap of CN¥15.76 billion.

Operations: Kunshan Huguang Auto Harness Co., Ltd. generates revenue through the development, manufacturing, and distribution of high and low voltage automotive wiring harness assemblies across domestic and international markets.

Estimated Discount To Fair Value: 18.7%

Kunshan Huguang Auto Harness Ltd. is trading at CN¥37.81, below its estimated fair value of CN¥46.52, indicating it could be undervalued based on cash flows despite not being significantly so. The company faces high debt levels but shows robust earnings growth, with a 34923.3% increase last year and forecasts of 30.93% annual growth over the next three years, outpacing the Chinese market's expected earnings growth rate of 25.3%.

- Our earnings growth report unveils the potential for significant increases in Kunshan Huguang Auto HarnessLtd's future results.

- Click here to discover the nuances of Kunshan Huguang Auto HarnessLtd with our detailed financial health report.

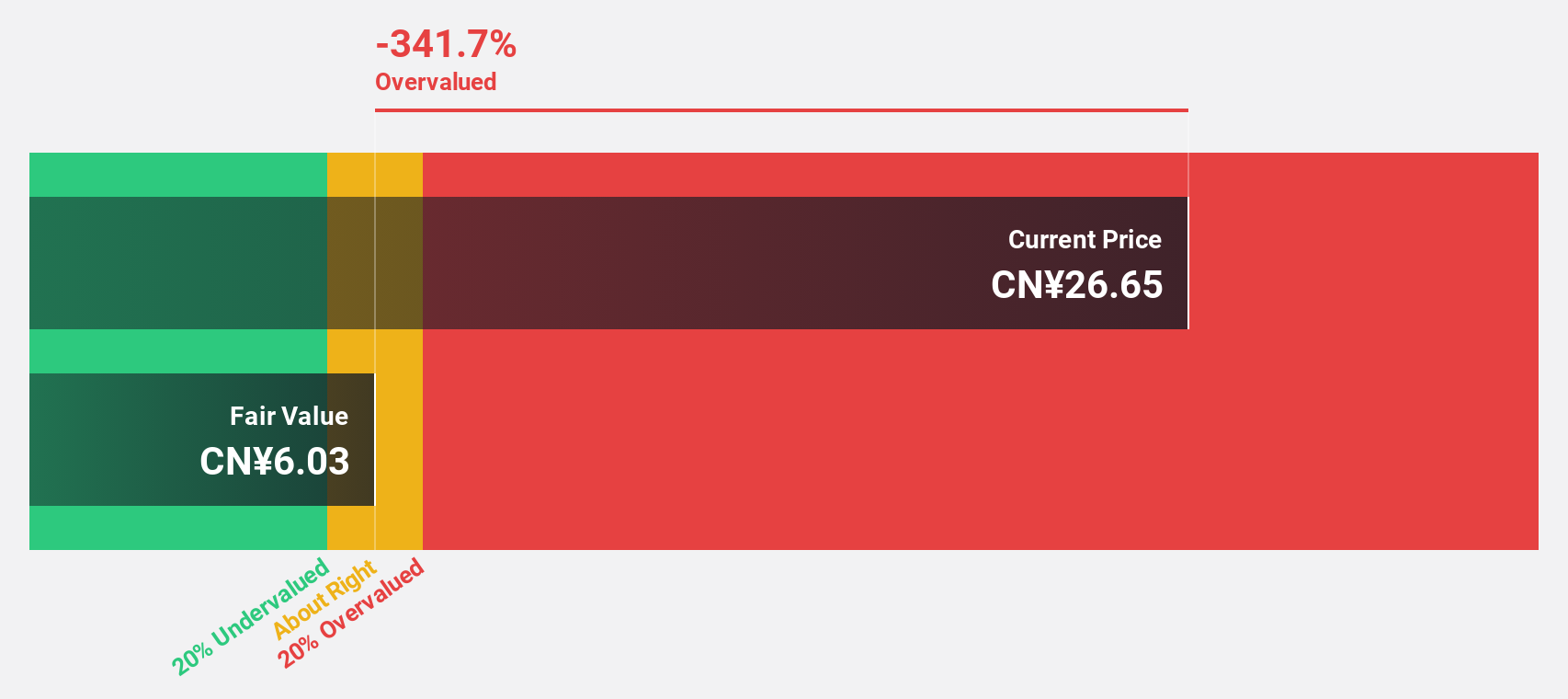

Zhejiang HangKe Technology (SHSE:688006)

Overview: Zhejiang HangKe Technology Incorporated Company specializes in the design, development, production, and sale of lithium-ion battery post-processing systems for the charging and discharging industry both in China and internationally, with a market cap of CN¥10.96 billion.

Operations: The company generates revenue through the design, development, production, and sale of lithium-ion battery post-processing systems for the charging and discharging industry in both domestic and international markets.

Estimated Discount To Fair Value: 17.7%

Zhejiang HangKe Technology is trading at CN¥18.49, below its fair value estimate of CN¥22.46, suggesting undervaluation based on cash flows. Despite lower profit margins this year (14.3% vs 20.6%), earnings are projected to grow significantly at 38.1% annually, outpacing the Chinese market's growth rate of 25.3%. However, its dividend yield of 2.43% isn't well-supported by free cash flows and it has a low forecasted return on equity of 14.8%.

- Our growth report here indicates Zhejiang HangKe Technology may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang HangKe Technology.

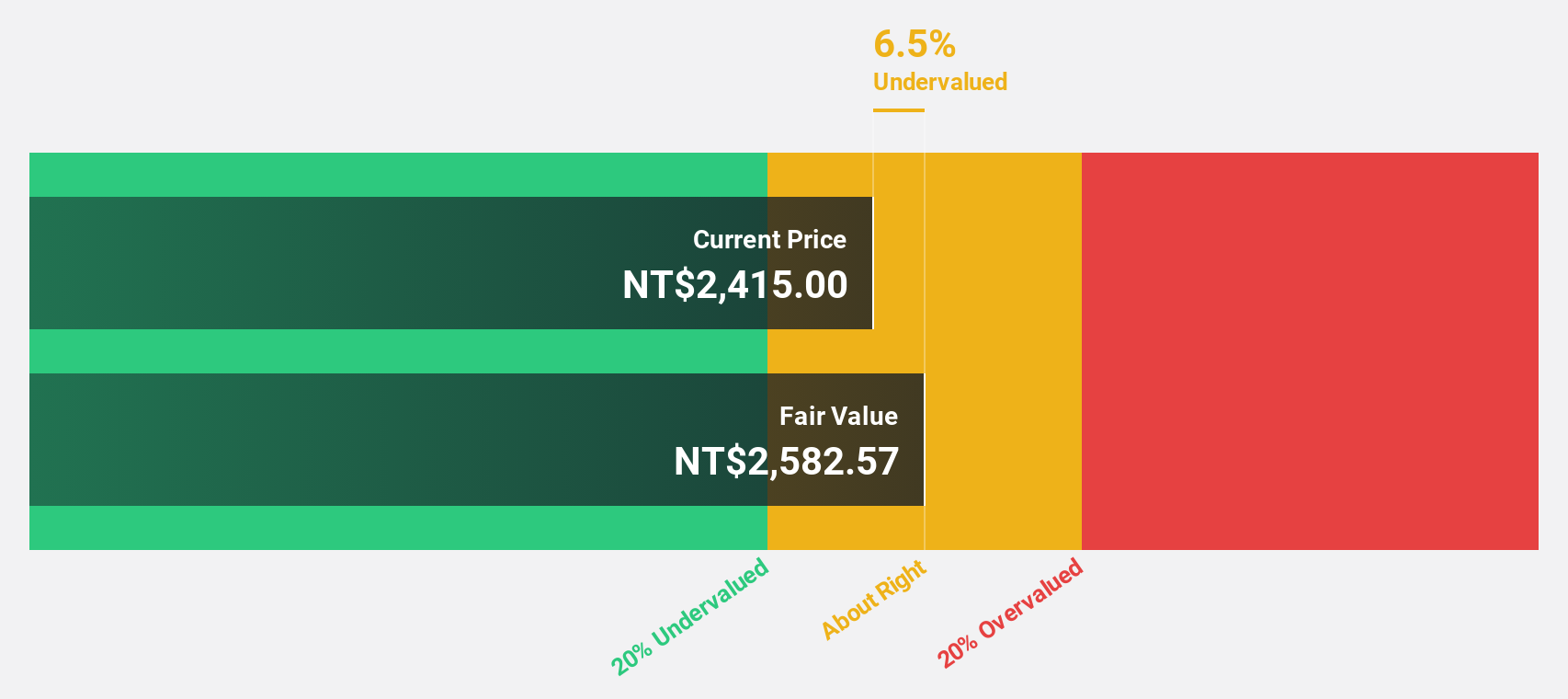

King Slide Works (TWSE:2059)

Overview: King Slide Works Co., Ltd. is a Taiwanese company specializing in the R&D, design, and sale of rail kits for servers and network communication equipment, with a market cap of NT$135.80 billion.

Operations: The company's revenue segments include NT$2.16 billion from Chuanhu Company and NT$7.12 billion from Chuan Yi Company.

Estimated Discount To Fair Value: 8.4%

King Slide Works is trading at NT$1,565, slightly below its fair value estimate of NT$1,708.45. Despite recent share price volatility, the company shows strong fundamentals with earnings growing 61.3% last year and revenue expected to increase by 21.1% annually—outpacing the Taiwan market's growth rate of 11.3%. The forecasted return on equity is high at 27.5%, though projected annual profit growth of 17.8% remains modest compared to revenue expansion expectations.

- In light of our recent growth report, it seems possible that King Slide Works' financial performance will exceed current levels.

- Navigate through the intricacies of King Slide Works with our comprehensive financial health report here.

Next Steps

- Embark on your investment journey to our 921 Undervalued Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang HangKe Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688006

Zhejiang HangKe Technology

Designs, develops, produces, and sells lithium-ion (Li-ion) battery post-processing systems for charging and discharging industry in China and internationally.

High growth potential and good value.

Market Insights

Community Narratives