- China

- /

- Electrical

- /

- SHSE:688005

Market Might Still Lack Some Conviction On Ningbo Ronbay New Energy Technology Co.,Ltd. (SHSE:688005) Even After 28% Share Price Boost

Ningbo Ronbay New Energy Technology Co.,Ltd. (SHSE:688005) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

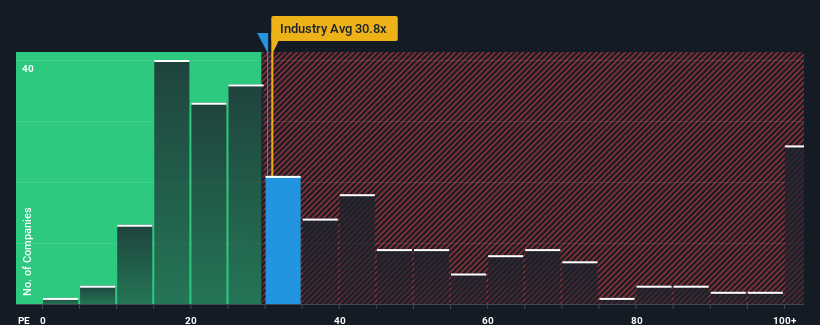

Even after such a large jump in price, there still wouldn't be many who think Ningbo Ronbay New Energy TechnologyLtd's price-to-earnings (or "P/E") ratio of 30.2x is worth a mention when the median P/E in China is similar at about 31x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Ningbo Ronbay New Energy TechnologyLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Ningbo Ronbay New Energy TechnologyLtd

How Is Ningbo Ronbay New Energy TechnologyLtd's Growth Trending?

In order to justify its P/E ratio, Ningbo Ronbay New Energy TechnologyLtd would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 57% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 155% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 41% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 20% per annum, which is noticeably less attractive.

With this information, we find it interesting that Ningbo Ronbay New Energy TechnologyLtd is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Ningbo Ronbay New Energy TechnologyLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Ningbo Ronbay New Energy TechnologyLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Ningbo Ronbay New Energy TechnologyLtd, and understanding these should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Ronbay New Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688005

Ningbo Ronbay New Energy TechnologyLtd

Ningbo Ronbay New Energy Technology Co.,Ltd.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives