3 Asian Stocks Estimated To Be Trading Below Intrinsic Value By Up To 35.8%

Reviewed by Simply Wall St

As Asian markets show signs of resilience with notable gains in major indices like Japan's Nikkei 225 and China's CSI 300, investors are increasingly attentive to the potential opportunities within these regions. In such a climate, identifying stocks that are trading below their intrinsic value can offer strategic entry points for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥37.42 | CN¥74.69 | 49.9% |

| Teikoku Sen-i (TSE:3302) | ¥3390.00 | ¥6726.75 | 49.6% |

| TaewoongLtd (KOSDAQ:A044490) | ₩31400.00 | ₩61932.32 | 49.3% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.42 | CN¥26.39 | 49.2% |

| NexTone (TSE:7094) | ¥2266.00 | ¥4509.38 | 49.7% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.197 | NZ$0.39 | 49% |

| COVER (TSE:5253) | ¥1867.00 | ¥3693.14 | 49.4% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.22 | CN¥94.98 | 48.2% |

| Andes Technology (TWSE:6533) | NT$268.00 | NT$531.36 | 49.6% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.58 | CN¥54.10 | 49% |

Underneath we present a selection of stocks filtered out by our screen.

AVIC Shenyang Aircraft (SHSE:600760)

Overview: AVIC Shenyang Aircraft Company Limited is involved in the manufacture and sale of aviation products in China, with a market cap of CN¥183.94 billion.

Operations: AVIC Shenyang Aircraft's revenue primarily stems from its aviation product manufacturing and sales operations within China.

Estimated Discount To Fair Value: 35.8%

AVIC Shenyang Aircraft is trading at CN¥64.88, significantly below its estimated fair value of CN¥101.13, suggesting it may be undervalued based on cash flows. Despite a recent decline in H1 2025 revenue and net income compared to the previous year, the company's revenue is forecast to grow over 21% annually, outpacing the Chinese market average. However, earnings growth is expected to lag behind market rates with an unstable dividend history and low future return on equity projections.

- Our earnings growth report unveils the potential for significant increases in AVIC Shenyang Aircraft's future results.

- Get an in-depth perspective on AVIC Shenyang Aircraft's balance sheet by reading our health report here.

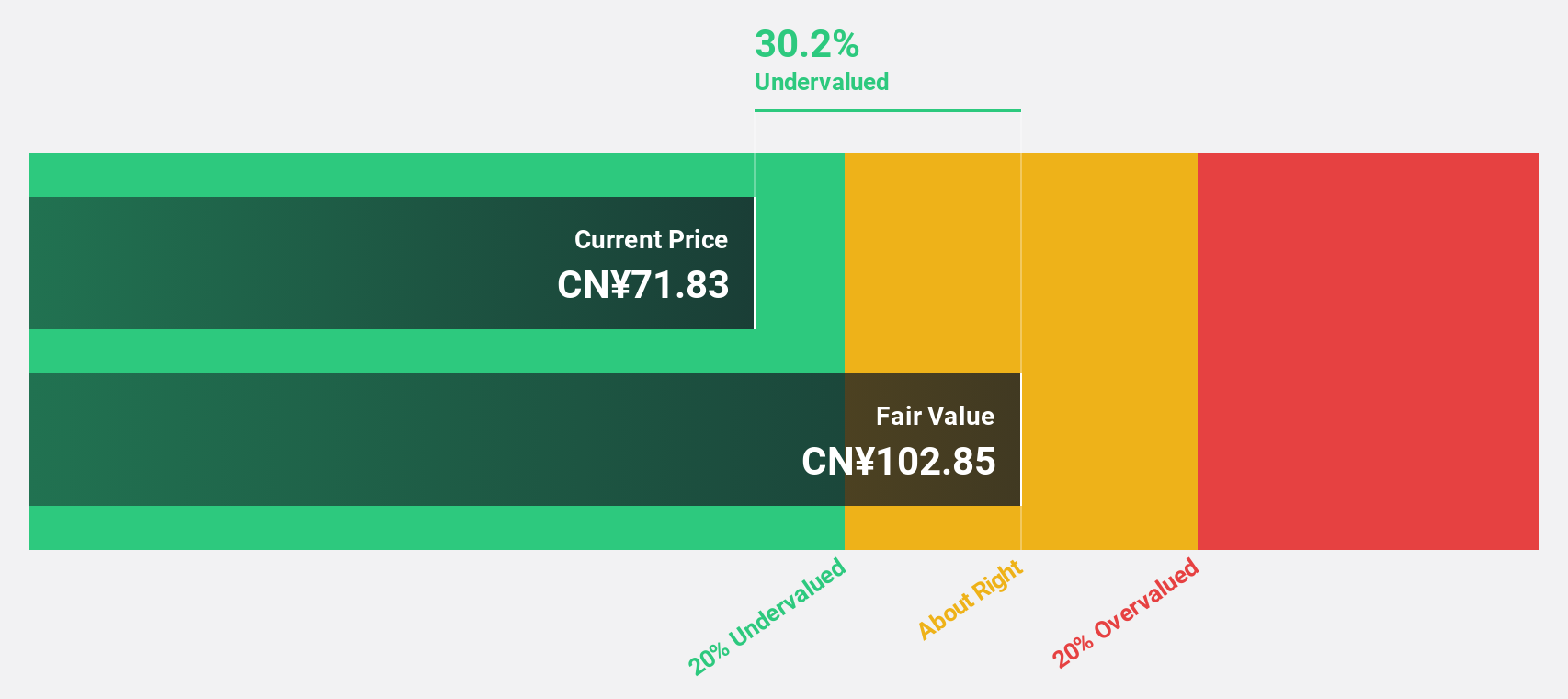

Ficont Industry (Beijing) (SHSE:605305)

Overview: Ficont Industry (Beijing) Co., Ltd. operates in the wind energy, construction, and safety protection equipment sectors both in China and internationally, with a market cap of CN¥8.39 billion.

Operations: Revenue Segments (in millions of CN¥): Construction Machinery & Equipment: 1,546.87

Estimated Discount To Fair Value: 35.1%

Ficont Industry (Beijing) is trading at CN¥39.46, below its estimated fair value of CN¥60.76, highlighting a potential undervaluation based on cash flows. The company reported significant growth in H1 2025 earnings and revenue compared to last year, with forecasts predicting over 20% annual revenue growth, surpassing the Chinese market average. However, earnings growth is expected to be slower than the market rate, and it has an unstable dividend track record with low future return on equity projections.

- Our expertly prepared growth report on Ficont Industry (Beijing) implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Ficont Industry (Beijing) stock in this financial health report.

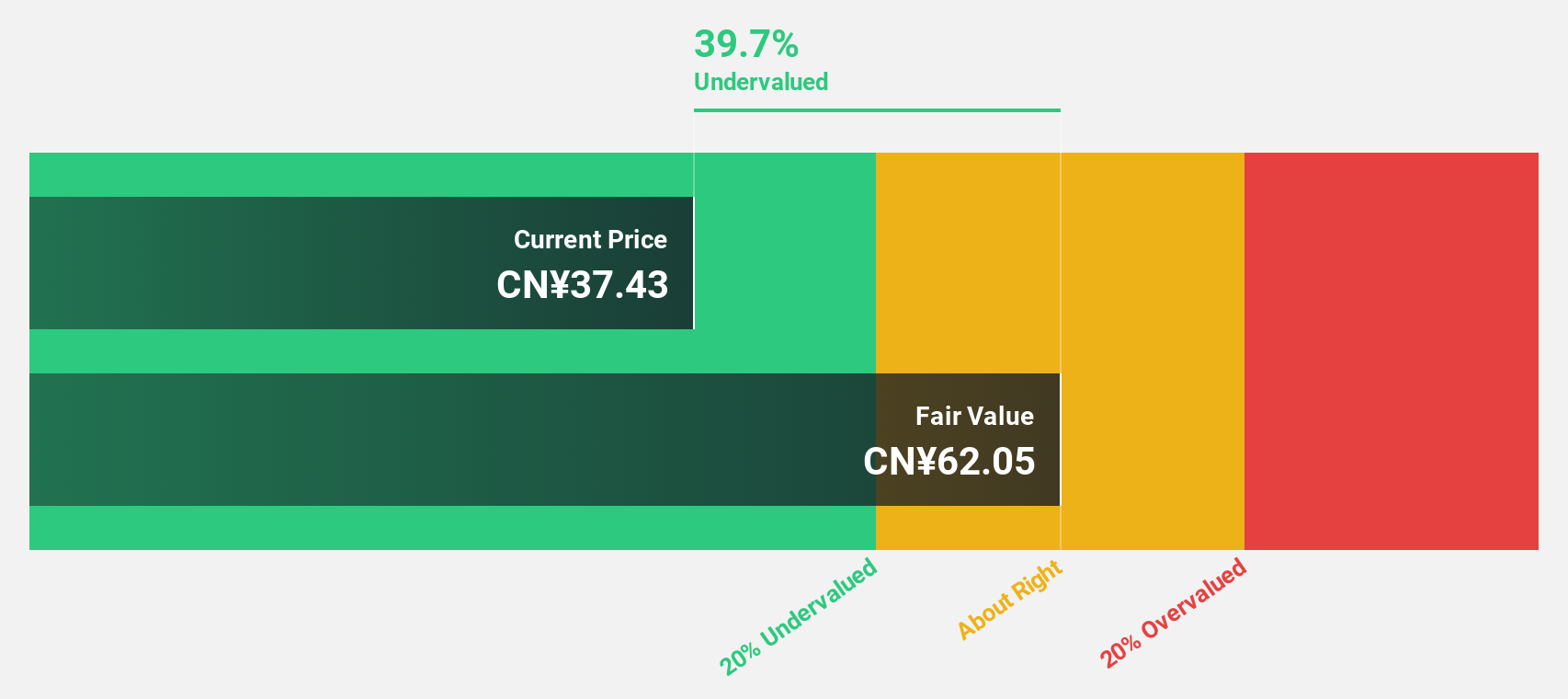

JWIPC Technology (SZSE:001339)

Overview: JWIPC Technology Co., Ltd. focuses on researching, developing, and manufacturing IoT hardware solutions with a market cap of CN¥13.48 billion.

Operations: JWIPC Technology Co., Ltd. generates revenue through its research, development, and manufacturing of IoT hardware solutions.

Estimated Discount To Fair Value: 31.9%

JWIPC Technology is trading at CN¥56.4, significantly below its estimated fair value of CN¥82.77, indicating potential undervaluation based on cash flows. Recent earnings for the nine months ended September 2025 showed net income growth to CN¥130.95 million from CN¥82.2 million last year, with basic EPS rising to CN¥0.53 from CNY 0.33 a year ago. Despite high share price volatility and low future return on equity forecasts, earnings are expected to grow significantly faster than the market average over the next three years.

- Upon reviewing our latest growth report, JWIPC Technology's projected financial performance appears quite optimistic.

- Navigate through the intricacies of JWIPC Technology with our comprehensive financial health report here.

Key Takeaways

- Click here to access our complete index of 268 Undervalued Asian Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605305

Ficont Industry (Beijing)

Provides wind energy, construction, and safety protection equipment in China and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives