- China

- /

- Construction

- /

- SHSE:605289

With A 26% Price Drop For Shanghai Luoman Technologies Inc. (SHSE:605289) You'll Still Get What You Pay For

To the annoyance of some shareholders, Shanghai Luoman Technologies Inc. (SHSE:605289) shares are down a considerable 26% in the last month, which continues a horrid run for the company. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

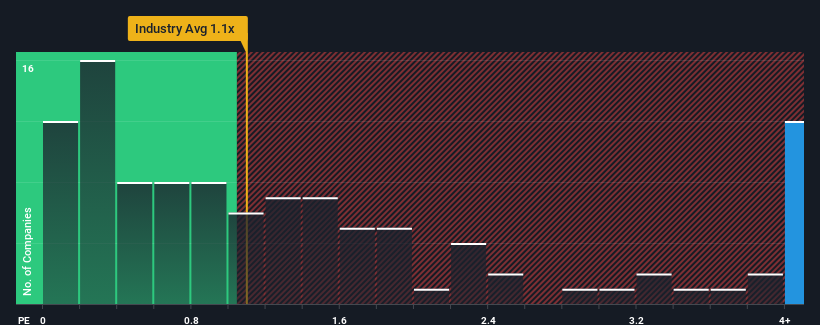

Even after such a large drop in price, given around half the companies in China's Construction industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Shanghai Luoman Technologies as a stock to avoid entirely with its 4.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Shanghai Luoman Technologies

How Shanghai Luoman Technologies Has Been Performing

Recent times have been advantageous for Shanghai Luoman Technologies as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Shanghai Luoman Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Shanghai Luoman Technologies?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shanghai Luoman Technologies' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 95% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 33% per annum over the next three years. That's shaping up to be materially higher than the 11% per year growth forecast for the broader industry.

With this information, we can see why Shanghai Luoman Technologies is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shanghai Luoman Technologies' P/S?

A significant share price dive has done very little to deflate Shanghai Luoman Technologies' very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai Luoman Technologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Construction industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shanghai Luoman Technologies, and understanding should be part of your investment process.

If you're unsure about the strength of Shanghai Luoman Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605289

Shanghai Luoman Technologies

Provides urban and rural landscape lighting solutions in China.

Mediocre balance sheet very low.

Market Insights

Community Narratives