Wangli Security & Surveillance Product Co., Ltd (SHSE:605268) Stock Rockets 38% But Many Are Still Ignoring The Company

Wangli Security & Surveillance Product Co., Ltd (SHSE:605268) shares have continued their recent momentum with a 38% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

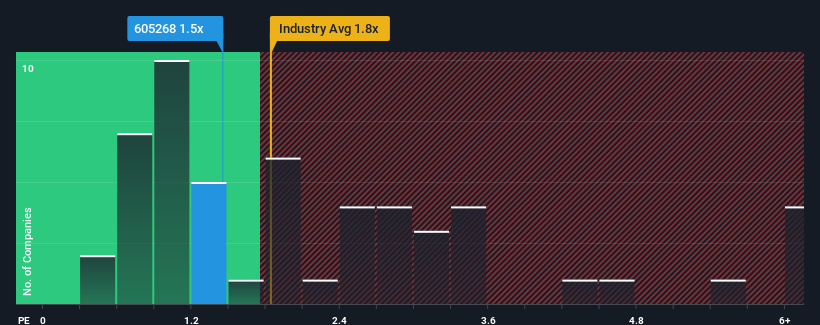

Even after such a large jump in price, there still wouldn't be many who think Wangli Security & Surveillance Product's price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in China's Building industry is similar at about 1.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Wangli Security & Surveillance Product

How Wangli Security & Surveillance Product Has Been Performing

Recent times have been advantageous for Wangli Security & Surveillance Product as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wangli Security & Surveillance Product.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Wangli Security & Surveillance Product's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. Revenue has also lifted 27% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 34% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 22% growth forecast for the broader industry.

With this information, we find it interesting that Wangli Security & Surveillance Product is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Wangli Security & Surveillance Product's P/S?

Wangli Security & Surveillance Product appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Wangli Security & Surveillance Product's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Wangli Security & Surveillance Product (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wangli Security & Surveillance Product might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605268

Wangli Security & Surveillance Product

Engages in the research, development, manufacturing, sells, and service of safety doors and security door locks.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives