- China

- /

- Construction

- /

- SHSE:605178

What Beijing New Space Technology Co., Ltd.'s (SHSE:605178) 25% Share Price Gain Is Not Telling You

Beijing New Space Technology Co., Ltd. (SHSE:605178) shares have continued their recent momentum with a 25% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.8% over the last year.

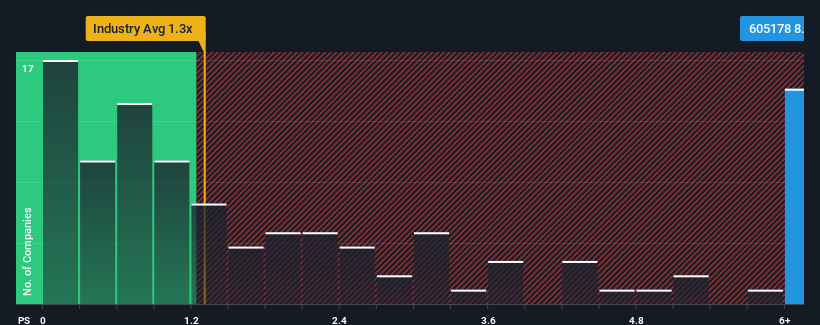

After such a large jump in price, given around half the companies in China's Construction industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Beijing New Space Technology as a stock to avoid entirely with its 8.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Beijing New Space Technology

What Does Beijing New Space Technology's P/S Mean For Shareholders?

Beijing New Space Technology has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beijing New Space Technology's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Beijing New Space Technology?

Beijing New Space Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 72% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Beijing New Space Technology's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Beijing New Space Technology's P/S

Beijing New Space Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Beijing New Space Technology revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you settle on your opinion, we've discovered 1 warning sign for Beijing New Space Technology that you should be aware of.

If these risks are making you reconsider your opinion on Beijing New Space Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beijing New Space Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605178

Beijing New Space Technology

Engages in the provision of professional contracting services for urban and road lighting engineering.

Flawless balance sheet and fair value.

Market Insights

Community Narratives