Undiscovered Gems And 2 Other Hidden Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and concerns over consumer spending, major U.S. indices experienced declines, with small-cap stocks in particular facing pressure as the Russell 2000 fell by 1.56%. Amidst this backdrop of cautious market sentiment and economic uncertainty, identifying stocks with strong fundamentals becomes crucial for investors seeking resilient opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Xiamen Solex High-tech Industries (SHSE:603992)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen Solex High-Tech Industries Co., Ltd. operates in the high-tech industry and has a market capitalization of CN¥7.92 billion.

Operations: Solex generates revenue primarily from its high-tech industry operations. The company has a market capitalization of CN¥7.92 billion, reflecting its scale in the sector.

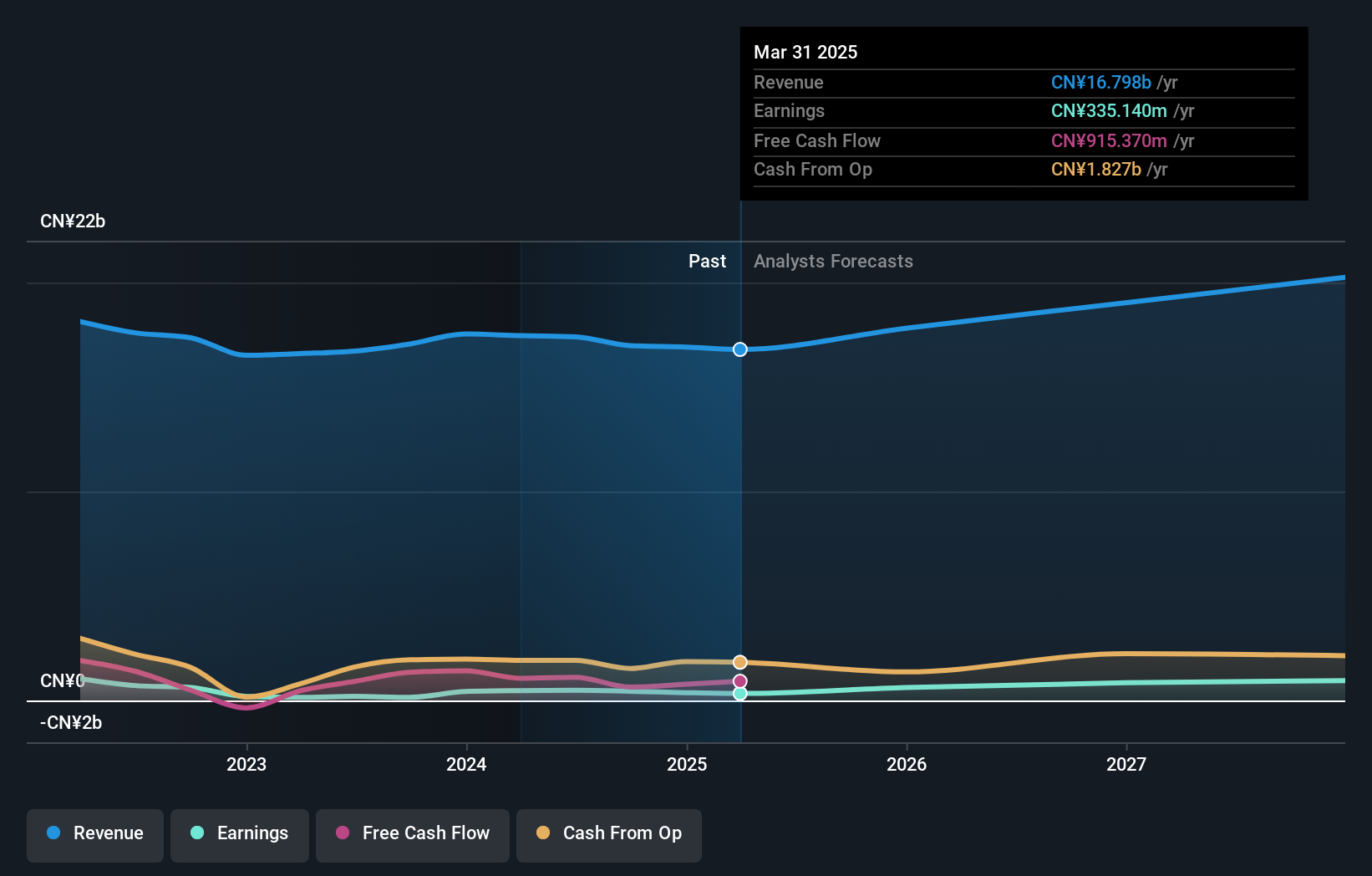

Xiamen Solex, a notable player in the high-tech sector, has demonstrated robust financial health with earnings growing by 27% over the past year, far outpacing the building industry's -8% performance. The company’s net income reached CNY 448 million in 2024, up from CNY 352 million in the previous year. With a debt-to-equity ratio increasing to 22.9% over five years and more cash than total debt, its financial footing seems solid. Additionally, its price-to-earnings ratio of 18.9x is attractive compared to the broader CN market's average of 38.1x, suggesting potential value for investors seeking growth opportunities.

MLS (SZSE:002745)

Simply Wall St Value Rating: ★★★★★★

Overview: MLS Co., Ltd. operates in the brand lighting and LED intelligent manufacturing sector both in China and internationally, with a market cap of CN¥12.17 billion.

Operations: The company generates revenue primarily from its brand lighting and LED intelligent manufacturing segments. It operates both domestically in China and internationally, contributing to its market presence.

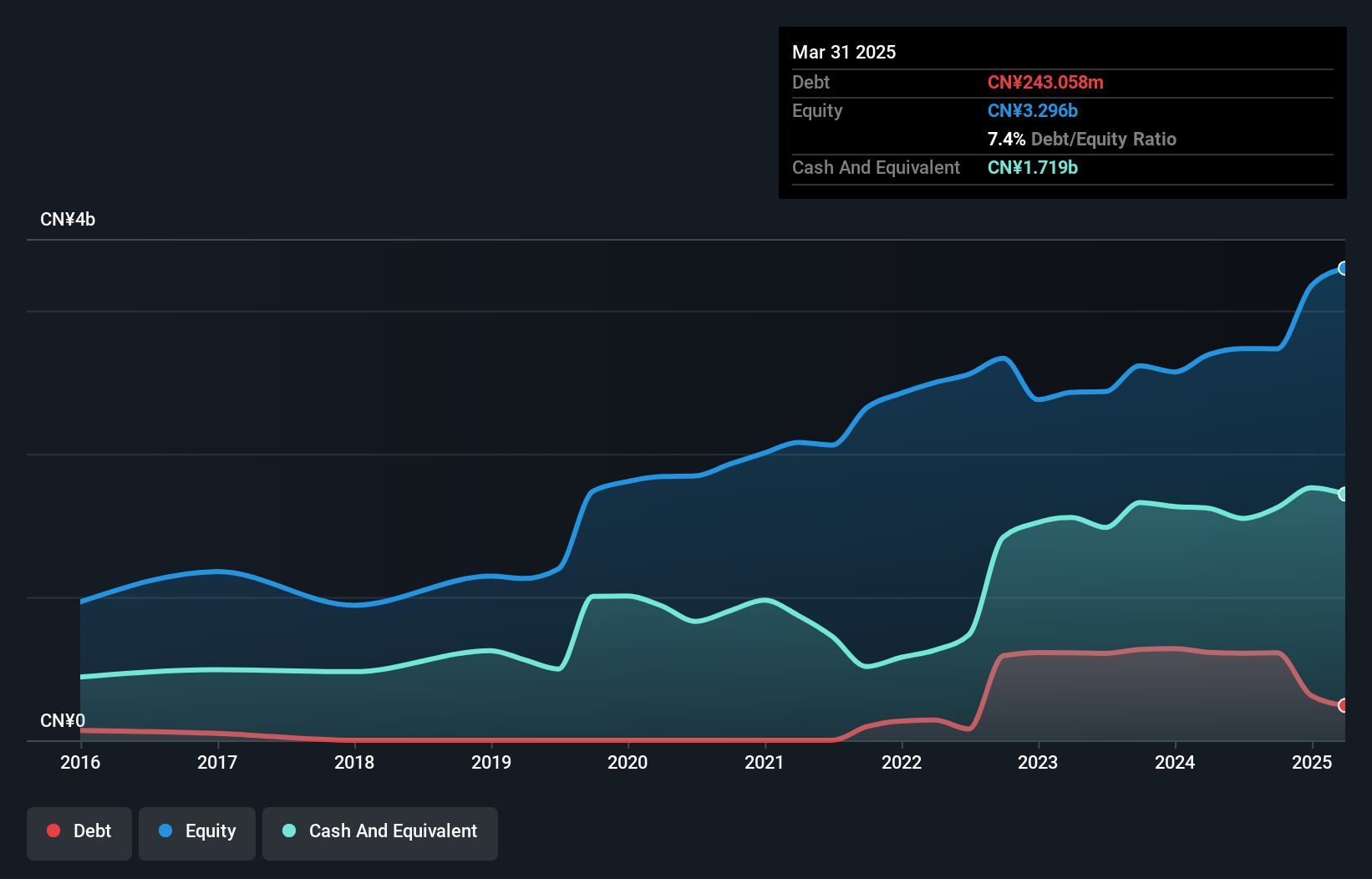

MLS stands out with a notable debt-to-equity reduction from 103.8% to 3.4% over five years, indicating improved financial health. The company enjoys high-quality earnings, having achieved an impressive 194.3% growth last year, far surpassing the semiconductor industry's average of 13.9%. Trading at a price-to-earnings ratio of 29.5x, MLS is attractively valued compared to the CN market's average of 38.1x. With more cash than its total debt and positive free cash flow, MLS seems well-positioned for continued growth at a forecasted rate of 30.55% annually, making it an intriguing prospect in its sector.

Toread Holdings Group (SZSE:300005)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toread Holdings Group Co., Ltd. focuses on the research, development, operation, and sales of outdoor products in China with a market cap of CN¥5.97 billion.

Operations: Toread Holdings generates revenue primarily through the sale of outdoor products. The company's financial performance is influenced by its ability to manage costs related to research, development, and operations.

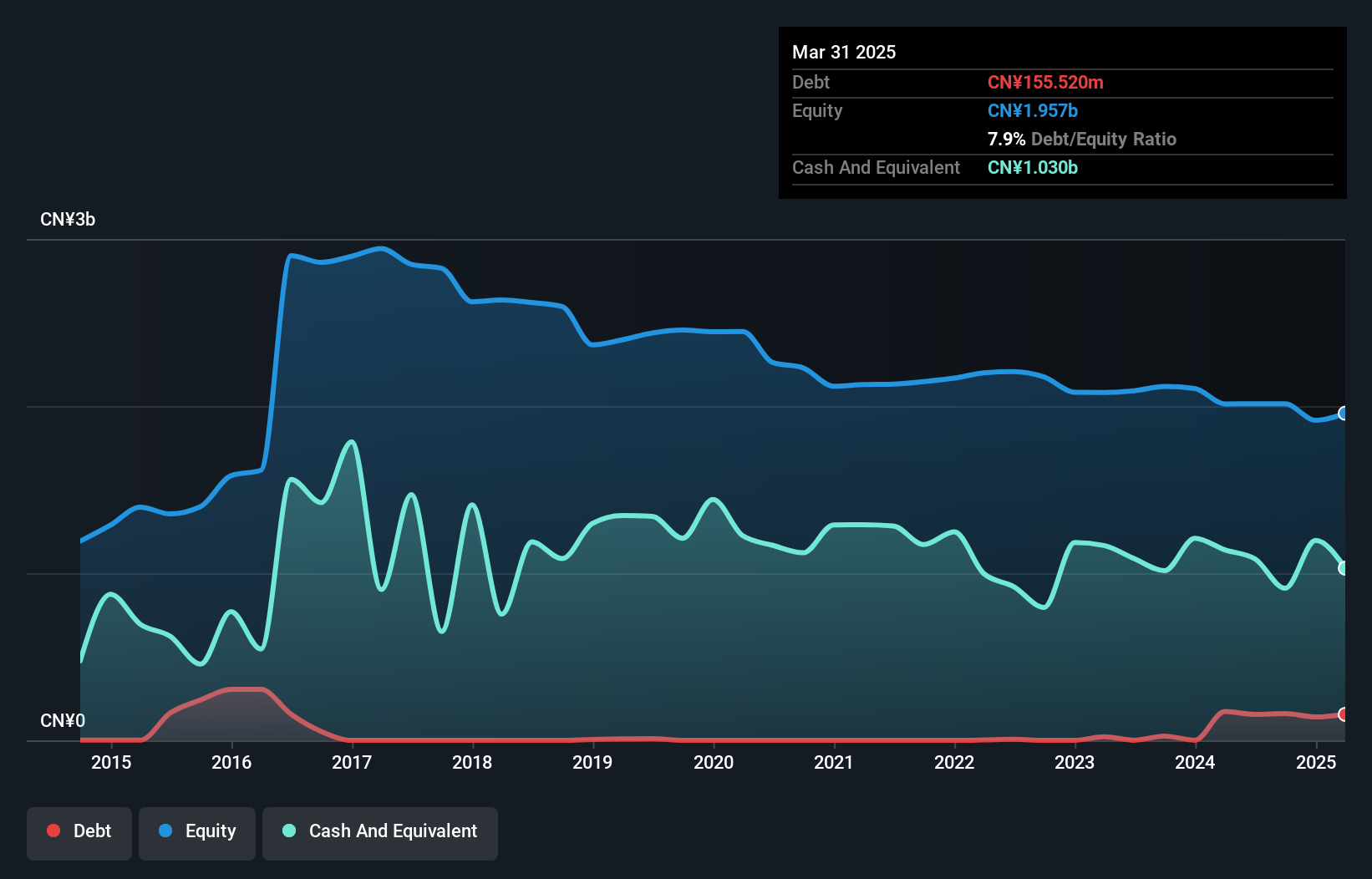

Toread Holdings Group, a relatively small player in the market, has shown impressive earnings growth of 21.8% over the past year, surpassing the Leisure industry's -0.7%. Its financial health appears robust with more cash than total debt and interest payments well covered by profits. However, a notable one-off gain of CN¥22.7M has impacted recent results, suggesting some volatility in earnings quality. The company's debt to equity ratio increased to 7.9% over five years but remains manageable given its strong cash position and positive free cash flow trajectory. Earnings are forecasted to grow by 25.37% annually, indicating potential for future expansion.

Summing It All Up

- Access the full spectrum of 4757 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toread Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300005

Toread Holdings Group

Engages in the research, development, operation, and sales of outdoor products in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives