After Leaping 190% Shanghai Kelai Mechatronics Engineering Co.,Ltd. (SHSE:603960) Shares Are Not Flying Under The Radar

Shanghai Kelai Mechatronics Engineering Co.,Ltd. (SHSE:603960) shares have had a really impressive month, gaining 190% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 80%.

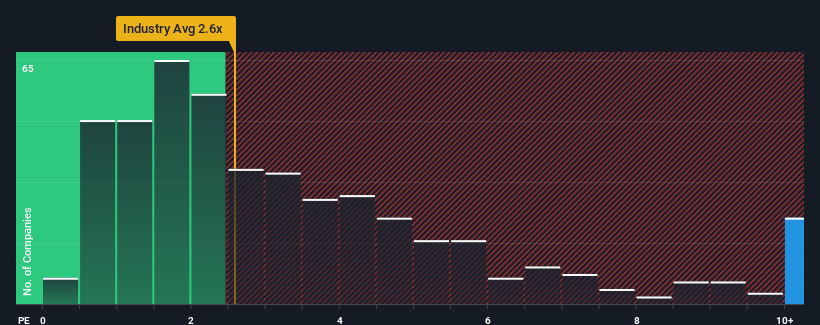

After such a large jump in price, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 2.6x, you may consider Shanghai Kelai Mechatronics EngineeringLtd as a stock to avoid entirely with its 15.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shanghai Kelai Mechatronics EngineeringLtd

How Shanghai Kelai Mechatronics EngineeringLtd Has Been Performing

Shanghai Kelai Mechatronics EngineeringLtd's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Kelai Mechatronics EngineeringLtd will help you uncover what's on the horizon.How Is Shanghai Kelai Mechatronics EngineeringLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Shanghai Kelai Mechatronics EngineeringLtd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. However, this wasn't enough as the latest three year period has seen an unpleasant 21% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 49% over the next year. With the industry only predicted to deliver 28%, the company is positioned for a stronger revenue result.

With this information, we can see why Shanghai Kelai Mechatronics EngineeringLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has lead to Shanghai Kelai Mechatronics EngineeringLtd's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Shanghai Kelai Mechatronics EngineeringLtd shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Shanghai Kelai Mechatronics EngineeringLtd.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603960

Shanghai Kelai Mechatronics EngineeringLtd

Shanghai Kelai Mechatronics Engineering Co.,Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives