As global markets continue to navigate a landscape marked by accelerating inflation and climbing U.S. stock indexes, growth stocks have shown resilience, outperforming their value counterparts. In such an environment, companies with high insider ownership can be particularly appealing as they often reflect strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 128.7% |

Here's a peek at a few of the choices from the screener.

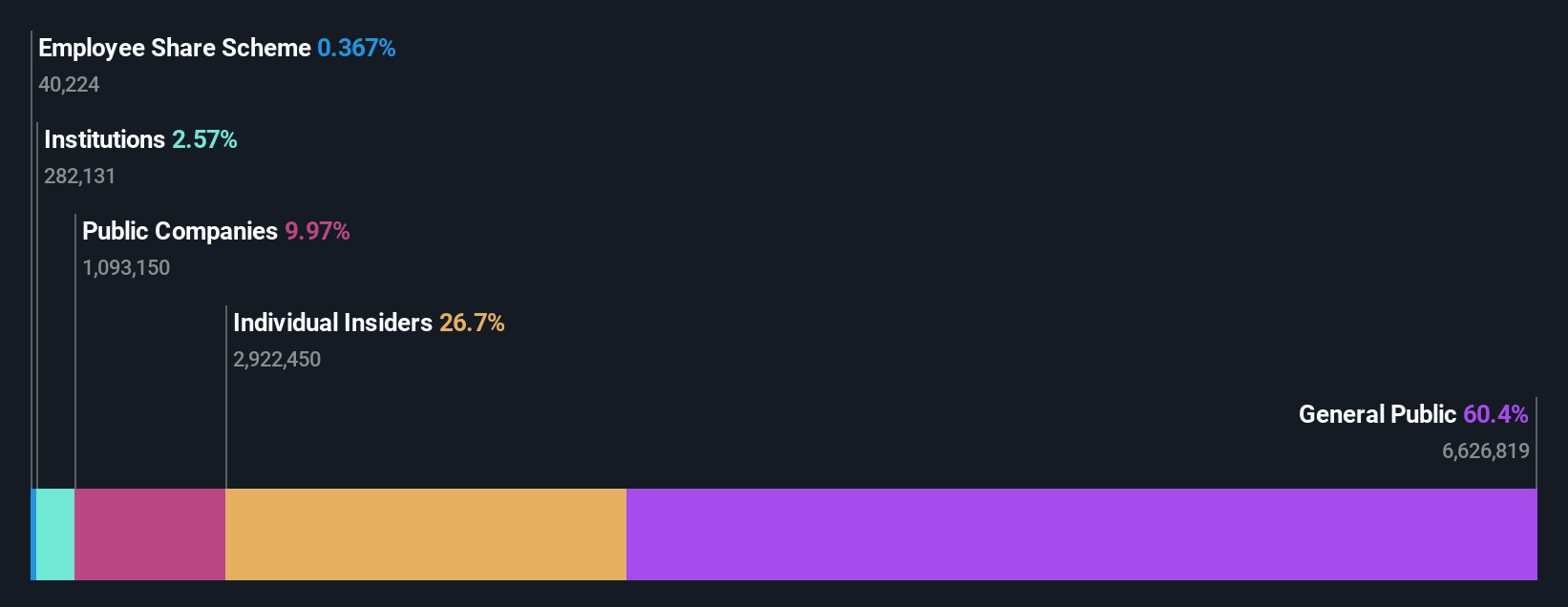

Devsisters (KOSDAQ:A194480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Devsisters Corporation develops mobile games in South Korea and internationally, with a market cap of ₩370.60 billion.

Operations: The company generates revenue from computer graphics, amounting to ₩223.84 million.

Insider Ownership: 26.6%

Revenue Growth Forecast: 24.2% p.a.

Devsisters is trading significantly below its estimated fair value, with analysts projecting a 65.5% stock price increase. The company's earnings and revenue are expected to grow substantially faster than the Korean market, at 57.7% and 24.2% annually, respectively. Despite becoming profitable recently, high-quality earnings are impacted by large one-off items. No substantial insider trading activity has been reported in the past three months, indicating stable insider confidence amidst growth prospects.

- Dive into the specifics of Devsisters here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Devsisters' current price could be quite moderate.

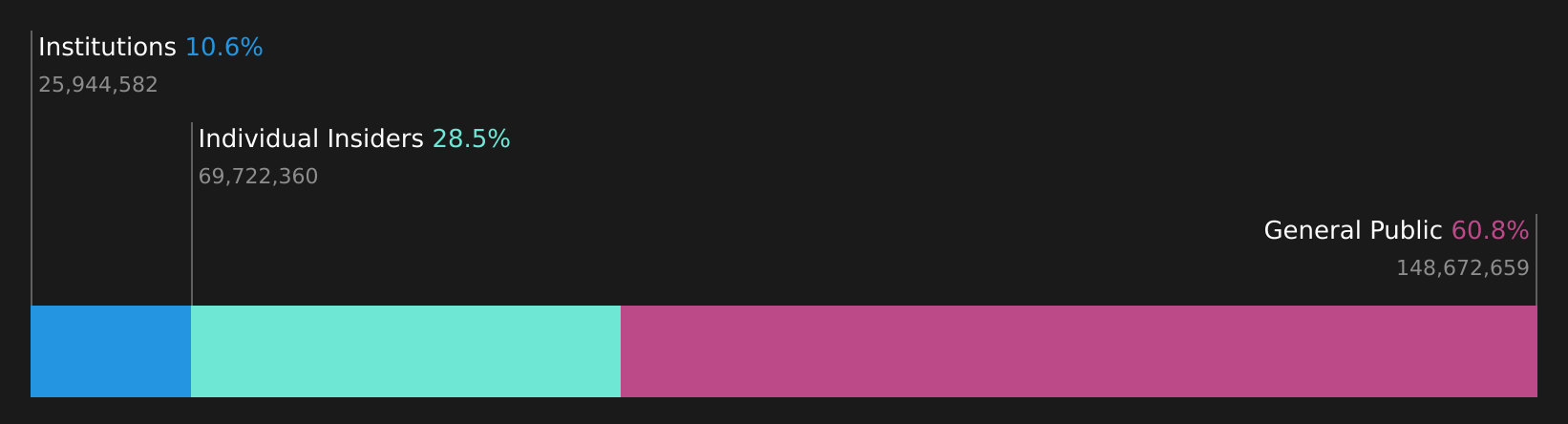

Nancal TechnologyLtd (SHSE:603859)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nancal Technology Co., Ltd offers digital transformation solutions both in China and internationally, with a market capitalization of CN¥8.44 billion.

Operations: Nancal Technology Co., Ltd generates revenue from its digital transformation solutions provided to both domestic and international markets.

Insider Ownership: 29.1%

Revenue Growth Forecast: 24% p.a.

Nancal Technology Ltd. is trading at a significant discount to its estimated fair value, with earnings projected to grow 36.6% annually, outpacing the Chinese market's expected growth rate of 25%. Revenue is also set to increase by 24% per year, surpassing the market average of 13.3%. However, its forecasted Return on Equity remains low at 11.4%, and the share price has been highly volatile recently. No substantial insider trading activity has been reported in three months.

- Navigate through the intricacies of Nancal TechnologyLtd with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Nancal TechnologyLtd shares in the market.

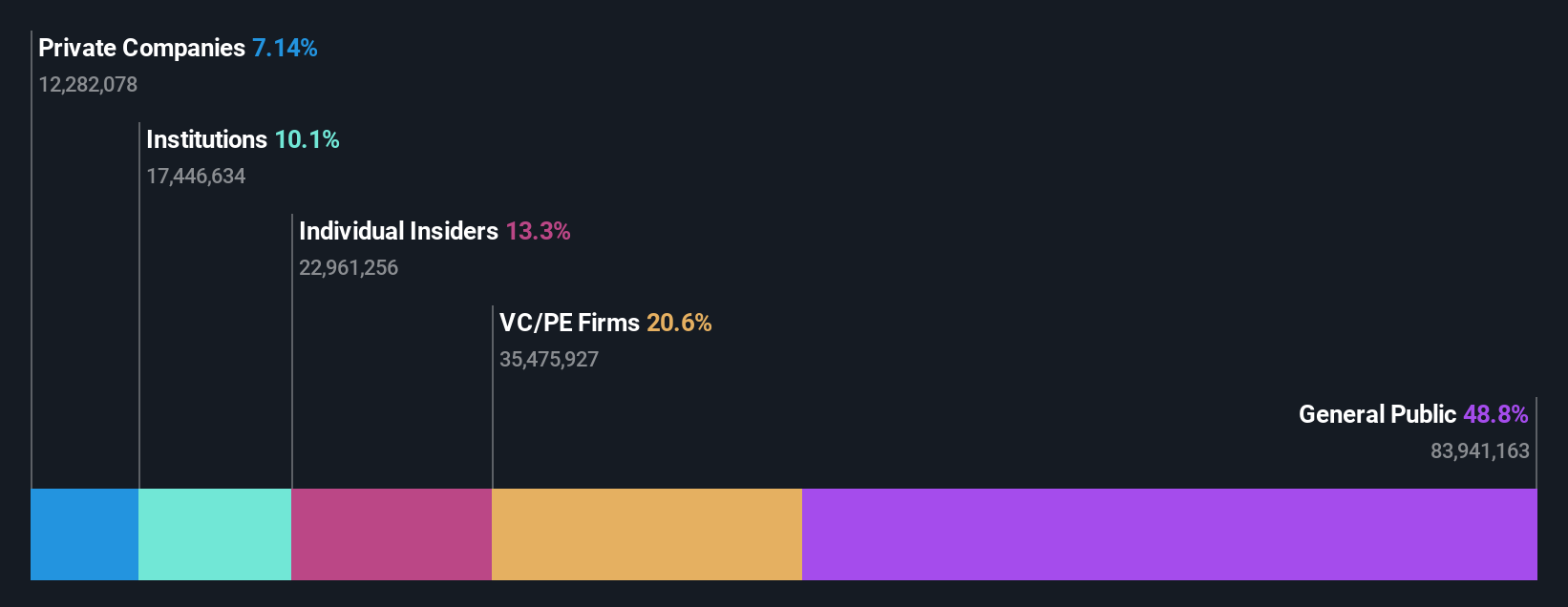

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and sale of liquid crystal materials, OLED materials, and drug intermediates, with a market cap of CN¥5.93 billion.

Operations: The company's revenue from its specialty chemicals segment amounts to CN¥1.37 billion.

Insider Ownership: 13.3%

Revenue Growth Forecast: 23.9% p.a.

Xi'an Manareco New Materials Ltd. is trading 33.8% below its estimated fair value, with revenue anticipated to grow at 23.9% annually, exceeding the Chinese market's 13.3%. Earnings are projected to rise significantly at 25% per year over the next three years, although Return on Equity is expected to remain low at 10%. The company has not reported substantial insider trading in recent months and maintains an unstable dividend track record.

- Click here to discover the nuances of Xi'an Manareco New MaterialsLtd with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Xi'an Manareco New MaterialsLtd's share price might be too pessimistic.

Seize The Opportunity

- Get an in-depth perspective on all 1454 Fast Growing Companies With High Insider Ownership by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nancal TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603859

Nancal TechnologyLtd

Provides digital transformation solutions in China and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives