- China

- /

- Electrical

- /

- SHSE:603728

Shanghai Moons' Electric Co., Ltd.'s (SHSE:603728) Shares Climb 30% But Its Business Is Yet to Catch Up

Shanghai Moons' Electric Co., Ltd. (SHSE:603728) shares have continued their recent momentum with a 30% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

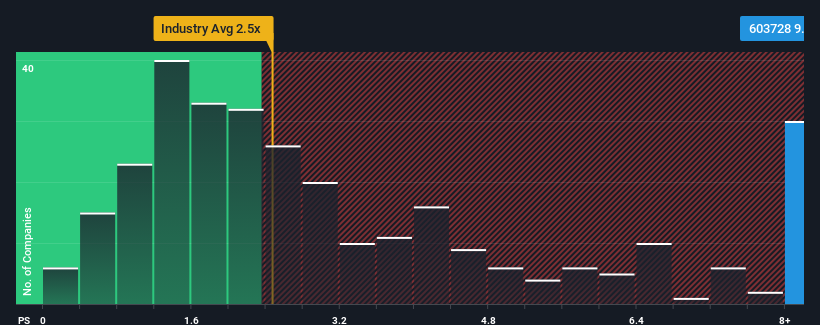

Following the firm bounce in price, when almost half of the companies in China's Electrical industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Shanghai Moons' Electric as a stock not worth researching with its 9.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Shanghai Moons' Electric

How Has Shanghai Moons' Electric Performed Recently?

While the industry has experienced revenue growth lately, Shanghai Moons' Electric's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Moons' Electric will help you uncover what's on the horizon.How Is Shanghai Moons' Electric's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Shanghai Moons' Electric's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. As a result, revenue from three years ago have also fallen 6.4% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 21% as estimated by the four analysts watching the company. With the industry predicted to deliver 26% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Shanghai Moons' Electric's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Shanghai Moons' Electric's P/S Mean For Investors?

Shanghai Moons' Electric's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Shanghai Moons' Electric trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shanghai Moons' Electric, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603728

Shanghai Moons' Electric

Engages in the research and development, production, operation, and sale of motion control, LED intelligent lighting control, and industrial equipment in the Asia Pacific, the Americas, and Europe.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives