Undiscovered Gems Three Promising Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape marked by rising inflation and cautious monetary policies, major U.S. stock indexes are approaching record highs, with growth stocks outperforming their value counterparts. Amid this backdrop, small-cap stocks have lagged behind larger indices like the S&P 500, creating potential opportunities for investors seeking undervalued assets. In such an environment, identifying promising small-cap stocks requires careful consideration of factors such as financial health and market positioning—qualities that can transform these lesser-known companies into standout performers in a dynamic market setting.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AOKI Holdings | 27.05% | 3.74% | 52.54% | ★★★★★★ |

| NS United Kaiun Kaisha | 55.99% | 13.51% | 20.23% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Shenzhen Farben Information TechnologyLtd | 7.69% | 21.56% | 3.60% | ★★★★★★ |

| AJIS | 0.78% | 2.14% | -13.06% | ★★★★★☆ |

| Wema Bank | 45.02% | 36.14% | 60.04% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

| Sanstar | 9.90% | 23.18% | 36.19% | ★★★★☆☆ |

| MNtech | 65.44% | 16.96% | -17.92% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

KTK Group (SHSE:603680)

Simply Wall St Value Rating: ★★★★★☆

Overview: KTK Group Co., Ltd. engages in the research, development, production, sale, and servicing of interior systems, electrical controlling systems, and vehicle equipment for various rail vehicles both in China and internationally with a market capitalization of CN¥6.76 billion.

Operations: KTK Group generates revenue primarily from the sale of interior systems, electrical controlling systems, and vehicle equipment for rail vehicles. The company's net profit margin is 9.5%, reflecting its efficiency in managing production and operational costs relative to its revenue streams.

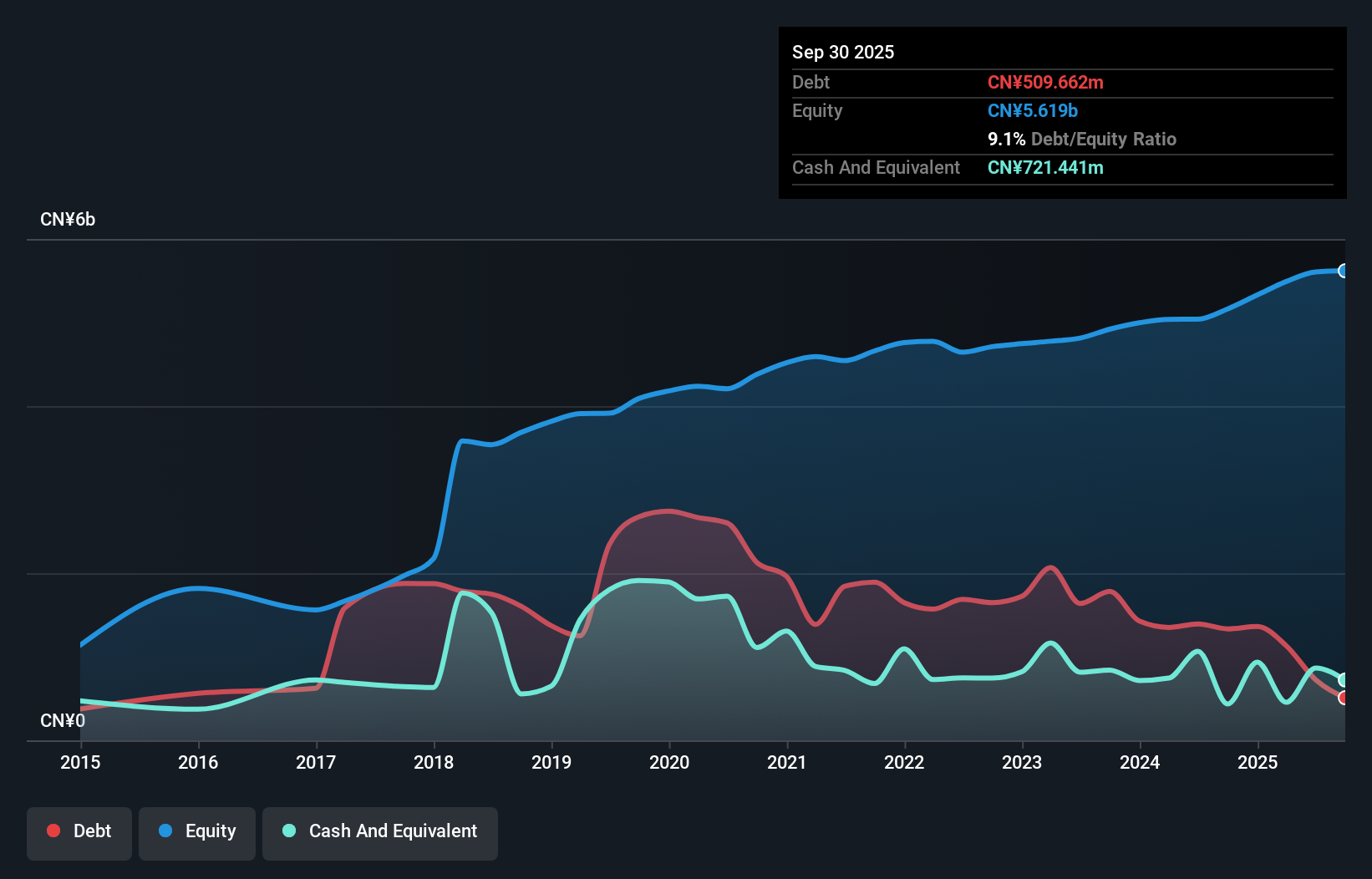

KTK Group, a small cap entity in the machinery sector, has shown impressive earnings growth of 32% over the past year, outpacing the industry average. This performance is supported by a significant reduction in its debt to equity ratio from 65% to 26% over five years, indicating improved financial health. The company boasts high-quality earnings and maintains a satisfactory net debt to equity ratio of 17%. With a price-to-earnings ratio of 19x below the CN market average of 36.5x, KTK Group appears attractively valued for investors considering its recent performance metrics and financial discipline.

- Dive into the specifics of KTK Group here with our thorough health report.

Gain insights into KTK Group's historical performance by reviewing our past performance report.

Aurisco PharmaceuticalLtd (SHSE:605116)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aurisco Pharmaceutical Co., Ltd. is involved in the research, manufacturing, and marketing of pharmaceutical intermediates, specialty active pharmaceutical ingredients (APIs), and formulations for the global pharmaceutical market, with a market cap of CN¥8.28 billion.

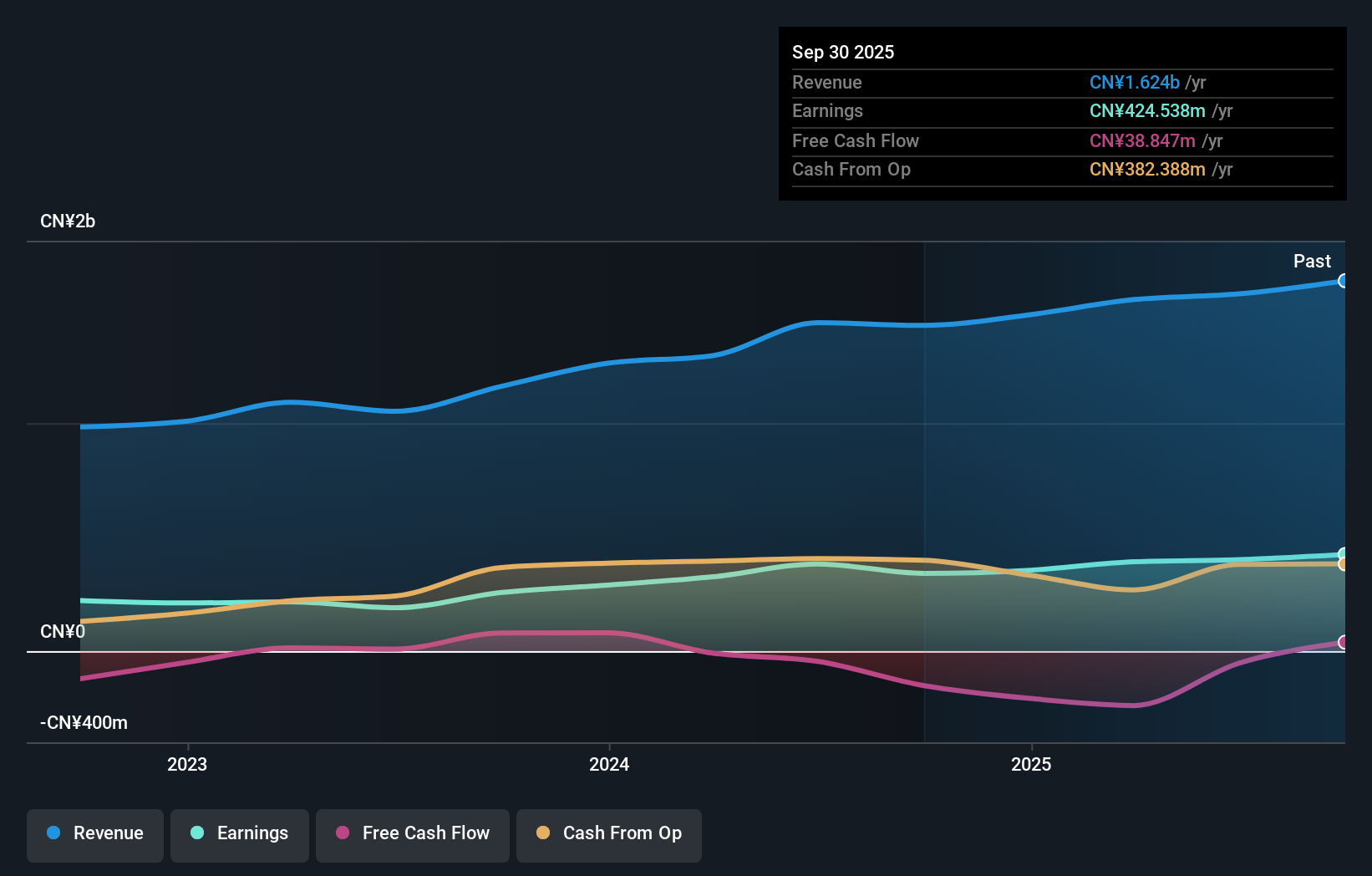

Operations: Aurisco generates revenue primarily through the sale of pharmaceutical intermediates, specialty active pharmaceutical ingredients (APIs), and formulations. The company's net profit margin is 15%, reflecting its efficiency in converting sales into actual profit.

Aurisco Pharma, a dynamic player in the pharmaceutical sector, has shown impressive growth with earnings climbing 32.5% over the past year, outpacing the industry average of -2.5%. The company trades at a favorable price-to-earnings ratio of 24.3x compared to the broader CN market's 36.5x, suggesting good relative value. Despite an increase in its debt-to-equity ratio from 0% to 37.4% over five years, Aurisco remains financially sound with more cash than total debt and high-quality non-cash earnings. Recently announced plans for a CNY 120 million share repurchase program could enhance shareholder value by converting convertible bonds effectively using available funds.

- Click here and access our complete health analysis report to understand the dynamics of Aurisco PharmaceuticalLtd.

Gain insights into Aurisco PharmaceuticalLtd's past trends and performance with our Past report.

Hold-Key Electric Wire & Cable (TWSE:1618)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hold-Key Electric Wire & Cable Co., Ltd. is engaged in the manufacturing, importing, and selling of cable products in Taiwan with a market capitalization of NT$10.14 billion.

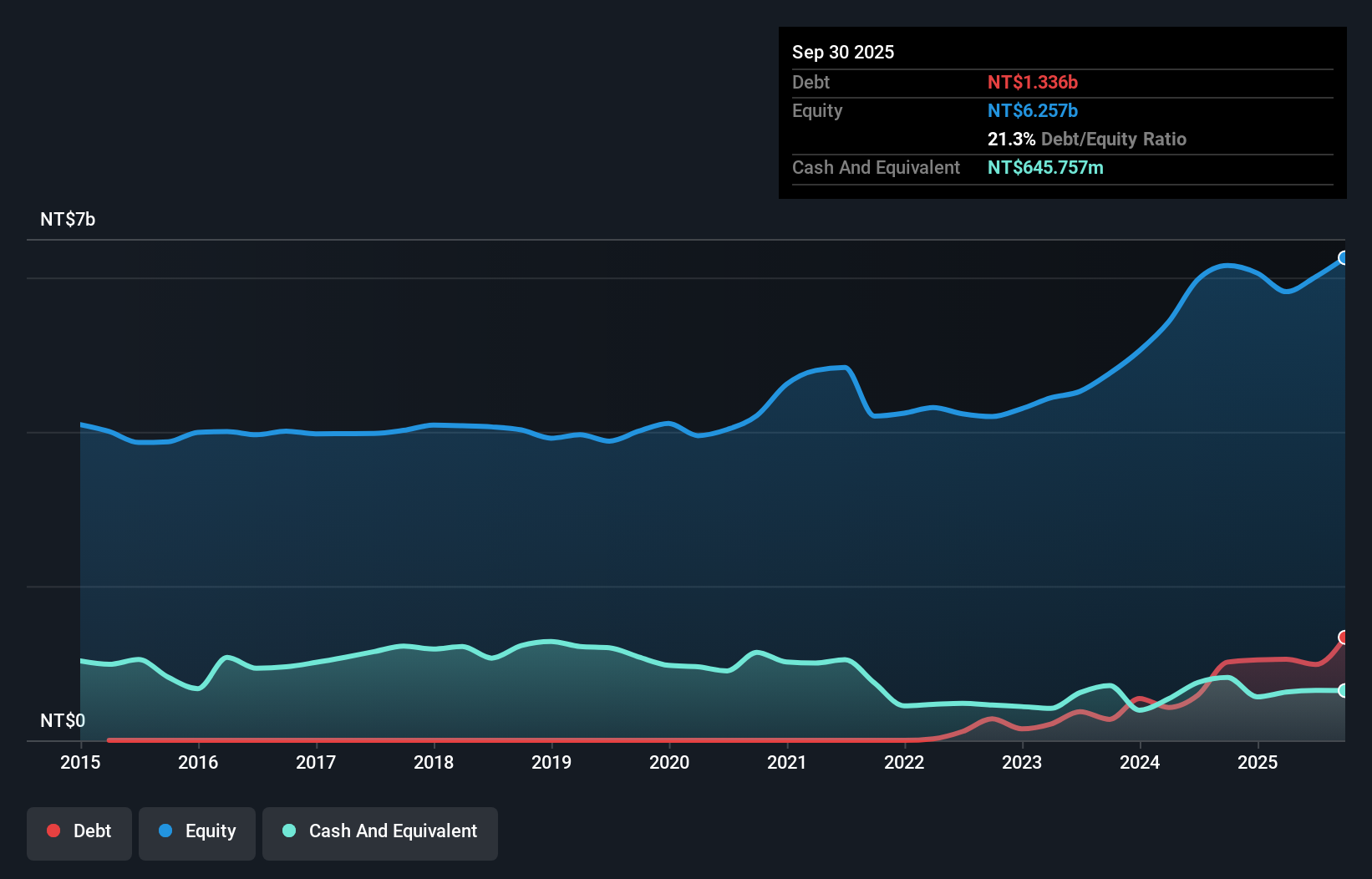

Operations: Hold-Key generates revenue primarily from its wire and cable segment, amounting to NT$4.60 billion.

Hold-Key Electric Wire & Cable, a small-cap player in the electrical industry, has shown impressive earnings growth of 120.9% over the past year, outpacing its industry peers who grew at 7.3%. With a price-to-earnings ratio of 14.7x, it offers good value compared to the market average of 21.6x. The company's debt to equity ratio has risen from 0% to 16.5% over five years but remains satisfactory with a net debt to equity ratio at just 3.2%. Recent strategic moves include forming a Sustainable Development Committee with experienced members in finance and capital markets, potentially enhancing governance and long-term growth prospects.

Seize The Opportunity

- Click through to start exploring the rest of the 4742 Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605116

Aurisco PharmaceuticalLtd

Engages in research, manufacturing, and marketing of pharmaceutical intermediates, specialty active pharmaceutical ingredients (API’s), and formulations catering to the pharmaceutical market worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives