- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6187

Undiscovered Gems in Global Markets for April 2025

Reviewed by Simply Wall St

As global markets experience a cautious optimism with easing trade tensions and better-than-expected corporate earnings, small-cap stocks have shown resilience, posting gains for the third consecutive week. In this environment of fluctuating consumer sentiment and economic indicators, identifying promising small-cap stocks requires a keen eye for companies that demonstrate strong fundamentals and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| Daphne International Holdings | NA | -40.78% | 85.98% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 38.63% | 65.41% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

KTK Group (SHSE:603680)

Simply Wall St Value Rating: ★★★★★☆

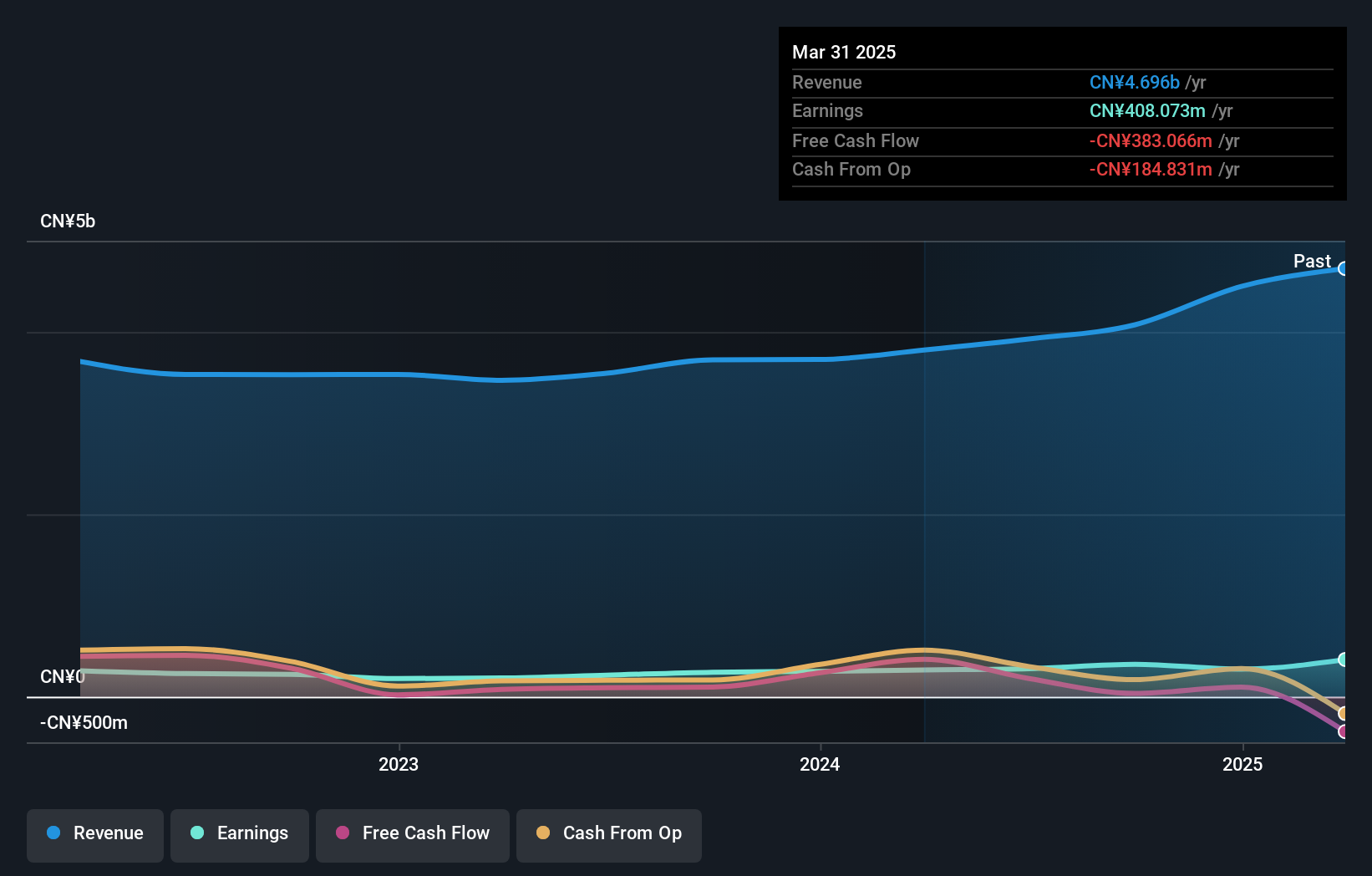

Overview: KTK Group Co., Ltd. engages in the research, development, production, sales, and servicing of interior systems, electrical controlling systems, and vehicle equipment for high-speed trains and other rail vehicles both in China and internationally with a market cap of CN¥7.12 billion.

Operations: KTK Group generates revenue primarily through the sale of interior systems, electrical controlling systems, and vehicle equipment for rail vehicles. The company's financial performance is influenced by its cost structure associated with these segments.

KTK Group, a smaller player in the market, has shown promising financial improvements recently. Over the past five years, its debt to equity ratio impressively dropped from 62.9% to 20.6%, indicating stronger financial health. The company also reported a notable earnings growth of 38.9% last year, outpacing the machinery industry average of 1.8%. Its price-to-earnings ratio stands at a favorable 17.7x compared to the broader CN market's 36.8x, suggesting good value potential for investors seeking opportunities in this space. With net income jumping from CNY 43 million to CNY 149 million year-over-year for Q1, KTK seems well-positioned for continued performance improvement.

- Click to explore a detailed breakdown of our findings in KTK Group's health report.

Review our historical performance report to gain insights into KTK Group's's past performance.

All Ring Tech (TPEX:6187)

Simply Wall St Value Rating: ★★★★★☆

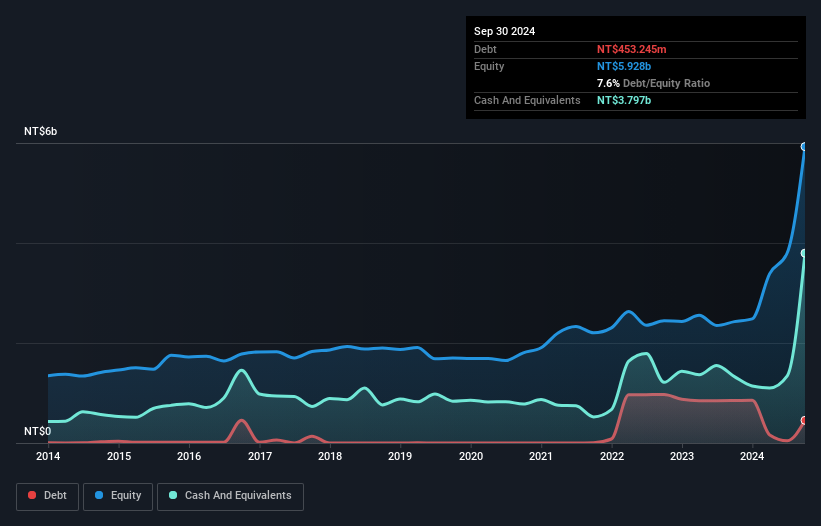

Overview: All Ring Tech Co., Ltd. specializes in the design, manufacture, and assembly of automation machines in Taiwan and China, with a market cap of NT$25.11 billion.

Operations: All Ring Tech generates revenue primarily from the design, manufacture, and assembly of automation machines. The company reported a net profit margin of 12.5%, reflecting its ability to manage costs effectively within its operational framework.

All Ring Tech, a small yet dynamic player in the tech scene, recently showcased impressive earnings growth of 848.5% over the past year, outpacing its industry peers. Despite a volatile share price in recent months, it trades at 63.4% below its estimated fair value. The company's net income soared to TWD 1,310 million from TWD 138 million last year, with basic earnings per share climbing to TWD 14.57 from TWD 1.7 previously. While shareholders faced dilution recently and debt-to-equity rose to 4.4%, All Ring remains profitable with more cash than total debt on hand.

- Unlock comprehensive insights into our analysis of All Ring Tech stock in this health report.

Understand All Ring Tech's track record by examining our Past report.

Tokuyama (TSE:4043)

Simply Wall St Value Rating: ★★★★★★

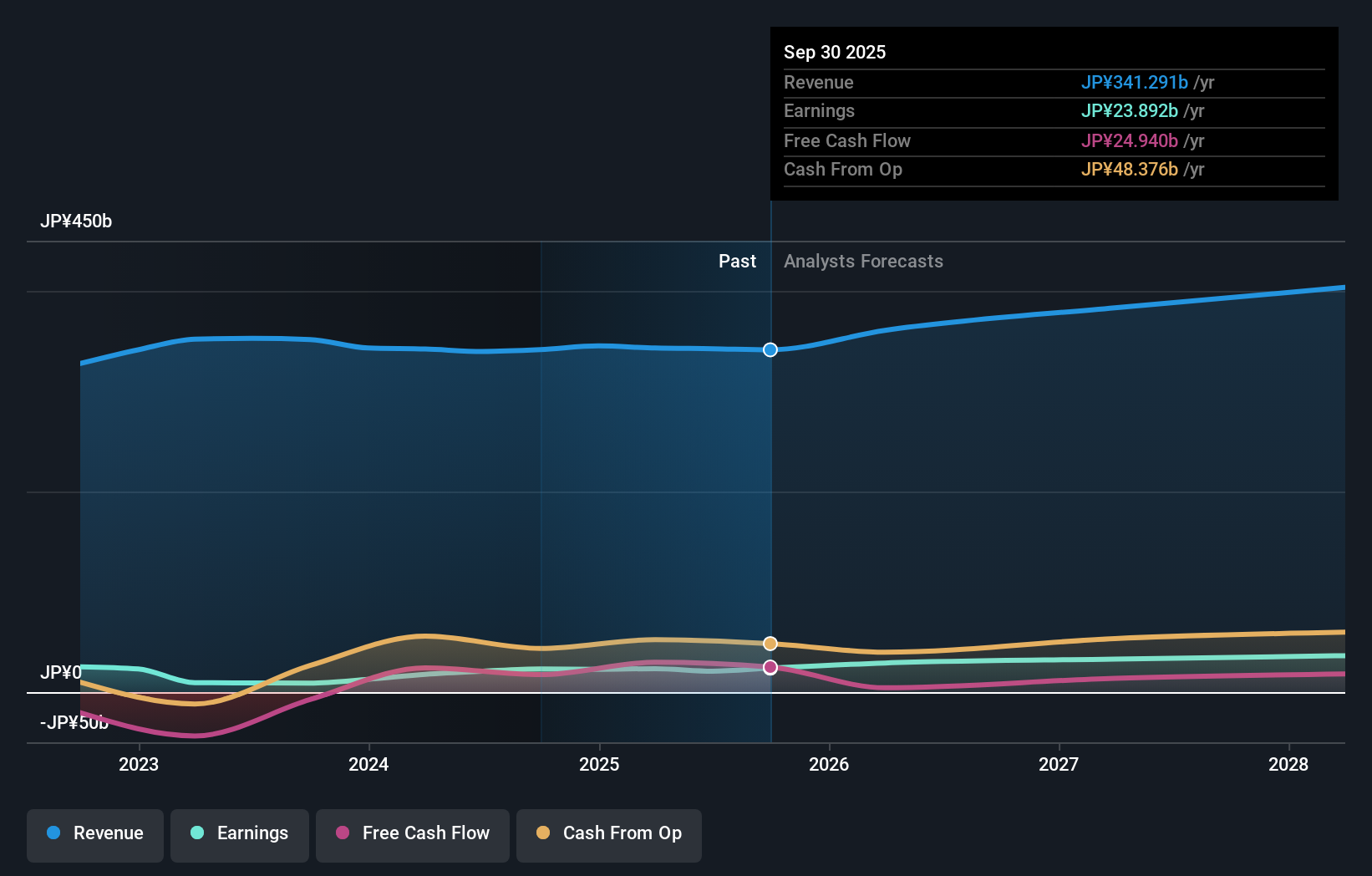

Overview: Tokuyama Corporation is a Japanese company engaged in the production and sale of various chemical products, with a market capitalization of ¥194.82 billion.

Operations: Tokuyama Corporation's primary revenue streams are derived from its Chemical Products segment, generating ¥115.00 billion, and the Electronic & Advanced Materials segment, contributing ¥87.05 billion. The Cement segment also adds significantly with ¥64.71 billion in revenue.

Tokuyama, a nimble player in the chemicals sector, has demonstrated strong earnings growth of 31.8% over the past year, outpacing the industry's 17.9%. With a net debt to equity ratio of 10.4%, its financial health appears robust and interest payments are well covered at an impressive 731 times by EBIT. Trading at a price-to-earnings ratio of 8.9x against Japan's market average of 12.9x suggests it's undervalued relative to peers. Recent strategic moves include plans to acquire JSR's in vitro diagnostics business, potentially expanding its footprint in pharmaceuticals and enhancing future growth prospects.

Make It Happen

- Explore the 3274 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6187

All Ring Tech

Engages in the design, manufacture, and assembly of automation machines in Taiwan and China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives