- China

- /

- Electrical

- /

- SHSE:603679

Unpleasant Surprises Could Be In Store For Sichuan Huati Lighting Technology Co.,Ltd.'s (SHSE:603679) Shares

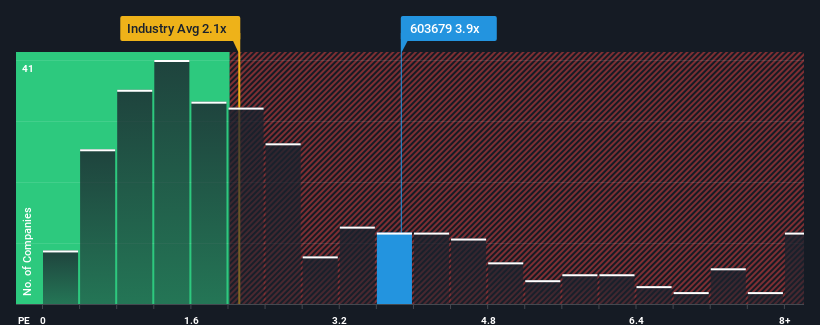

When close to half the companies in the Electrical industry in China have price-to-sales ratios (or "P/S") below 2.1x, you may consider Sichuan Huati Lighting Technology Co.,Ltd. (SHSE:603679) as a stock to potentially avoid with its 3.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Sichuan Huati Lighting TechnologyLtd

How Has Sichuan Huati Lighting TechnologyLtd Performed Recently?

For example, consider that Sichuan Huati Lighting TechnologyLtd's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Sichuan Huati Lighting TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Sichuan Huati Lighting TechnologyLtd?

The only time you'd be truly comfortable seeing a P/S as high as Sichuan Huati Lighting TechnologyLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. As a result, revenue from three years ago have also fallen 29% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 23% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Sichuan Huati Lighting TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Sichuan Huati Lighting TechnologyLtd currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Plus, you should also learn about these 4 warning signs we've spotted with Sichuan Huati Lighting TechnologyLtd (including 2 which shouldn't be ignored).

If you're unsure about the strength of Sichuan Huati Lighting TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603679

Sichuan Huati Lighting TechnologyLtd

Sichuan Huati Lighting Technology Co.,Ltd.

Mediocre balance sheet very low.

Market Insights

Community Narratives