- China

- /

- Electrical

- /

- SHSE:603662

Many Still Looking Away From Keli Sensing Technology (Ningbo) Co.,Ltd. (SHSE:603662)

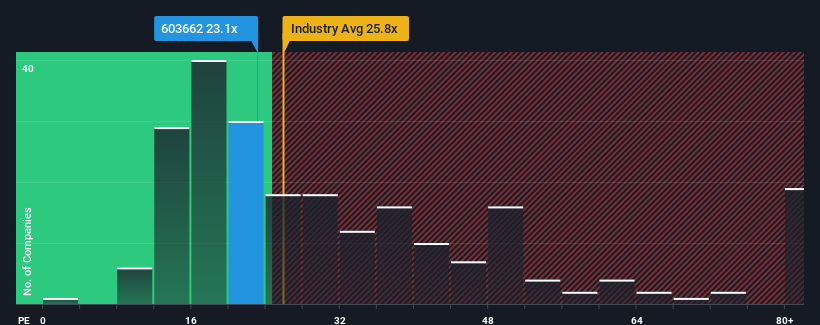

With a price-to-earnings (or "P/E") ratio of 23.1x Keli Sensing Technology (Ningbo) Co.,Ltd. (SHSE:603662) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 27x and even P/E's higher than 50x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Keli Sensing Technology (Ningbo)Ltd as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Keli Sensing Technology (Ningbo)Ltd

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Keli Sensing Technology (Ningbo)Ltd's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 6.2% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen an unpleasant 2.8% overall drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 18% each year during the coming three years according to the two analysts following the company. That's shaping up to be similar to the 19% each year growth forecast for the broader market.

In light of this, it's peculiar that Keli Sensing Technology (Ningbo)Ltd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Keli Sensing Technology (Ningbo)Ltd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Keli Sensing Technology (Ningbo)Ltd is showing 3 warning signs in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Keli Sensing Technology (Ningbo)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603662

Keli Sensing Technology (Ningbo)Ltd

Engages in the research and development, manufacture, and sale of various types of sensors, weighing indicators, electronic weighing systems, system integration and health scales in China and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives