- China

- /

- Electrical

- /

- SHSE:603662

Keli Sensing Technology (Ningbo)Ltd (SHSE:603662) Has More To Do To Multiply In Value Going Forward

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after briefly looking over the numbers, we don't think Keli Sensing Technology (Ningbo)Ltd (SHSE:603662) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Keli Sensing Technology (Ningbo)Ltd is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.078 = CN¥235m ÷ (CN¥4.3b - CN¥1.3b) (Based on the trailing twelve months to September 2024).

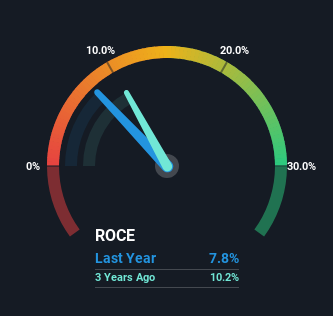

So, Keli Sensing Technology (Ningbo)Ltd has an ROCE of 7.8%. On its own that's a low return, but compared to the average of 5.8% generated by the Electrical industry, it's much better.

See our latest analysis for Keli Sensing Technology (Ningbo)Ltd

In the above chart we have measured Keli Sensing Technology (Ningbo)Ltd's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Keli Sensing Technology (Ningbo)Ltd .

So How Is Keli Sensing Technology (Ningbo)Ltd's ROCE Trending?

In terms of Keli Sensing Technology (Ningbo)Ltd's historical ROCE trend, it doesn't exactly demand attention. The company has consistently earned 7.8% for the last five years, and the capital employed within the business has risen 75% in that time. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 30% of total assets, this reported ROCE would probably be less than7.8% because total capital employed would be higher.The 7.8% ROCE could be even lower if current liabilities weren't 30% of total assets, because the the formula would show a larger base of total capital employed. With that in mind, just be wary if this ratio increases in the future, because if it gets particularly high, this brings with it some new elements of risk.

The Key Takeaway

As we've seen above, Keli Sensing Technology (Ningbo)Ltd's returns on capital haven't increased but it is reinvesting in the business. Investors must think there's better things to come because the stock has knocked it out of the park, delivering a 292% gain to shareholders who have held over the last five years. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

On a final note, we've found 2 warning signs for Keli Sensing Technology (Ningbo)Ltd that we think you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Keli Sensing Technology (Ningbo)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603662

Keli Sensing Technology (Ningbo)Ltd

Engages in the research and development, manufacture, and sale of various types of sensors, weighing indicators, electronic weighing systems, system integration and health scales in China and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives