- China

- /

- Electrical

- /

- SHSE:603662

Keli Sensing Technology (Ningbo) Co.,Ltd.'s (SHSE:603662) 43% Price Boost Is Out Of Tune With Earnings

Keli Sensing Technology (Ningbo) Co.,Ltd. (SHSE:603662) shares have continued their recent momentum with a 43% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 87%.

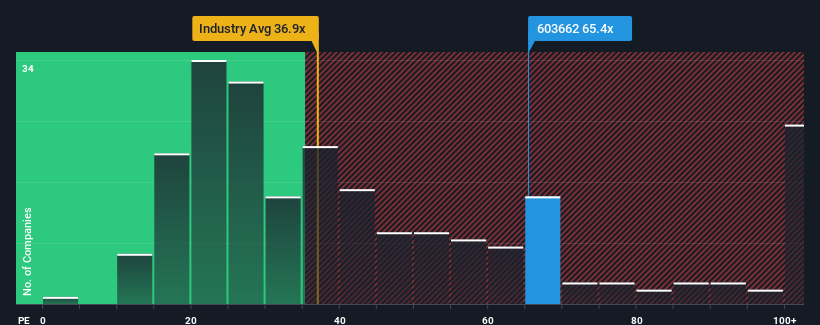

Since its price has surged higher, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 35x, you may consider Keli Sensing Technology (Ningbo)Ltd as a stock to avoid entirely with its 65.4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been pleasing for Keli Sensing Technology (Ningbo)Ltd as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Keli Sensing Technology (Ningbo)Ltd

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Keli Sensing Technology (Ningbo)Ltd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 18% gain to the company's bottom line. Still, incredibly EPS has fallen 5.0% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 29% as estimated by the three analysts watching the company. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that Keli Sensing Technology (Ningbo)Ltd is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Shares in Keli Sensing Technology (Ningbo)Ltd have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Keli Sensing Technology (Ningbo)Ltd currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Keli Sensing Technology (Ningbo)Ltd that you need to be mindful of.

If you're unsure about the strength of Keli Sensing Technology (Ningbo)Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Keli Sensing Technology (Ningbo)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603662

Keli Sensing Technology (Ningbo)Ltd

Engages in the research and development, manufacture, and sale of various types of sensors, weighing indicators, electronic weighing systems, system integration and health scales in China and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives