What Beijing Hanjian Heshan Pipeline Co.,Ltd's (SHSE:603616) P/S Is Not Telling You

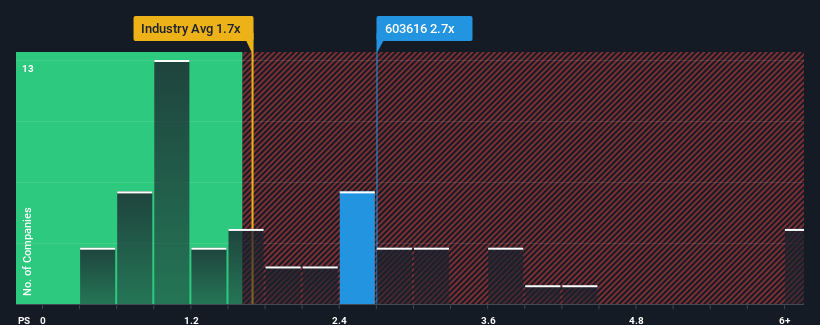

When close to half the companies in the Building industry in China have price-to-sales ratios (or "P/S") below 1.7x, you may consider Beijing Hanjian Heshan Pipeline Co.,Ltd (SHSE:603616) as a stock to potentially avoid with its 2.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing Hanjian Heshan PipelineLtd

What Does Beijing Hanjian Heshan PipelineLtd's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Beijing Hanjian Heshan PipelineLtd over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beijing Hanjian Heshan PipelineLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Beijing Hanjian Heshan PipelineLtd?

The only time you'd be truly comfortable seeing a P/S as high as Beijing Hanjian Heshan PipelineLtd's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. The last three years don't look nice either as the company has shrunk revenue by 59% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 20% shows it's an unpleasant look.

In light of this, it's alarming that Beijing Hanjian Heshan PipelineLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Beijing Hanjian Heshan PipelineLtd's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Beijing Hanjian Heshan PipelineLtd currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Beijing Hanjian Heshan PipelineLtd, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Hanjian Heshan PipelineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603616

Beijing Hanjian Heshan PipelineLtd

Manufactures and sells pre-stressed steel cylinder concrete pipes, reinforced concrete drainage pipes, commercial concrete products, concrete admixtures, and environmental protection engineering products and equipment in China.

Slightly overvalued very low.

Market Insights

Community Narratives