As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are closely watching the performance of major indices like the S&P 500, which showed resilience despite recent declines. Amidst this backdrop, dividend stocks can offer a measure of stability and income potential, especially when market volatility is heightened.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.88% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

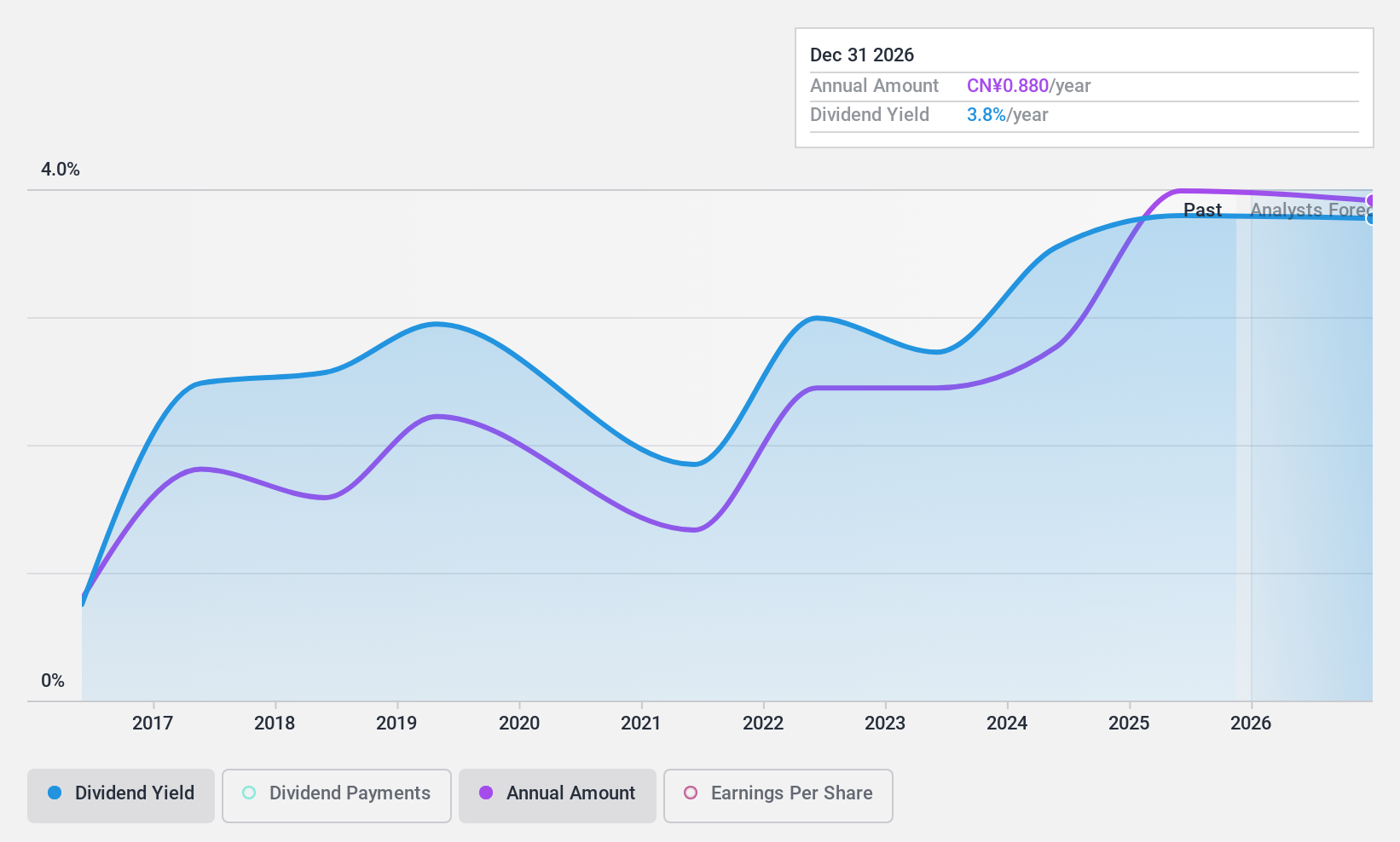

Noblelift Intelligent EquipmentLtd (SHSE:603611)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Noblelift Intelligent Equipment Co., Ltd. operates in the intelligent manufacturing equipment and smart logistics system sectors both in China and internationally, with a market cap of CN¥4.80 billion.

Operations: Noblelift Intelligent Equipment Co., Ltd. generates its revenue from the intelligent manufacturing equipment and smart logistics system sectors, serving both domestic and international markets.

Dividend Yield: 3.3%

Noblelift Intelligent Equipment Ltd. offers a dividend yield of 3.31%, placing it in the top 25% of dividend payers in China, yet its dividends are not covered by free cash flows and have been unreliable over the past decade due to volatility. Despite this, the payout ratio remains low at 34.6%, suggesting dividends are well-covered by earnings. The stock trades at a favorable price-to-earnings ratio of 10.5x compared to the market average of 36.7x.

- Get an in-depth perspective on Noblelift Intelligent EquipmentLtd's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Noblelift Intelligent EquipmentLtd is trading behind its estimated value.

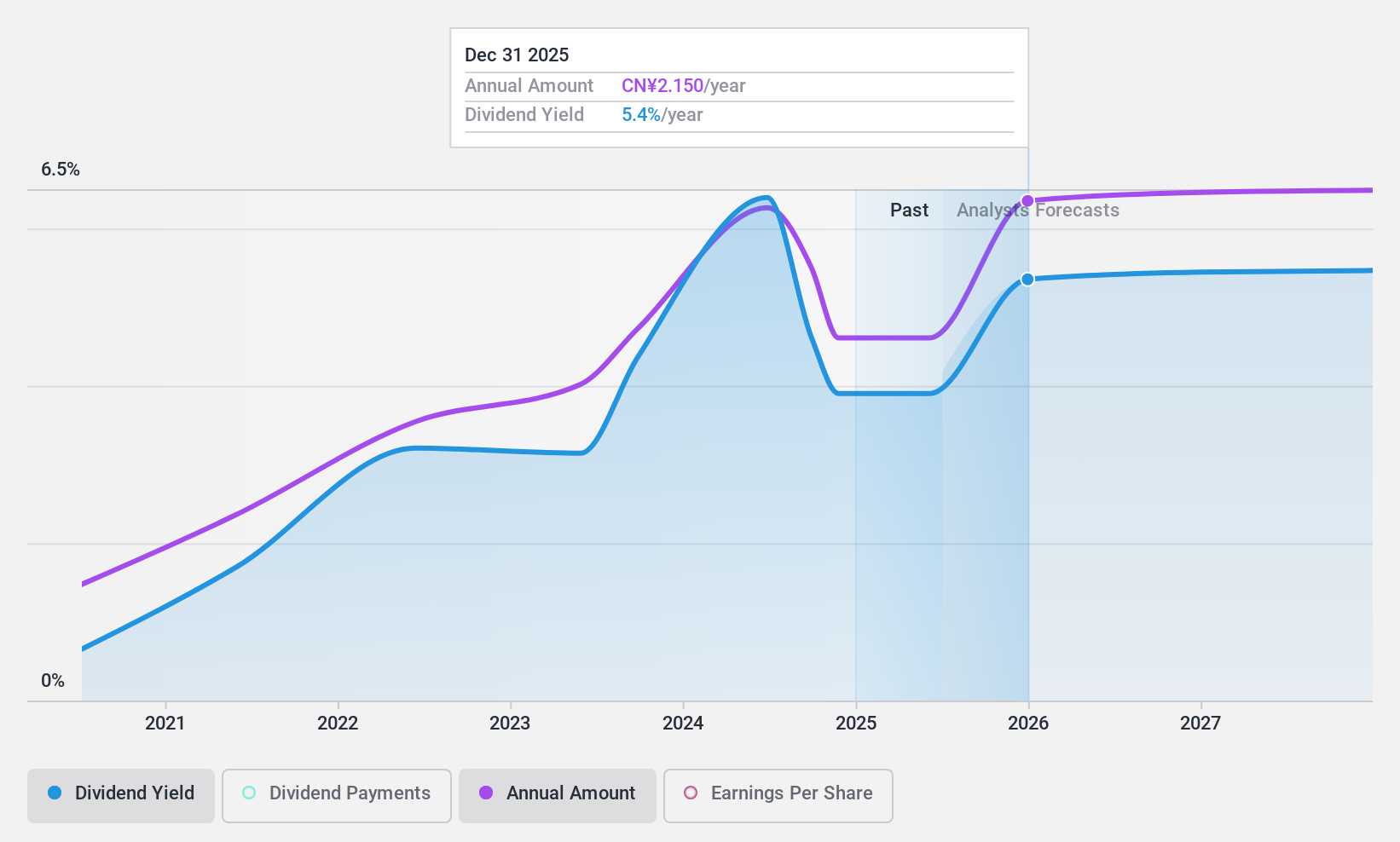

Guangdong South New MediaLtd (SZSE:300770)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guangdong Southern New Media Co., Ltd. operates in China, offering IPTV, internet audio-visual services, and content copyright services, with a market capitalization of CN¥9.64 billion.

Operations: Guangdong Southern New Media Co., Ltd. generates revenue from the Information Dissemination Industry, amounting to CN¥1.57 billion.

Dividend Yield: 4.4%

Guangdong South New Media Ltd. offers a dividend yield of 4.41%, ranking in the top 25% of Chinese dividend payers, with dividends well-covered by earnings and cash flows, as indicated by a payout ratio of 66.9% and a cash payout ratio of 49%. Despite recent volatility in its five-year dividend history, the company announced a special dividend in November 2024. The stock is attractively valued with a price-to-earnings ratio of 15.2x below the market average.

- Unlock comprehensive insights into our analysis of Guangdong South New MediaLtd stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Guangdong South New MediaLtd is priced lower than what may be justified by its financials.

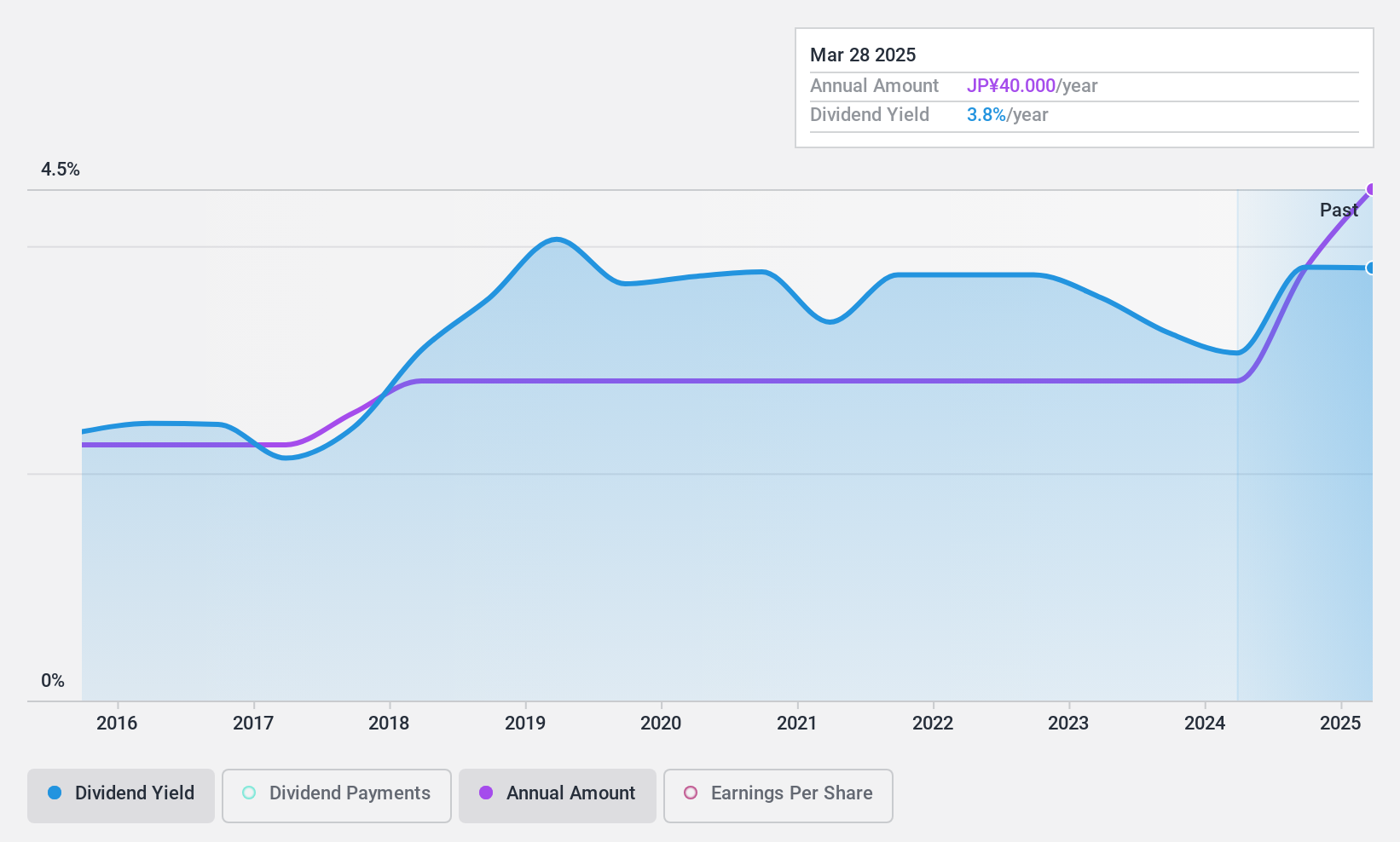

Kyodo Printing (TSE:7914)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyodo Printing Co., Ltd., with a market cap of ¥29.59 billion, operates in Japan's printing industry alongside its subsidiaries.

Operations: Kyodo Printing Co., Ltd. generates revenue through its core printing business in Japan, supported by its subsidiaries.

Dividend Yield: 3.7%

Kyodo Printing offers a stable dividend yield of 3.7%, with dividends well-covered by earnings, indicated by a low payout ratio of 29.3%. However, the cash payout ratio is higher at 89.6%, suggesting tighter cash flow coverage. The company's price-to-earnings ratio of 11.7x is below the JP market average, indicating potential value for investors. Recent buybacks totaling ¥999.7 million could enhance shareholder value and reflect management's confidence in future performance despite large one-off items impacting earnings quality.

- Click here to discover the nuances of Kyodo Printing with our detailed analytical dividend report.

- Our expertly prepared valuation report Kyodo Printing implies its share price may be too high.

Summing It All Up

- Get an in-depth perspective on all 1964 Top Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noblelift Intelligent EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603611

Noblelift Intelligent EquipmentLtd

Engages in the intelligent manufacturing equipment and smart logistics system businesses in China and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives