- China

- /

- Electrical

- /

- SHSE:603595

Zhejiang Tony Electronic Co., Ltd's (SHSE:603595) Shares Climb 28% But Its Business Is Yet to Catch Up

Zhejiang Tony Electronic Co., Ltd (SHSE:603595) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 42% in the last twelve months.

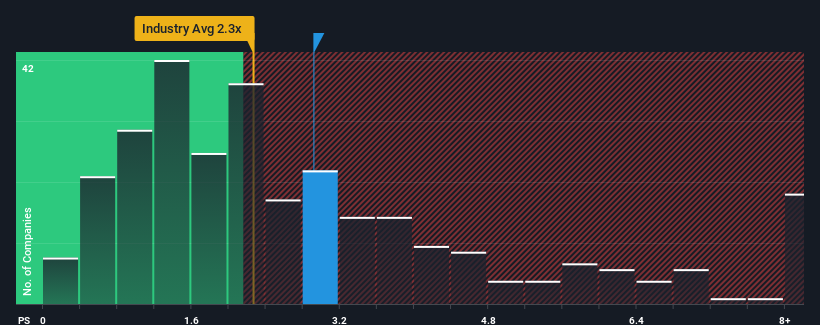

Since its price has surged higher, when almost half of the companies in China's Electrical industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Zhejiang Tony Electronic as a stock probably not worth researching with its 2.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Zhejiang Tony Electronic

How Zhejiang Tony Electronic Has Been Performing

Revenue has risen at a steady rate over the last year for Zhejiang Tony Electronic, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Zhejiang Tony Electronic, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Zhejiang Tony Electronic's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Zhejiang Tony Electronic's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.0% last year. Pleasingly, revenue has also lifted 85% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 24% shows it's about the same on an annualised basis.

In light of this, it's curious that Zhejiang Tony Electronic's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Final Word

The large bounce in Zhejiang Tony Electronic's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't expect to see Zhejiang Tony Electronic trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Zhejiang Tony Electronic that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Tony Electronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603595

Zhejiang Tony Electronic

Engages in the research, development, production, and sale of ultra-fine alloy wires and metal matrix composite materials worldwide.

Low and slightly overvalued.

Market Insights

Community Narratives