As global markets navigate a choppy start to the year, with small-cap stocks underperforming and inflation concerns persisting, investors are keenly observing economic indicators that could influence market sentiment. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals and resilience amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Saudi Azm for Communication and Information Technology | 12.21% | 17.40% | 21.14% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

T&L (KOSDAQ:A340570)

Simply Wall St Value Rating: ★★★★★★

Overview: T&L Co., Ltd. is a South Korean company that manufactures and sells medical and polymer material products, with a market cap of ₩623.16 billion.

Operations: T&L generates revenue primarily from its medical products segment, amounting to ₩150.31 billion. The company's net profit margin is 12.5%, indicating the proportion of revenue that translates into profit after expenses are deducted.

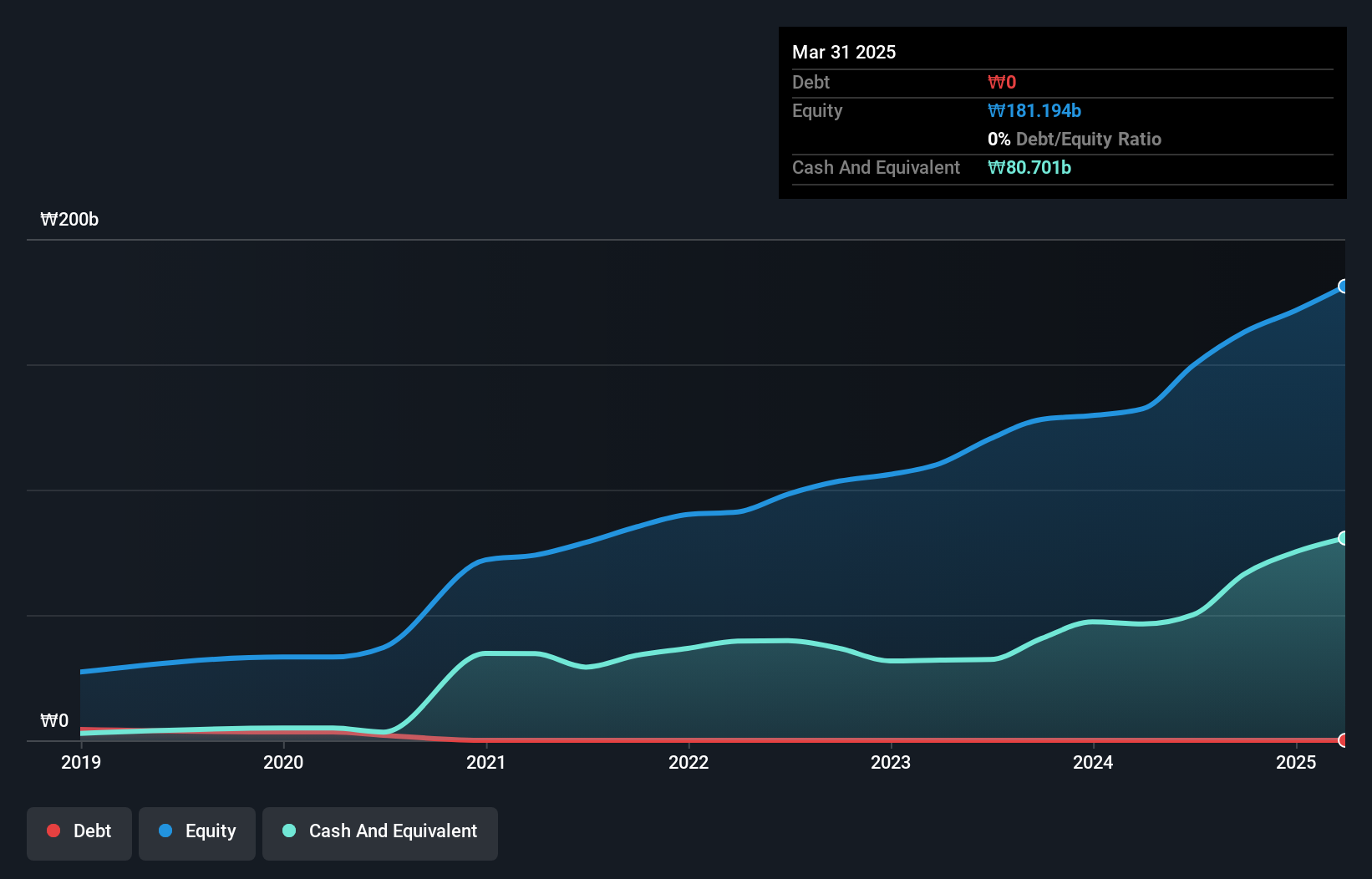

T&L, a promising small cap in the medical equipment sector, shows high quality earnings and is currently trading at 62.9% below its estimated fair value. Impressively, the company is debt-free now compared to five years ago when its debt to equity ratio was 11.3%. Over the past year, T&L's earnings grew by 32.6%, outpacing the industry average of -16.5%, with future growth forecasted at an annual rate of 29.53%. A recent cash dividend announcement further enhances its appeal as a potential investment opportunity within this niche market segment.

- Delve into the full analysis health report here for a deeper understanding of T&L.

Assess T&L's past performance with our detailed historical performance reports.

Mayinglong Pharmaceutical Group (SHSE:600993)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mayinglong Pharmaceutical Group Co., LTD. is a company engaged in the production and sale of pharmaceutical products, with a market cap of CN¥10.58 billion.

Operations: Mayinglong Pharmaceutical Group generates revenue primarily from the sale of pharmaceutical products. The company's net profit margin has shown notable fluctuations over recent periods, reflecting changes in operational efficiency and cost management.

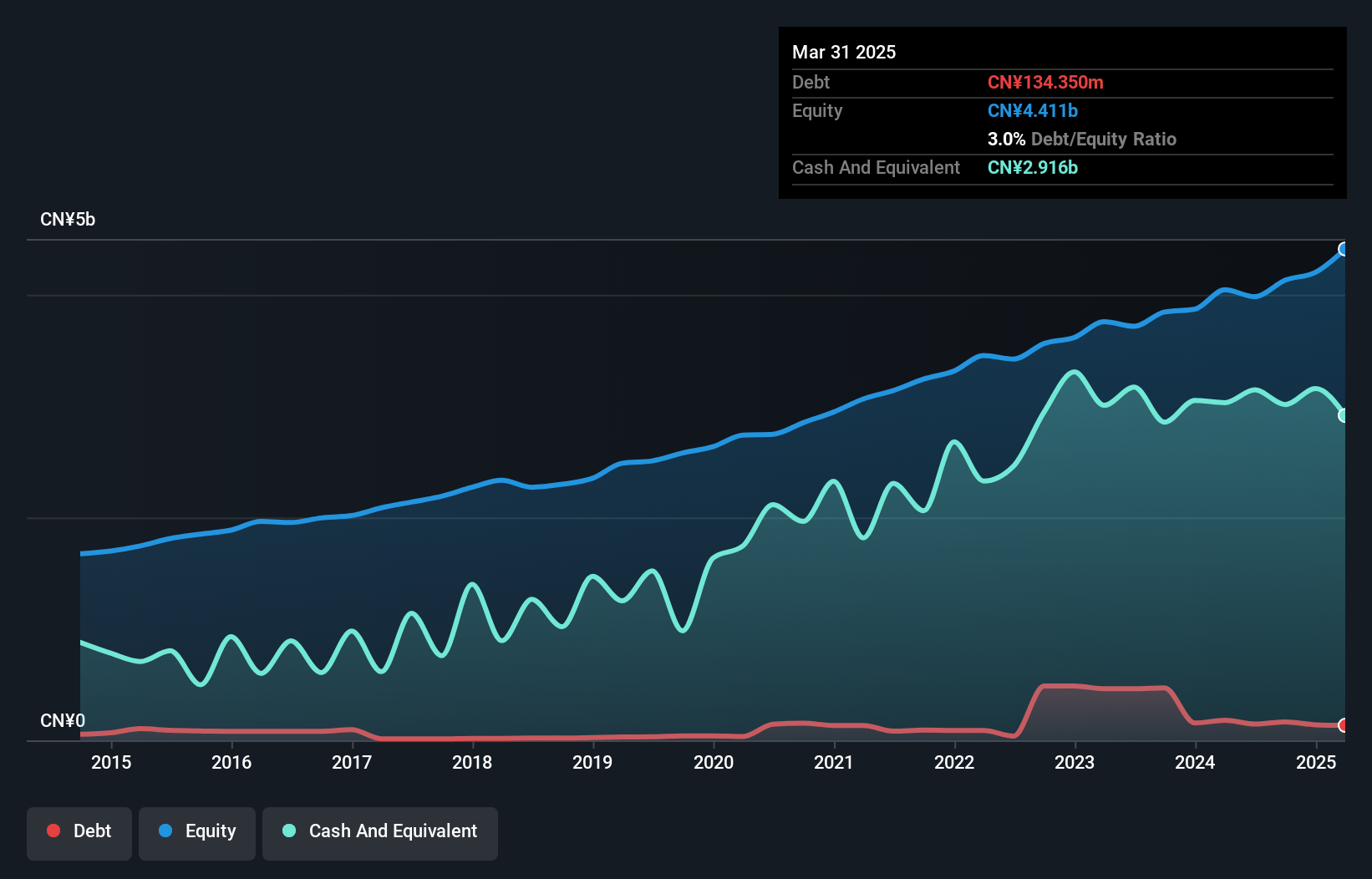

Mayinglong Pharma, a notable player in the pharmaceutical industry, has demonstrated high-quality earnings with its recent financial performance. Over the past year, earnings growth of 0.3% slightly outpaced the industry average of 0.2%. The company reported sales of CNY 2.79 billion for nine months ending September 2024, an increase from CNY 2.45 billion a year prior, with net income rising to CNY 457.5 million from CNY 418.38 million previously. Despite a debt-to-equity ratio increase from 1.5% to 4% over five years, it maintains more cash than total debt and trades at a significant discount to estimated fair value by about 46%.

Henan Thinker Automatic EquipmentLtd (SHSE:603508)

Simply Wall St Value Rating: ★★★★★☆

Overview: Henan Thinker Automatic Equipment Co., Ltd. is a company focused on providing automation solutions, with a market capitalization of CN¥8.29 billion.

Operations: Henan Thinker generates revenue primarily from its Software and Information Technology Services segment, amounting to CN¥1.35 billion.

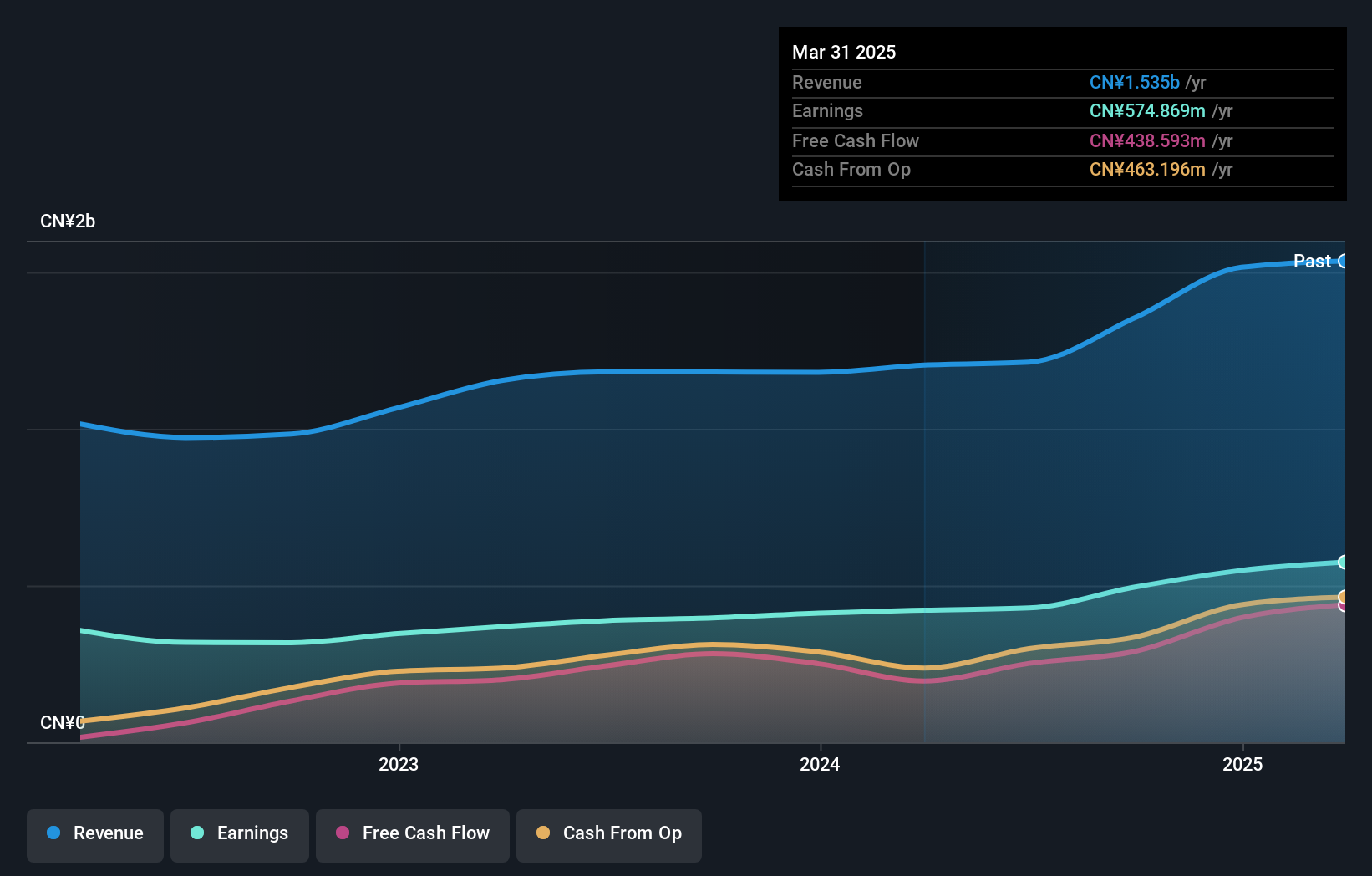

Henan Thinker Automatic Equipment has been making waves with its impressive earnings growth of 24.8% over the past year, outpacing the Machinery industry significantly. This company is sitting pretty with more cash than total debt, indicating sound financial health, while a price-to-earnings ratio of 17.5x suggests it's valued attractively compared to the broader CN market at 31.8x. Recent reports show sales reaching CNY 905 million for nine months ending September 2024, up from CNY 731 million last year, and net income climbing to CNY 328 million from CNY 245 million, highlighting robust performance in a competitive sector.

- Take a closer look at Henan Thinker Automatic EquipmentLtd's potential here in our health report.

Understand Henan Thinker Automatic EquipmentLtd's track record by examining our Past report.

Taking Advantage

- Discover the full array of 4518 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600993

Mayinglong Pharmaceutical Group

Engages in the manufacturing and sale of Chinese and Western medicines primarily in China.

Very undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives