Austevoll Seafood And Two Other Leading Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets react to political developments and economic indicators, with U.S. stocks reaching record highs amid optimism over trade policies and AI investments, investors are increasingly exploring opportunities in dividend stocks for stable income. In this context, understanding the characteristics of strong dividend stocks—such as consistent earnings, robust cash flow, and a solid track record of paying dividends—becomes crucial for those looking to navigate the current market landscape effectively.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.94% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.96% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

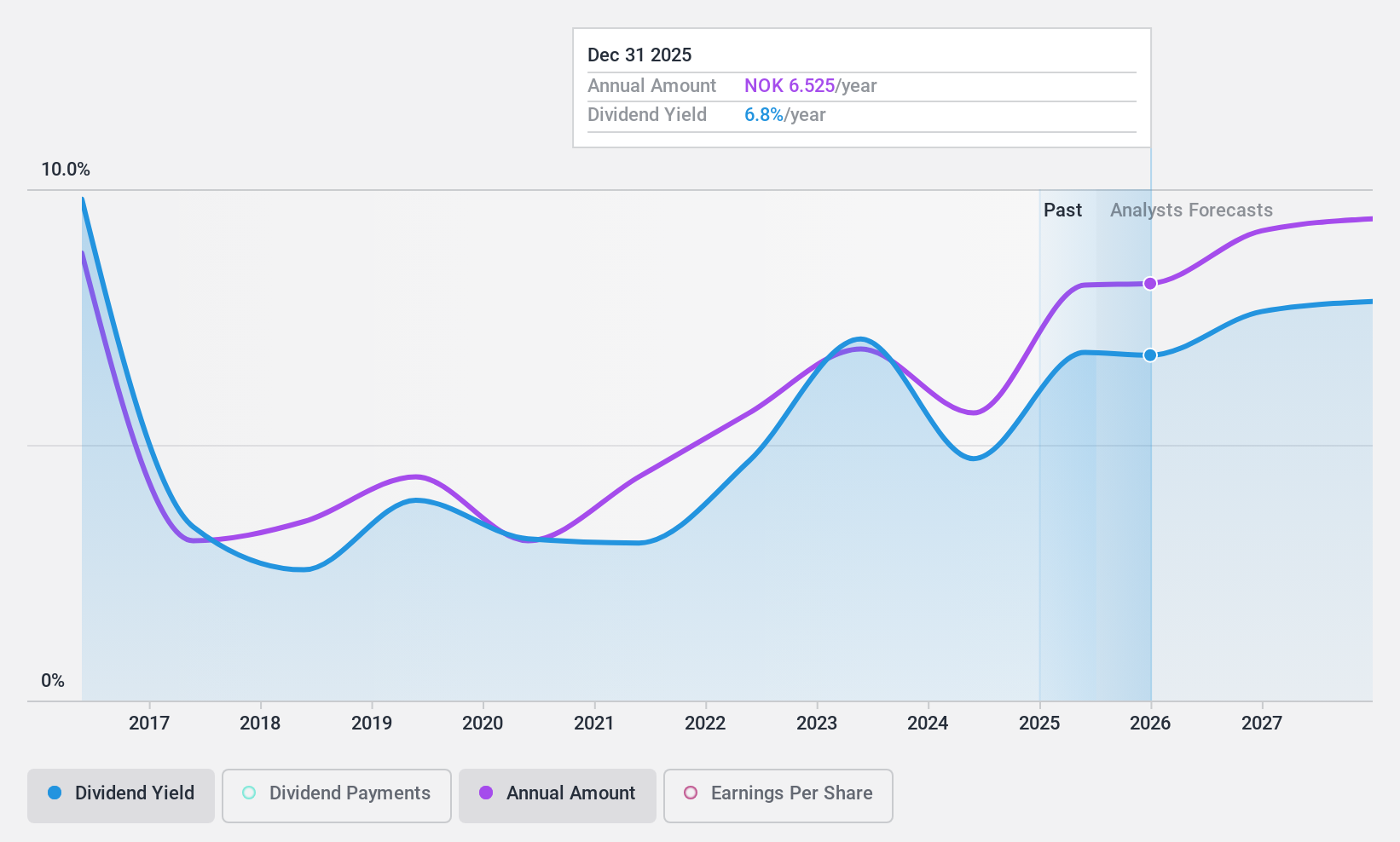

Austevoll Seafood (OB:AUSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Austevoll Seafood ASA is a seafood company involved in the production of salmon, trout, white fish, and pelagic species across various global markets, with a market cap of NOK22.02 billion.

Operations: Austevoll Seafood ASA generates revenue primarily from Lerøy Seafood Group ASA (NOK30.87 billion), followed by Austral Group SAA (NOK2.26 billion), Br.Birkeland (excluding Br.Birkeland Farming) (NOK2.19 billion), Foodcorp Chile SA (NOK954 million), and Br.Birkeland Farming AS (NOK953 million).

Dividend Yield: 4.1%

Austevoll Seafood's dividend sustainability is supported by a low payout ratio of 41.2% and a cash payout ratio of 49.4%, indicating dividends are well-covered by earnings and cash flows. Despite this, the dividend yield is relatively low at 4.05% compared to top payers in Norway, and the company's dividend history has been volatile over the past decade. Recent earnings improvements, with significant profit growth, may bolster future stability in payouts.

- Click here to discover the nuances of Austevoll Seafood with our detailed analytical dividend report.

- Our valuation report here indicates Austevoll Seafood may be undervalued.

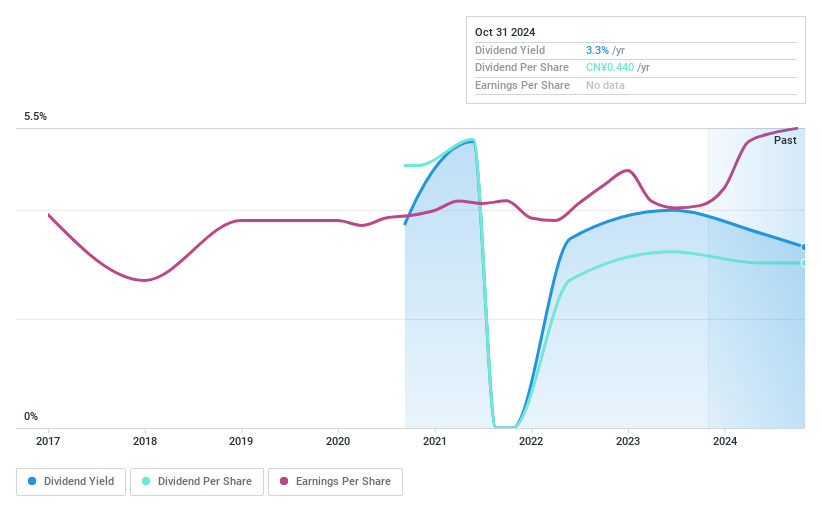

Runner (Xiamen) (SHSE:603408)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Runner (Xiamen) Corp. focuses on the R&D, design, production, and sale of kitchen and bathroom products as well as water purification products both in China and internationally, with a market cap of CN¥5.99 billion.

Operations: Runner (Xiamen) Corp.'s revenue is primarily derived from its kitchen and bathroom products and water purification products, catering to both domestic and international markets.

Dividend Yield: 3.4%

Runner (Xiamen) offers a compelling value proposition with a Price-To-Earnings ratio of 11.3x, significantly below the CN market average of 34.7x. Despite its top-tier dividend yield of 3.39%, the company's four-year dividend history is marked by volatility and declining payments, rendering it unreliable for consistent income seekers. However, dividends are well-supported by earnings and cash flows, with payout ratios of 55.9% and 46% respectively, suggesting current sustainability amidst recent robust earnings growth of 35.9%.

- Dive into the specifics of Runner (Xiamen) here with our thorough dividend report.

- Our expertly prepared valuation report Runner (Xiamen) implies its share price may be lower than expected.

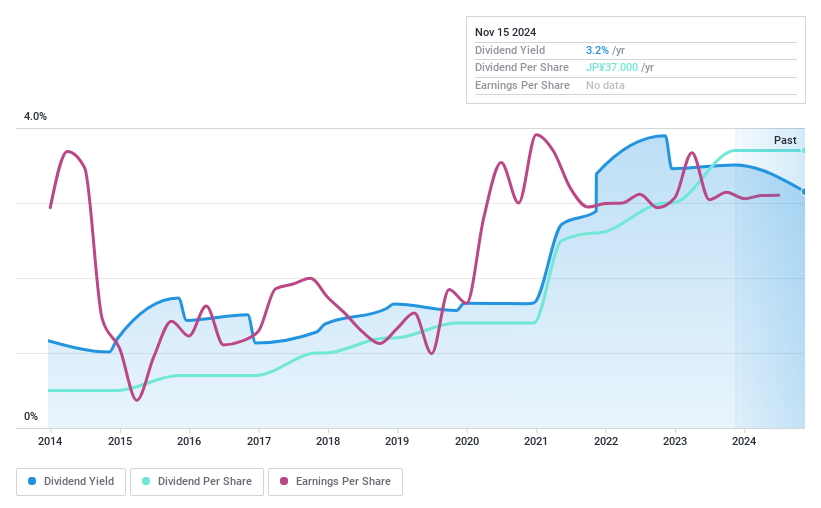

Asia Air Survey (TSE:9233)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asia Air Survey Co., Ltd. offers aerial surveying services and products both in Japan and internationally, with a market cap of ¥21.27 billion.

Operations: Asia Air Survey Co., Ltd. generates revenue of ¥40.27 billion from its Spatial Information Consultant Business segment.

Dividend Yield: 3.8%

Asia Air Survey's dividend yield of 3.76% ranks in the top 25% of Japan's market, though it is not covered by free cash flows. Despite this, a low payout ratio of 35.3% indicates dividends are well-supported by earnings. The company has maintained stable and reliable dividends over the past decade, with consistent growth in payments and earnings increasing at 3.9% annually over five years. Its Price-To-Earnings ratio stands attractively below the market average at 11.2x.

- Delve into the full analysis dividend report here for a deeper understanding of Asia Air Survey.

- In light of our recent valuation report, it seems possible that Asia Air Survey is trading beyond its estimated value.

Seize The Opportunity

- Gain an insight into the universe of 1938 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603408

Runner (Xiamen)

Engages in the research and development, design, production, and sale of kitchen and bathroom products, water purification products, and other products in China and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives