- China

- /

- Retail Distributors

- /

- SZSE:000025

Undiscovered Gems To Explore In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical uncertainties, small-cap stocks have experienced mixed performance, with indices like the S&P 600 reflecting these broader economic dynamics. Amidst this backdrop of volatility and opportunity, discerning investors often seek out lesser-known companies that demonstrate resilience and potential for growth. Identifying such undiscovered gems requires a keen eye for businesses that can adapt to changing market conditions while maintaining strong fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.78% | 27.31% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Zhejiang Goldensea Hi-Tech (SHSE:603311)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Goldensea Hi-Tech Co., Ltd specializes in the production and sale of environmental protection filter materials both domestically and internationally, with a market cap of CN¥2.70 billion.

Operations: Goldensea Hi-Tech generates revenue primarily from the production and sale of environmental protection filter materials. The company's financial performance is highlighted by a net profit margin trend that has shown notable fluctuations over recent periods.

Zhejiang Goldensea Hi-Tech, a promising player in its sector, has demonstrated impressive growth with earnings surging 71.5% over the past year, outpacing the building industry's -8% performance. The company boasts high-quality earnings and positive free cash flow, suggesting robust financial health. A significant reduction in debt to equity from 28.1% to 10.2% over five years indicates prudent financial management. With more cash than total debt and interest payments well-covered by profits, Zhejiang Goldensea appears well-positioned for future growth as it anticipates a further 31.11% annual earnings increase, reflecting strong potential for investors seeking value in emerging markets.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang Goldensea Hi-Tech.

Gain insights into Zhejiang Goldensea Hi-Tech's past trends and performance with our Past report.

Shenzhen Tellus Holding (SZSE:000025)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Tellus Holding Co., Ltd. operates in the automotive sector in China, focusing on automobile sales, maintenance, and testing services, with a market capitalization of CN¥6.53 billion.

Operations: The company generates revenue primarily from automobile sales, maintenance, and testing services. It operates within the automotive sector in China.

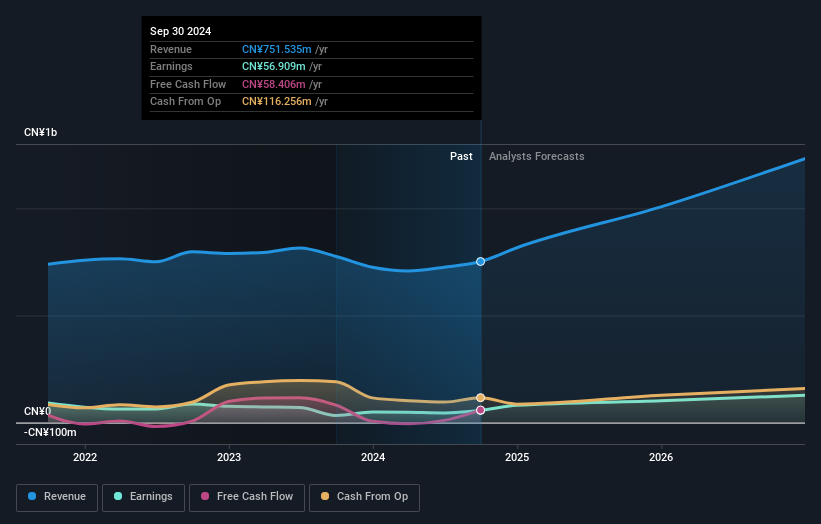

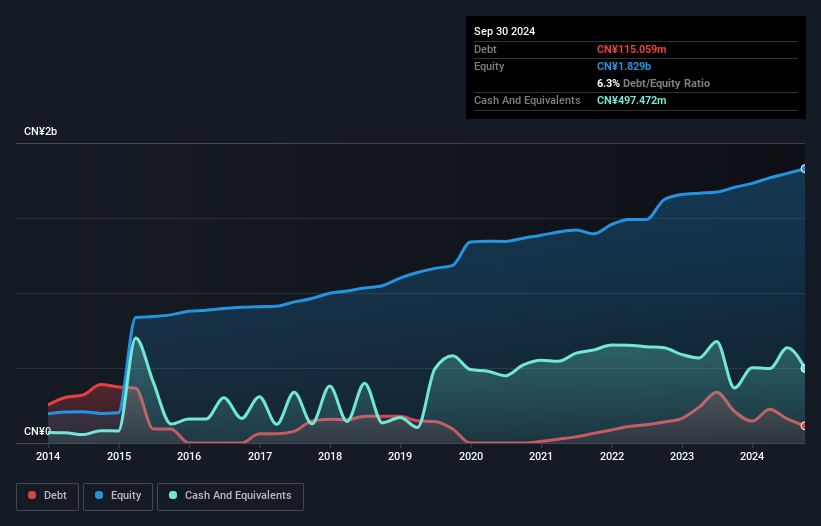

Shenzhen Tellus Holding, a nimble player in its sector, has shown impressive earnings growth of 60.5% over the past year, far outpacing the industry average of -6.8%. The company's debt to equity ratio has improved from 7.9 to 6.3 over five years, indicating better financial health with more cash than total debt. Despite a free cash flow that isn't positive yet and an earnings decline of 7.5% per annum over five years, it remains profitable with no concerns about covering interest payments. A recent shareholders meeting focused on auditing firm reappointment underscores its commitment to governance improvements.

- Unlock comprehensive insights into our analysis of Shenzhen Tellus Holding stock in this health report.

Evaluate Shenzhen Tellus Holding's historical performance by accessing our past performance report.

Zhejiang Garden BiopharmaceuticalLtd (SZSE:300401)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Garden Biopharmaceutical Co., Ltd. is a company involved in the biopharmaceutical industry with a market cap of CN¥7.77 billion.

Operations: The company's revenue streams and cost breakdowns are not provided in the available data.

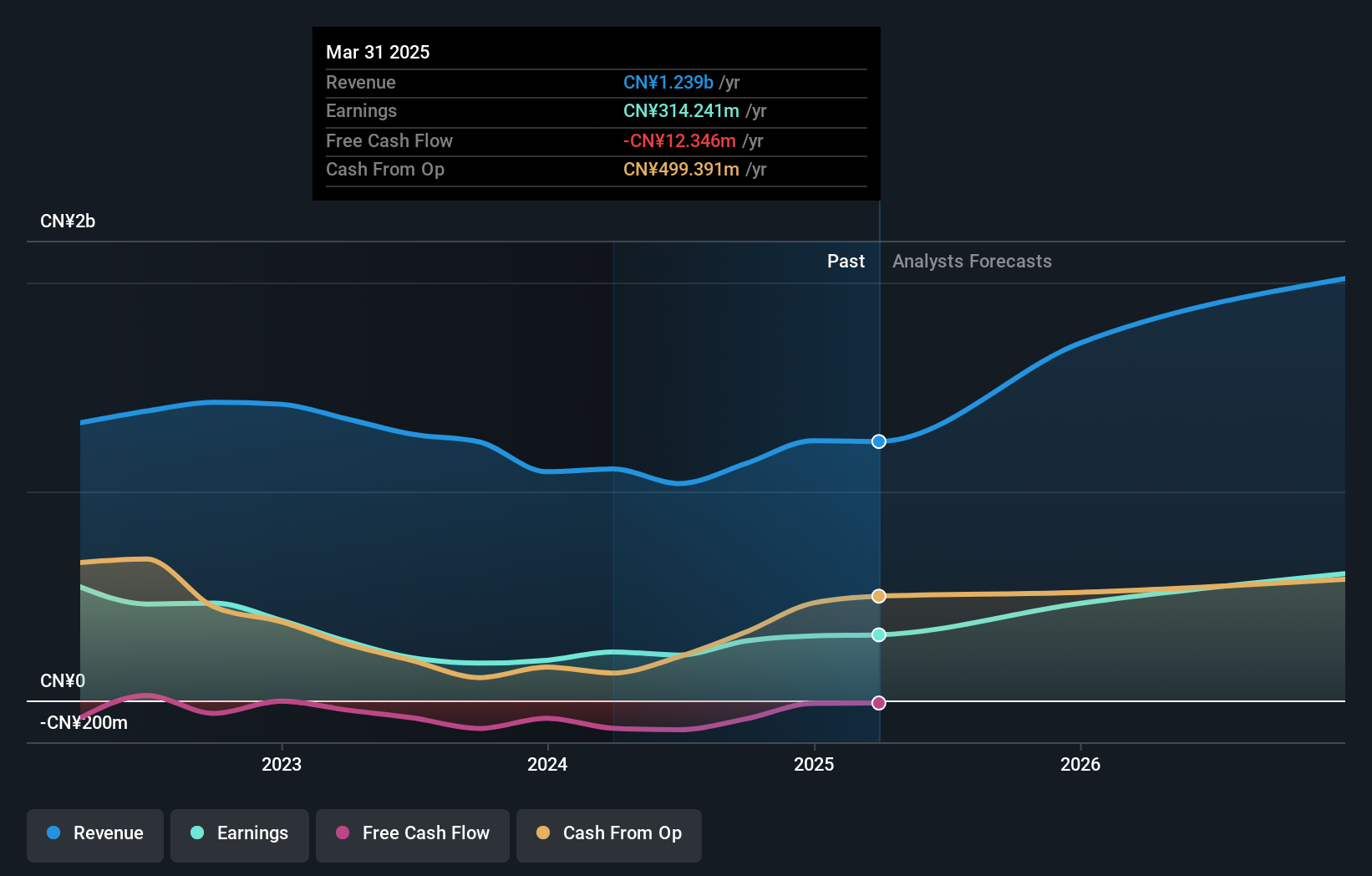

Zhejiang Garden Biopharmaceutical, a smaller player in the pharmaceuticals sector, has shown impressive growth with earnings surging 59% last year, outpacing the industry average of -2.5%. Its debt-to-equity ratio climbed from 8.8% to 55.6% over five years, yet interest payments are well-covered by EBIT at 12 times coverage. The company's net debt to equity sits at a satisfactory 10%, and its price-to-earnings ratio of 27x is favorable compared to the CN market's 35x. A significant one-off gain of CN¥86 million impacted recent financial results, hinting at potential volatility ahead.

Summing It All Up

- Click through to start exploring the rest of the 4718 Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000025

Shenzhen Tellus Holding

Engages in automobiles sales, and maintenance and testing activities in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives