Further Upside For Suzhou Secote Precision Electronic Co.,LTD (SHSE:603283) Shares Could Introduce Price Risks After 25% Bounce

Suzhou Secote Precision Electronic Co.,LTD (SHSE:603283) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 82% in the last year.

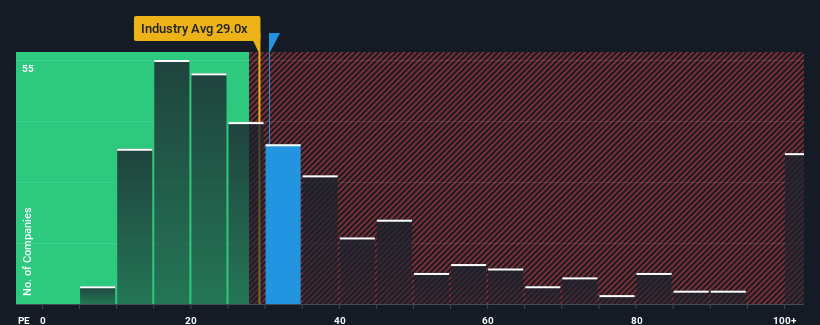

Even after such a large jump in price, it's still not a stretch to say that Suzhou Secote Precision ElectronicLTD's price-to-earnings (or "P/E") ratio of 30.5x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Suzhou Secote Precision ElectronicLTD has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Suzhou Secote Precision ElectronicLTD

How Is Suzhou Secote Precision ElectronicLTD's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Suzhou Secote Precision ElectronicLTD's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 81% gain to the company's bottom line. Pleasingly, EPS has also lifted 128% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 58% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 42% growth forecast for the broader market.

With this information, we find it interesting that Suzhou Secote Precision ElectronicLTD is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Suzhou Secote Precision ElectronicLTD's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Suzhou Secote Precision ElectronicLTD currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - Suzhou Secote Precision ElectronicLTD has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603283

Suzhou Secote Precision ElectronicLTD

Provides automation solutions in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives