- China

- /

- Commercial Services

- /

- SZSE:001267

Exploring Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In a global market environment where U.S. stock indexes are nearing record highs and inflation data has fueled expectations for prolonged interest rate levels, small-cap stocks have been lagging behind their larger counterparts, as evidenced by the Russell 2000 Index's recent performance. Against this backdrop of mixed economic signals and cautious investor sentiment, identifying undiscovered gems in the small-cap space requires a keen eye for companies with solid fundamentals and potential growth catalysts that can thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Konya Kagit Sanayi ve Ticaret | 0.67% | 24.97% | 7.82% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jiangsu Seagull Cooling TowerLtd (SHSE:603269)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Seagull Cooling Tower Co., Ltd. specializes in the design, research and development, manufacturing, and installation of cooling towers both in China and internationally, with a market cap of CN¥2.77 billion.

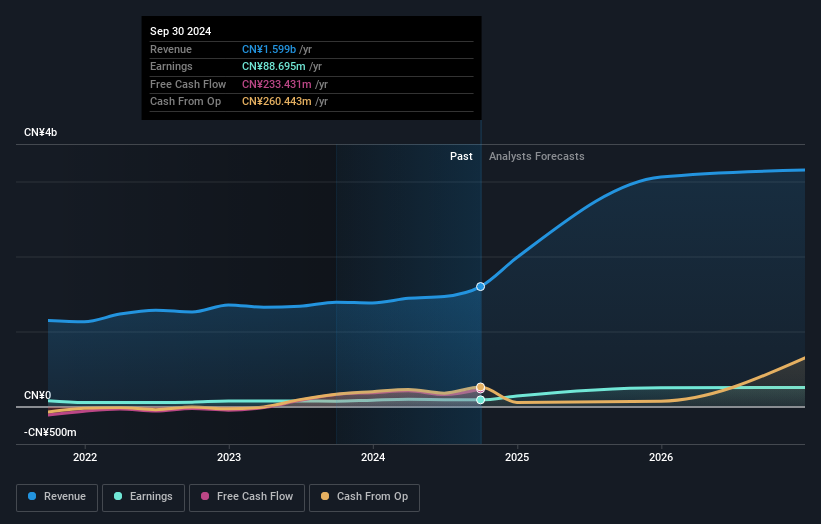

Operations: Seagull Cooling Tower generates revenue primarily from its General Equipment Manufacturing segment, amounting to CN¥1.60 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Jiangsu Seagull Cooling Tower Ltd., a smaller player in its field, has shown notable financial resilience. The company boasts earnings growth of 24%, outpacing the construction industry's -3.9%. With an EBIT covering interest payments 8 times over, it seems well-positioned to manage debt obligations despite a rising debt-to-equity ratio from 35% to 49% over five years. A significant CN¥34M one-off gain recently impacted results, and it's trading at a substantial discount of nearly 69% below estimated fair value. These factors suggest potential for value appreciation if operational stability continues amidst market volatility.

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hui Lyu Ecological Technology Groups Co., Ltd. operates in the ecological technology sector and has a market capitalization of approximately CN¥7.11 billion.

Operations: Hui Lyu Ecological Technology Groups Co., Ltd. generates revenue primarily from its ecological technology services. The company has a market capitalization of approximately CN¥7.11 billion, indicating its significant presence in the sector.

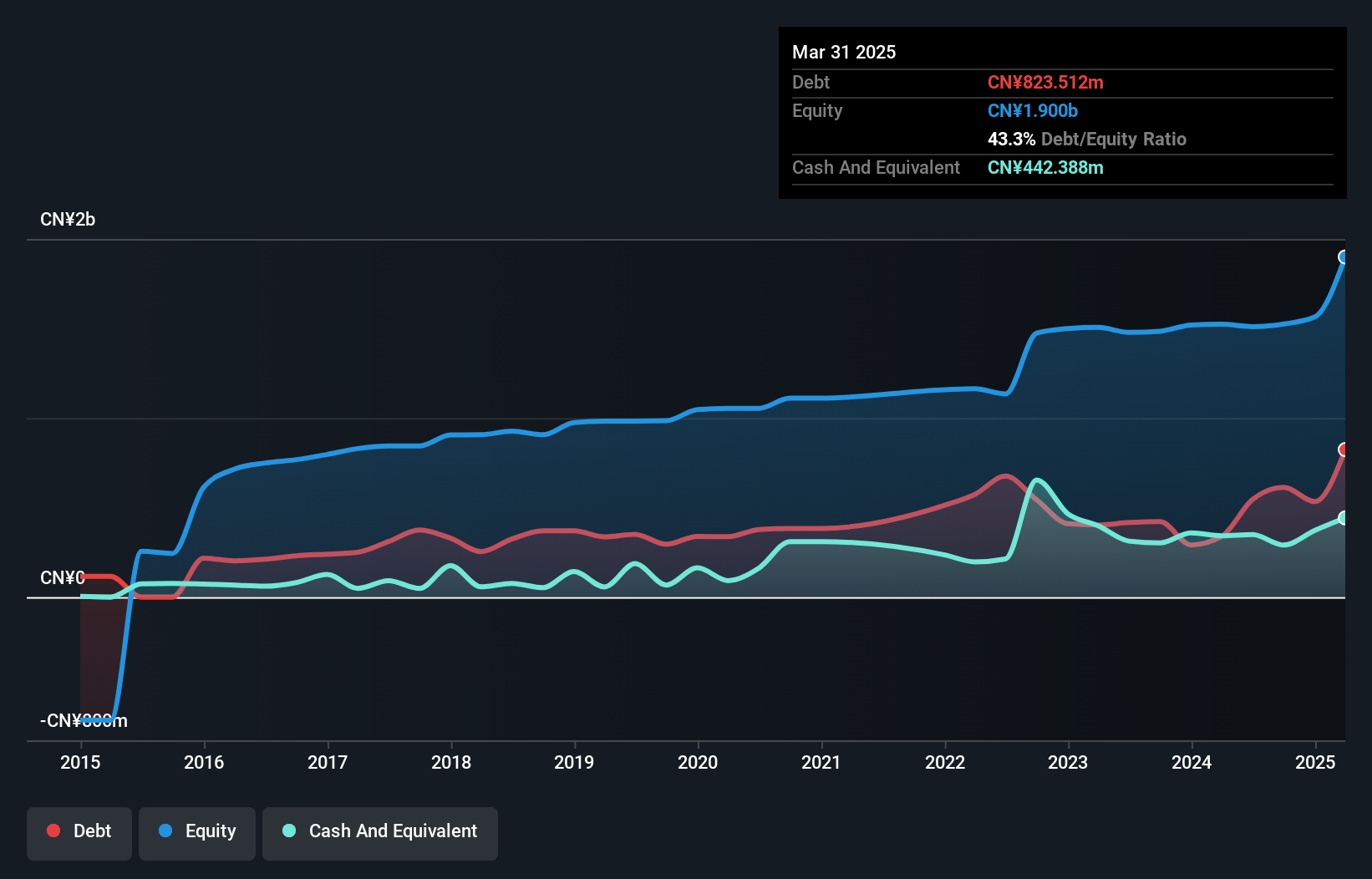

Hui Lyu Ecological Technology Group, a relatively smaller player in its sector, has demonstrated robust financial health with earnings growth of 17.3% over the past year, outpacing the broader Commercial Services industry. The company's debt to equity ratio has risen from 30% to 40.2% over five years; however, its net debt to equity remains satisfactory at 21.2%. With high-quality earnings and interest payments well-covered by profits, Hui Lyu appears financially sound. Recent shareholder meetings have focused on major asset restructuring and capital increase plans, potentially setting the stage for future expansion or strategic shifts.

NOVA Technology (SZSE:300921)

Simply Wall St Value Rating: ★★★★★★

Overview: NOVA Technology Corporation Limited offers network communication services in China and has a market cap of CN¥4.37 billion.

Operations: NOVA Technology's revenue is primarily derived from its network communication services in China. The company's financial performance is highlighted by a net profit margin of 15.3%, reflecting its ability to manage costs effectively relative to its revenue generation.

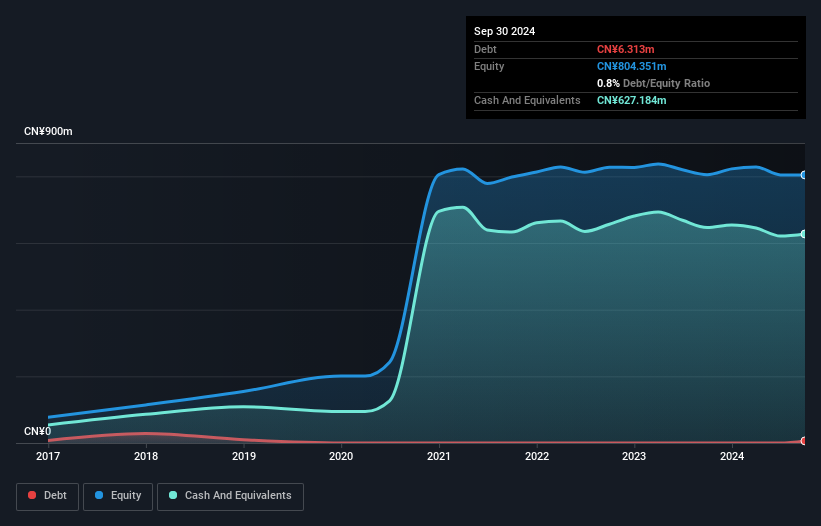

NOVA Technology, a smaller player in the tech space, has shown a mixed financial picture. Over the past year, its earnings grew by 9.8%, outpacing the telecom industry's modest 0.8% growth, yet its five-year earnings trajectory fell by an average of 20.8% annually. The company's debt-to-equity ratio improved from 1.3% to 0.8%, suggesting better capital management, and it holds more cash than total debt which is reassuring for investors concerned about leverage risks. Despite these positive signs, NOVA's free cash flow remains negative and share price volatility has been notable in recent months; however, profitability indicates no immediate cash runway concerns going forward.

- Click here to discover the nuances of NOVA Technology with our detailed analytical health report.

Evaluate NOVA Technology's historical performance by accessing our past performance report.

Make It Happen

- Gain an insight into the universe of 4746 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hui Lyu Ecological Technology GroupsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001267

Hui Lyu Ecological Technology GroupsLtd

Hui Lyu Ecological Technology Groups Co.,Ltd.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives