As global markets grapple with mixed economic signals, including subdued manufacturing activity and fluctuating job data, small-cap stocks have shown resilience compared to their larger counterparts. In this context of cautious optimism, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that can navigate the current economic landscape effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Forth Smart Service | 21.94% | -8.16% | -16.02% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.90% | 5.39% | 47.06% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

RPG Life Sciences (NSEI:RPGLIFE)

Simply Wall St Value Rating: ★★★★★★

Overview: RPG Life Sciences Limited is an integrated pharmaceutical company that develops, manufactures, and markets branded formulations, generic drugs, and synthetic active pharmaceutical ingredients (APIs) both in India and internationally, with a market cap of ₹43.36 billion.

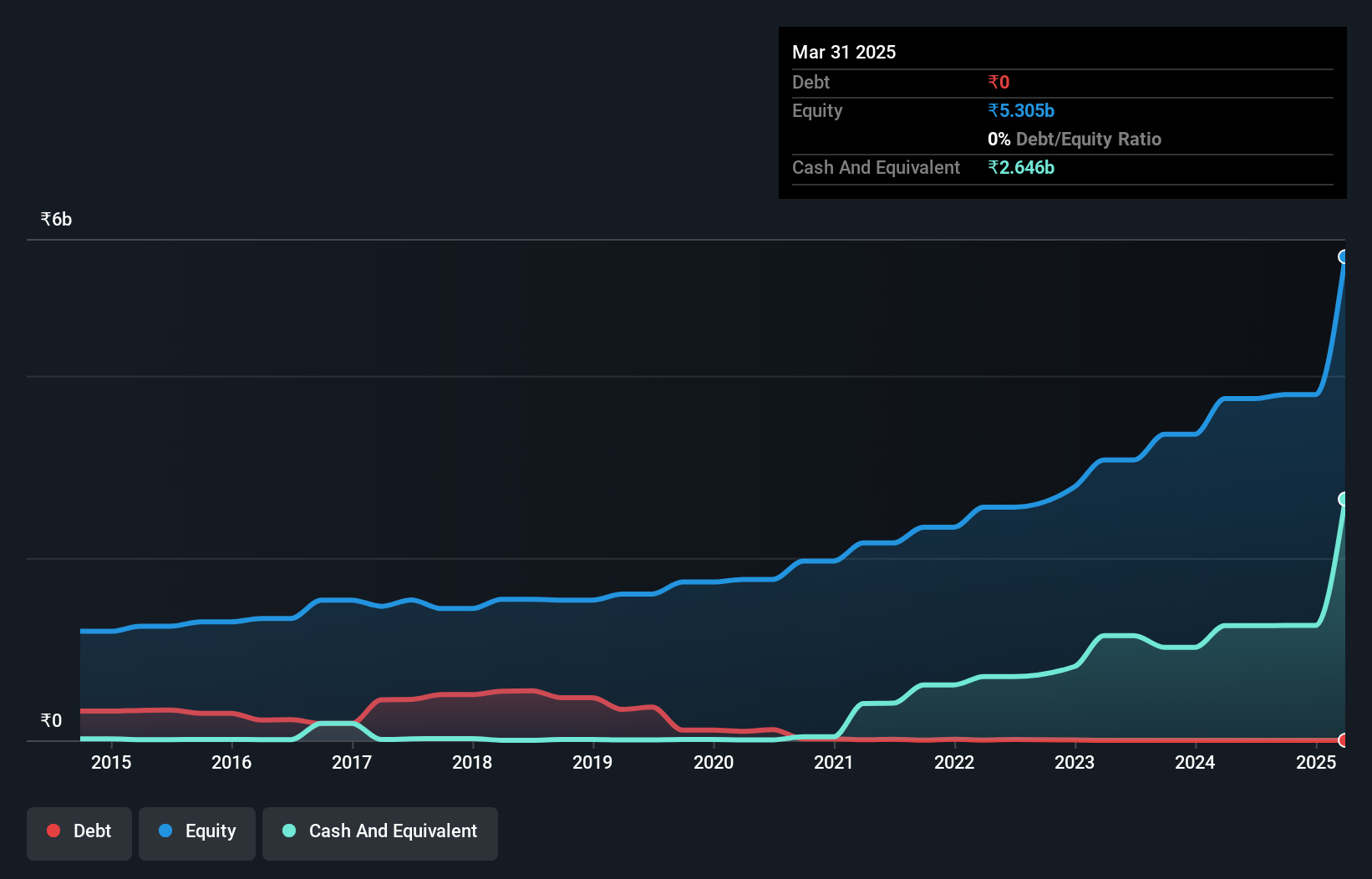

Operations: RPG Life Sciences generates revenue primarily from the manufacturing and marketing of pharmaceutical products, totaling ₹5.99 billion.

RPG Life Sciences, a nimble player in the pharmaceuticals sector, has shown impressive financial discipline by eliminating its debt over the past five years from a 22.7% debt-to-equity ratio. This strategic move aligns with its robust earnings growth of 29.1%, outpacing the industry average of 19.1%. The company enjoys high-quality earnings and positive free cash flow, indicating sound financial health. Recent board restructuring and inclusion in the S&P Global BMI Index highlight RPG's evolving governance and market recognition, although challenges like tax penalties need addressing to maintain momentum in this competitive landscape.

- Take a closer look at RPG Life Sciences' potential here in our health report.

Examine RPG Life Sciences' past performance report to understand how it has performed in the past.

Shanghai Research Institute of Building Sciences Group (SHSE:603153)

Simply Wall St Value Rating: ★★★★★★

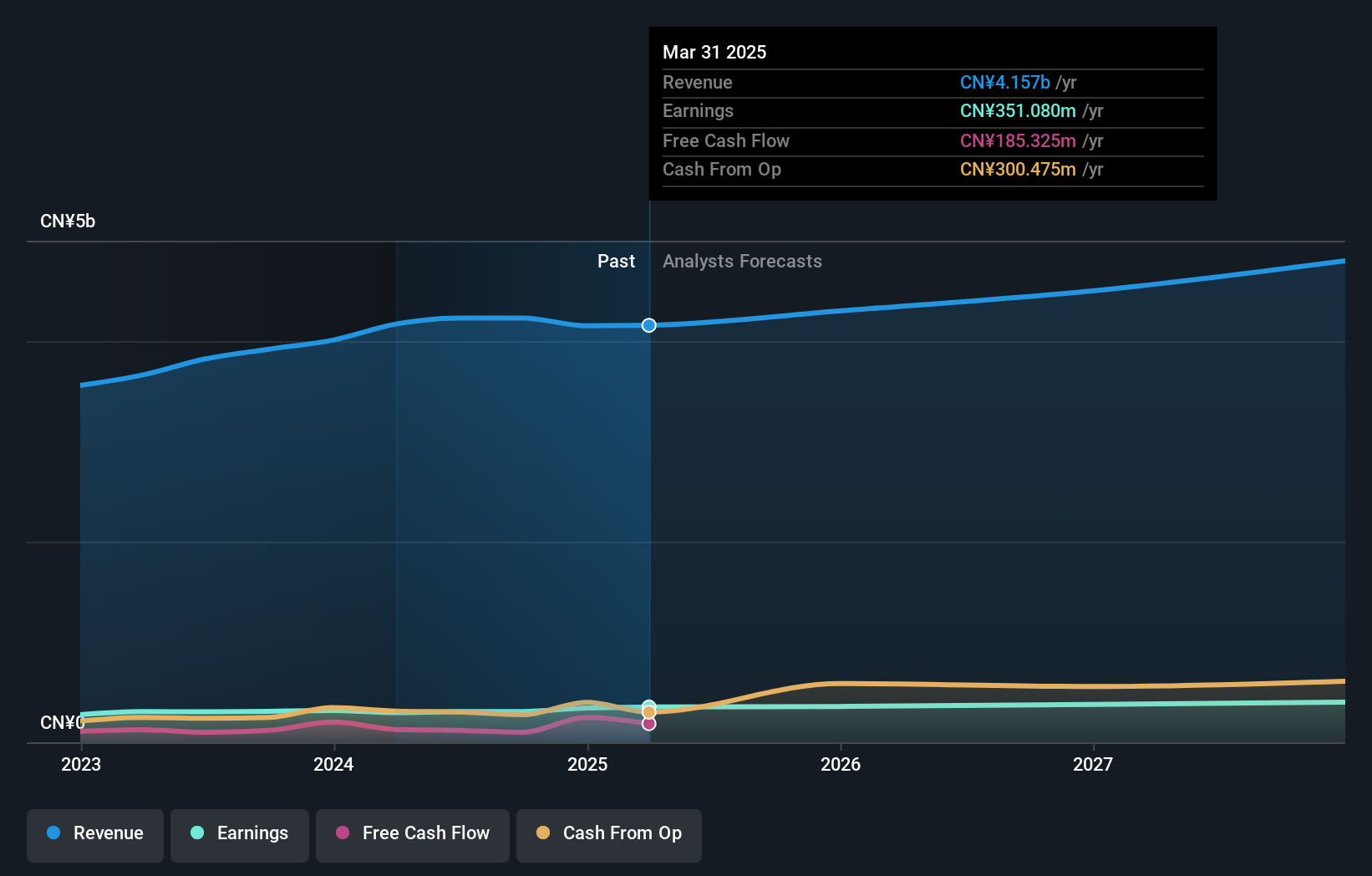

Overview: Shanghai Research Institute of Building Sciences Group Co., Ltd. operates in the building sciences sector and has a market cap of CN¥7.75 billion.

Operations: The company generates revenue primarily from its operations in the building sciences sector. It has a market capitalization of CN¥7.75 billion, indicating its scale within the industry.

Shanghai Research Institute of Building Sciences Group, a promising player in the construction sector, reported sales of CN¥2.59 billion for the first nine months of 2024, up from CN¥2.52 billion last year. Net income reached CN¥142.84 million compared to CN¥130.72 million previously, with basic earnings per share rising to CNY 0.35 from CNY 0.33 a year ago. The company is debt-free and has been growing faster than its industry peers with a recent earnings growth rate of 6.1%. Notably, it repurchased over 5 million shares this year for approximately CN¥94.97 million, enhancing shareholder value further by trading at an estimated discount of 31% below fair value estimates while maintaining positive free cash flow throughout this period without any leverage concerns or interest payment obligations due to zero debt levels presently recorded on their balance sheet records as well as past five years' history showing significant improvement since reducing previous debts entirely within that timeframe alone!

Zhongjing Food (SZSE:300908)

Simply Wall St Value Rating: ★★★★★★

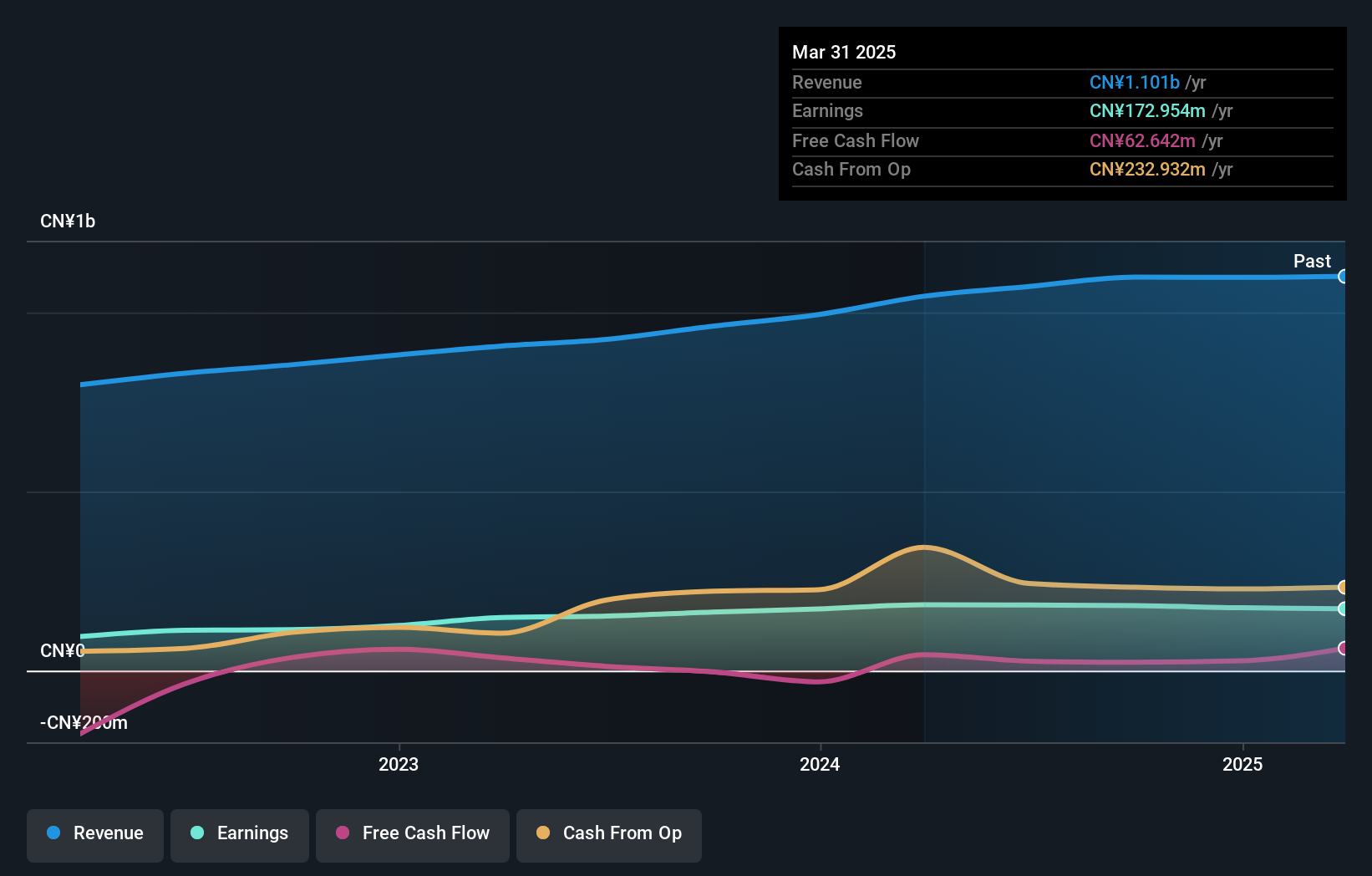

Overview: Zhongjing Food Co., Ltd. focuses on the research and development, production, and sale of seasoning food and ingredients in China, with a market cap of CN¥4.75 billion.

Operations: Zhongjing Food generates revenue through the sale of seasoning food and ingredients. The company's financial performance is highlighted by its market cap of CN¥4.75 billion.

Zhongjing Food, a smaller player in the food sector, has demonstrated notable financial performance. Over the past year, earnings grew by 10.9%, surpassing industry averages of -6%. This growth is supported by a favorable price-to-earnings ratio of 26.2x, which is below the broader Chinese market's 33.6x. The company has significantly improved its financial health over five years with a debt-to-equity ratio dropping from 10.5% to just 0.6%. Recent reports show net income reaching CNY 149 million for nine months ending September 2024, up from CNY 140 million last year, reflecting robust operational efficiency and strategic management decisions.

- Get an in-depth perspective on Zhongjing Food's performance by reading our health report here.

Explore historical data to track Zhongjing Food's performance over time in our Past section.

Key Takeaways

- Discover the full array of 4741 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RPGLIFE

RPG Life Sciences

An integrated pharmaceutical company, develops, manufactures, and markets branded formulations, generic, and synthetic active pharmaceutical ingredients (APIs) in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives