Shanxi Huaxiang Group Co., Ltd.'s (SHSE:603112) Shares Leap 27% Yet They're Still Not Telling The Full Story

Shanxi Huaxiang Group Co., Ltd. (SHSE:603112) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.5% in the last twelve months.

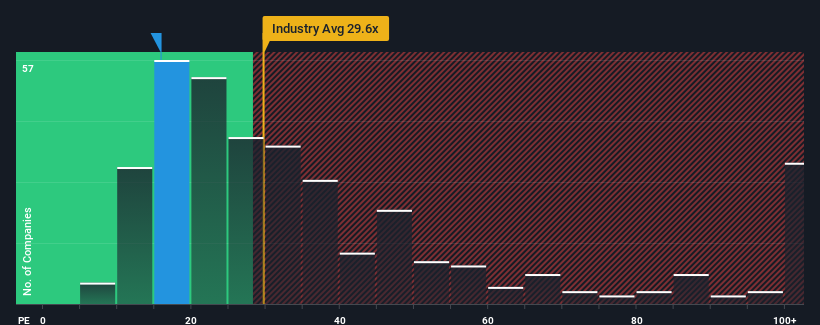

Although its price has surged higher, Shanxi Huaxiang Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 15.8x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Shanxi Huaxiang Group has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Shanxi Huaxiang Group

How Is Shanxi Huaxiang Group's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Shanxi Huaxiang Group's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 4.5%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 16% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 46% over the next year. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Shanxi Huaxiang Group is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Shanxi Huaxiang Group's P/E

The latest share price surge wasn't enough to lift Shanxi Huaxiang Group's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shanxi Huaxiang Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Shanxi Huaxiang Group that you need to be mindful of.

Of course, you might also be able to find a better stock than Shanxi Huaxiang Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603112

Shanxi Huaxiang Group

Engages in the research and development, production, and sale of customized metal parts in China and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives