Investors Still Aren't Entirely Convinced By JDM JingDaMachine (Ningbo) Co.Ltd's (SHSE:603088) Earnings Despite 30% Price Jump

Those holding JDM JingDaMachine (Ningbo) Co.Ltd (SHSE:603088) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

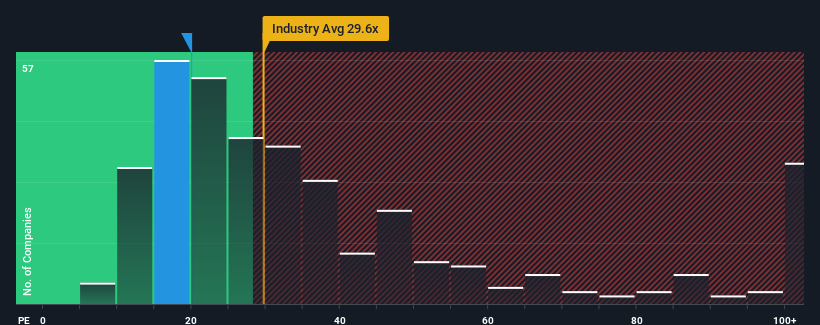

In spite of the firm bounce in price, JDM JingDaMachine (Ningbo)Ltd's price-to-earnings (or "P/E") ratio of 20x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

JDM JingDaMachine (Ningbo)Ltd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for JDM JingDaMachine (Ningbo)Ltd

Is There Any Growth For JDM JingDaMachine (Ningbo)Ltd?

There's an inherent assumption that a company should underperform the market for P/E ratios like JDM JingDaMachine (Ningbo)Ltd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 27% last year. Pleasingly, EPS has also lifted 121% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 45% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is not materially different.

With this information, we find it odd that JDM JingDaMachine (Ningbo)Ltd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On JDM JingDaMachine (Ningbo)Ltd's P/E

The latest share price surge wasn't enough to lift JDM JingDaMachine (Ningbo)Ltd's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of JDM JingDaMachine (Ningbo)Ltd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with JDM JingDaMachine (Ningbo)Ltd, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than JDM JingDaMachine (Ningbo)Ltd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603088

JDM JingDaMachine (Ningbo)Ltd

Produces and sells precision stamping parts in China and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives