- China

- /

- Electrical

- /

- SHSE:603045

Fuda Alloy Materials Co.,Ltd's (SHSE:603045) 32% Share Price Surge Not Quite Adding Up

Despite an already strong run, Fuda Alloy Materials Co.,Ltd (SHSE:603045) shares have been powering on, with a gain of 32% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.9% in the last twelve months.

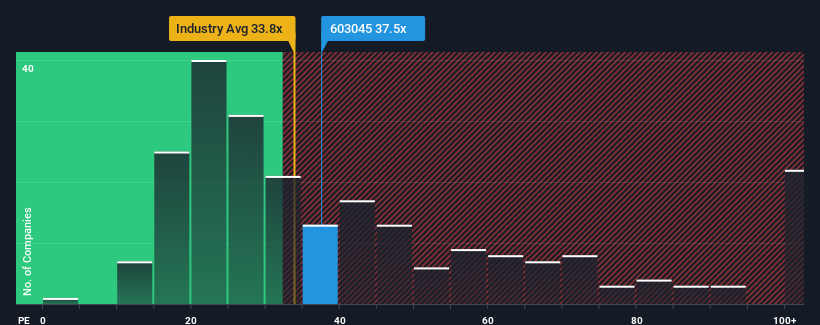

In spite of the firm bounce in price, there still wouldn't be many who think Fuda Alloy MaterialsLtd's price-to-earnings (or "P/E") ratio of 37.5x is worth a mention when the median P/E in China is similar at about 34x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been quite advantageous for Fuda Alloy MaterialsLtd as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Fuda Alloy MaterialsLtd

Does Growth Match The P/E?

In order to justify its P/E ratio, Fuda Alloy MaterialsLtd would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 35% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 32% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 39% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Fuda Alloy MaterialsLtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

What We Can Learn From Fuda Alloy MaterialsLtd's P/E?

Fuda Alloy MaterialsLtd's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Fuda Alloy MaterialsLtd currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware Fuda Alloy MaterialsLtd is showing 3 warning signs in our investment analysis, and 2 of those are significant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603045

Fuda Alloy MaterialsLtd

Engages in the research and development, production, sale, and technical consulting services of electrical contact materials in China and internationally.

Slight with imperfect balance sheet.

Market Insights

Community Narratives