Market Cool On Hefei Metalforming Intelligent Manufacturing Co., Ltd.'s (SHSE:603011) Revenues Pushing Shares 25% Lower

Hefei Metalforming Intelligent Manufacturing Co., Ltd. (SHSE:603011) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 12% share price drop.

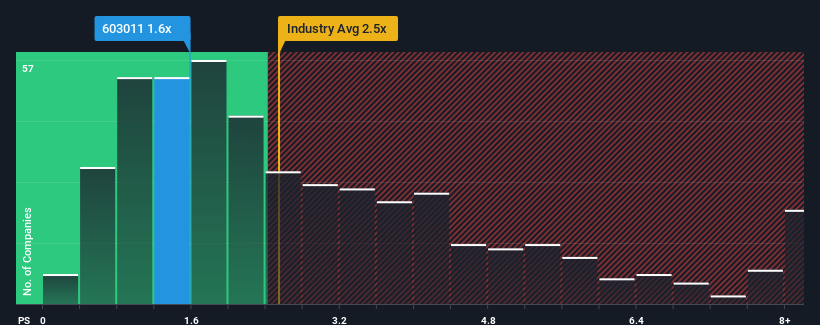

In spite of the heavy fall in price, Hefei Metalforming Intelligent Manufacturing's price-to-sales (or "P/S") ratio of 1.6x might still make it look like a buy right now compared to the Machinery industry in China, where around half of the companies have P/S ratios above 2.5x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Hefei Metalforming Intelligent Manufacturing

What Does Hefei Metalforming Intelligent Manufacturing's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Hefei Metalforming Intelligent Manufacturing, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Hefei Metalforming Intelligent Manufacturing, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Hefei Metalforming Intelligent Manufacturing's Revenue Growth Trending?

In order to justify its P/S ratio, Hefei Metalforming Intelligent Manufacturing would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.8%. The latest three year period has also seen an excellent 88% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 24% shows it's about the same on an annualised basis.

With this in consideration, we find it intriguing that Hefei Metalforming Intelligent Manufacturing's P/S falls short of its industry peers. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From Hefei Metalforming Intelligent Manufacturing's P/S?

Hefei Metalforming Intelligent Manufacturing's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Hefei Metalforming Intelligent Manufacturing revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Hefei Metalforming Intelligent Manufacturing (including 2 which are significant).

If you're unsure about the strength of Hefei Metalforming Intelligent Manufacturing's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Metalforming Intelligent Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603011

Hefei Metalforming Intelligent Manufacturing

Hefei Metalforming Intelligent Manufacturing Co., Ltd.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives