- China

- /

- Construction

- /

- SHSE:601886

Improved Earnings Required Before Jangho Group Co., Ltd. (SHSE:601886) Shares Find Their Feet

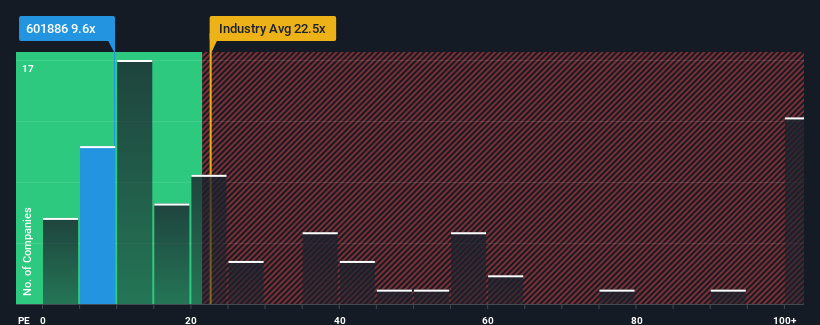

Jangho Group Co., Ltd.'s (SHSE:601886) price-to-earnings (or "P/E") ratio of 9.6x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 60x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been advantageous for Jangho Group as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Jangho Group

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Jangho Group's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 24% last year. Still, incredibly EPS has fallen 40% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 18% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 25% per year, which is noticeably more attractive.

In light of this, it's understandable that Jangho Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jangho Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Jangho Group is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Jangho Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601886

Jangho Group

Engages in architectural decoration business in Mainland China, Hong Kong, Macau, Taiwan, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives