- China

- /

- Electrical

- /

- SHSE:601877

Zhejiang Chint Electrics Co., Ltd. (SHSE:601877) Held Back By Insufficient Growth Even After Shares Climb 30%

Zhejiang Chint Electrics Co., Ltd. (SHSE:601877) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.4% over the last year.

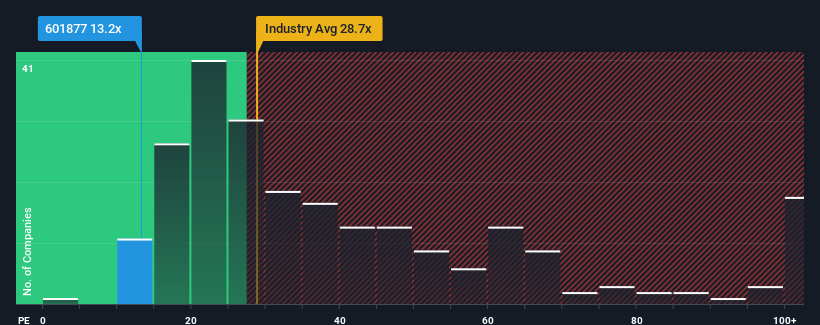

Although its price has surged higher, Zhejiang Chint Electrics' price-to-earnings (or "P/E") ratio of 13.2x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 58x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Zhejiang Chint Electrics has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Zhejiang Chint Electrics

Is There Any Growth For Zhejiang Chint Electrics?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Zhejiang Chint Electrics' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 43% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 14% per annum during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is noticeably more attractive.

With this information, we can see why Zhejiang Chint Electrics is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Zhejiang Chint Electrics' P/E

Even after such a strong price move, Zhejiang Chint Electrics' P/E still trails the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zhejiang Chint Electrics maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Zhejiang Chint Electrics.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Chint Electrics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601877

Zhejiang Chint Electrics

Through its subsidiaries, develops and sells low-voltage electrical products in China.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives