As global markets experience a resurgence, with major U.S. indices like the S&P 500 and MidCap 400 posting significant gains, investors are increasingly optimistic about cooling inflation and robust earnings reports. Amid this backdrop of economic recovery and market strength, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

First Tractor (SEHK:38)

Simply Wall St Value Rating: ★★★★★★

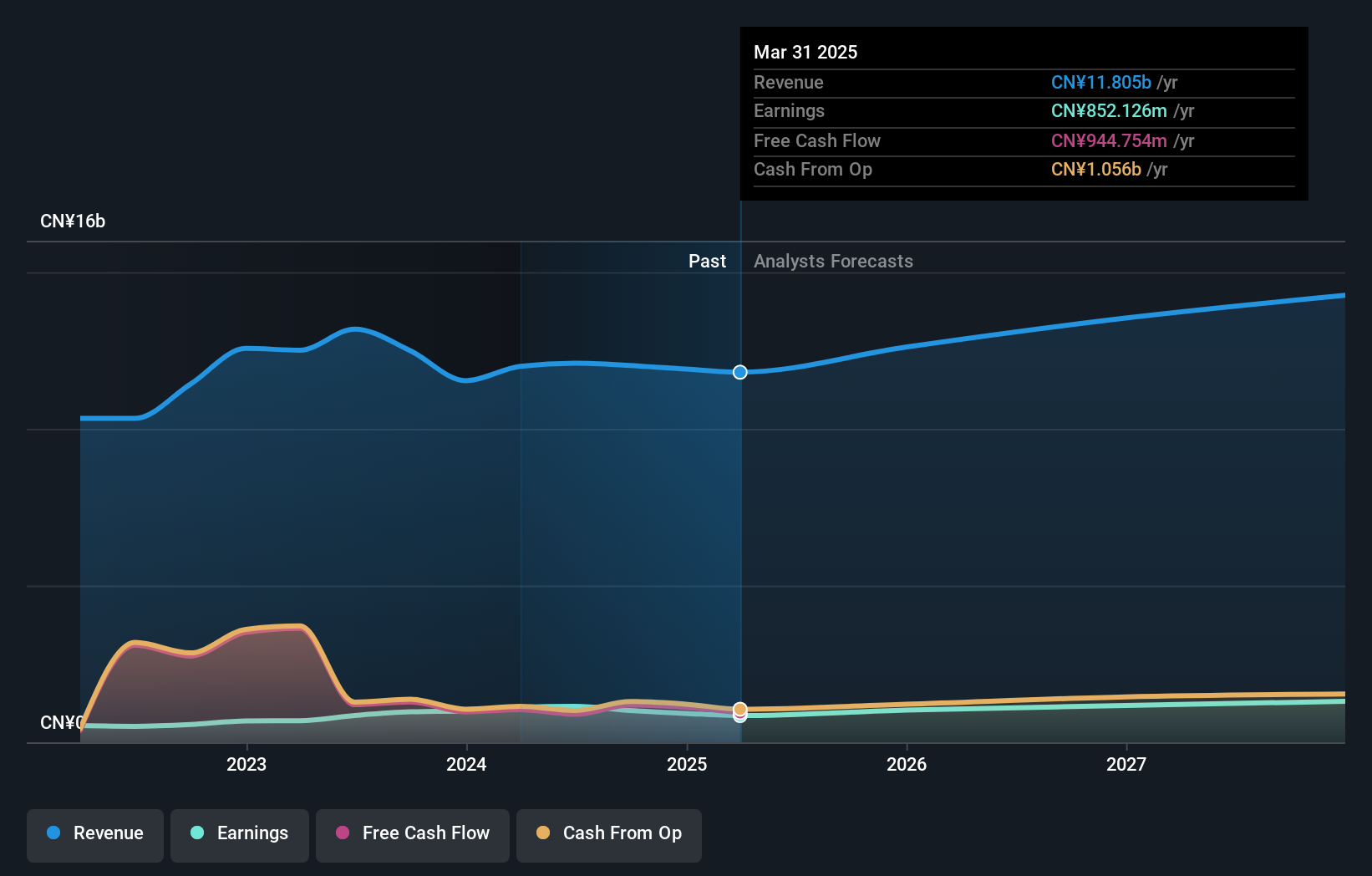

Overview: First Tractor Company Limited focuses on the research, development, manufacture, and sale of agricultural and power machinery globally, with a market capitalization of approximately HK$13.71 billion.

Operations: First Tractor derives its revenue primarily from the sale of agricultural and power machinery. The company's financial data indicates a focus on these core segments without detailed cost breakdowns or specific profit margins provided.

First Tractor, a smaller player in the machinery sector, shows a mixed performance profile. Over the past five years, earnings have grown at an impressive 39% annually, yet recent growth of 4.4% lagged behind the industry's 8.5%. The company's debt-to-equity ratio has significantly decreased from 44.6% to just 2.7%, indicating improved financial health and more cash than total debt suggests prudent management. Despite leadership changes with Mr. Li Xiaoyu's resignation and Ms. Wong Yee Man's appointment as an independent director, First Tractor remains stable with net income reaching CNY 1,100 million for the first nine months of 2024 compared to CNY 1,085 million last year.

- Take a closer look at First Tractor's potential here in our health report.

Examine First Tractor's past performance report to understand how it has performed in the past.

Shanghai Guangdian Electric Group (SHSE:601616)

Simply Wall St Value Rating: ★★★★★★

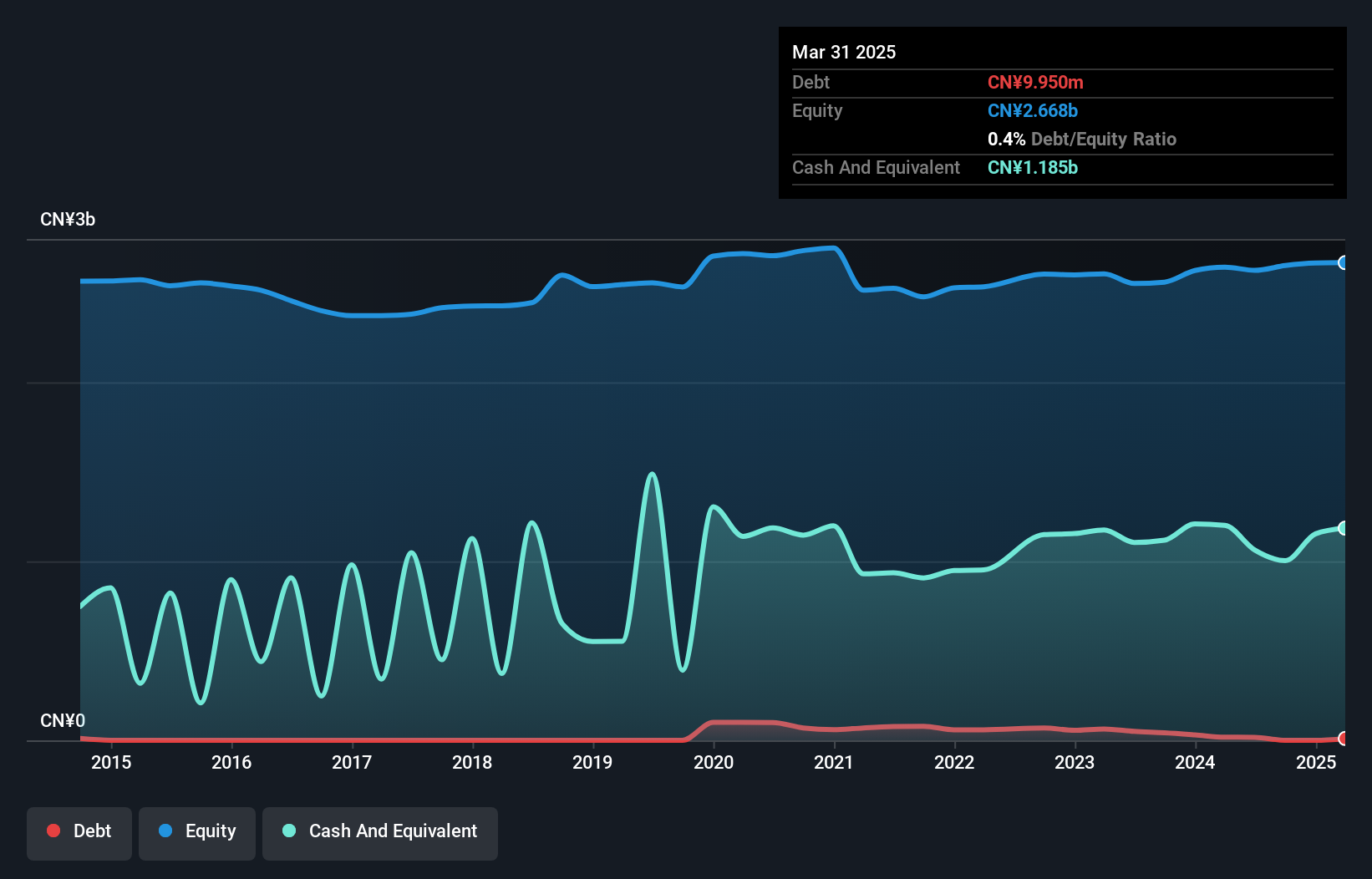

Overview: Shanghai Guangdian Electric Group Co., Ltd. operates in the electrical equipment manufacturing sector, focusing on transmission and distribution control equipment, with a market cap of CN¥3.45 billion.

Operations: Shanghai Guangdian Electric Group generates revenue primarily from its transmission and distribution control equipment manufacturing segment, amounting to CN¥935.54 million.

Guangdian Electric, a smaller player in the electrical sector, has seen its earnings skyrocket by 1568% over the past year, outpacing industry growth. The company is debt-free and enjoys positive free cash flow, suggesting financial stability. However, a notable CN¥15.6 million one-off gain influenced its recent financial results. For the nine months ending September 30, 2024, sales reached CN¥736.19 million compared to CN¥557.48 million the previous year; net income rose to CN¥47.95 million from CN¥16.11 million a year earlier with basic earnings per share increasing to CNY 0.0562 from CNY 0.0189.

- Click here to discover the nuances of Shanghai Guangdian Electric Group with our detailed analytical health report.

Understand Shanghai Guangdian Electric Group's track record by examining our Past report.

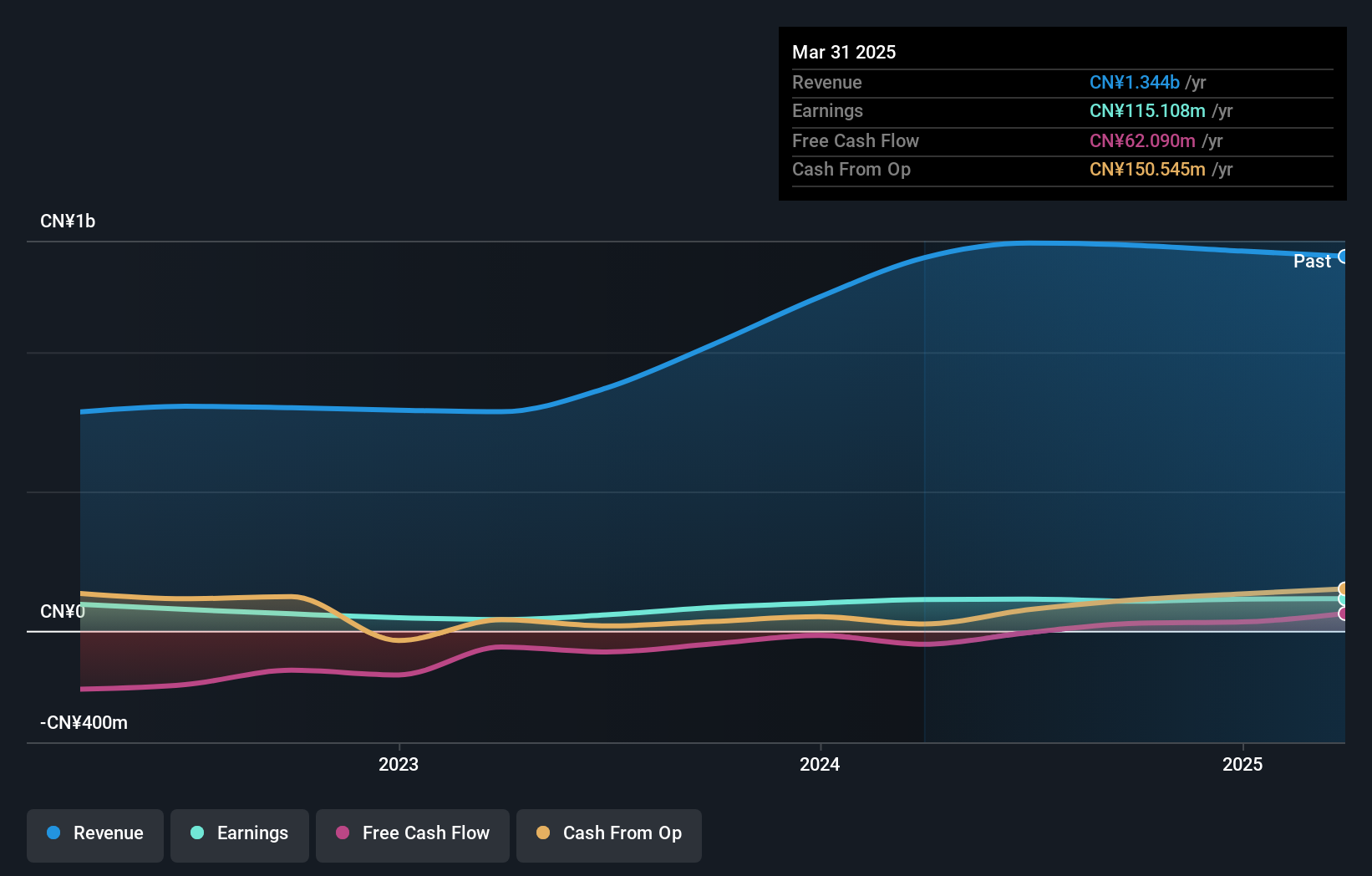

Poly Plastic Masterbatch (SuZhou)Ltd (SZSE:300905)

Simply Wall St Value Rating: ★★★★★☆

Overview: Poly Plastic Masterbatch (SuZhou) Co., Ltd specializes in the R&D, production, and sale of chemical fiber solution coloring and advanced functional modified materials globally, with a market cap of CN¥4.51 billion.

Operations: Poly Plastic Masterbatch generates revenue primarily from its industrial segment, totaling CN¥1.38 billion. The company's financial performance is reflected in its market capitalization of CN¥4.51 billion.

Poly Plastic Masterbatch (SuZhou) Ltd., a nimble player in the chemicals sector, has been making waves with its impressive earnings growth of 27% over the past year, outpacing the industry average. Despite a volatile share price recently, this company boasts high-quality earnings and more cash than total debt, suggesting financial resilience. Recent sales figures for nine months ending September 2024 hit CNY 1.01 billion compared to CNY 824.81 million previously, while net income reached CNY 80.87 million from CNY 74.22 million last year. A recent stake acquisition by Yunnan International Trust further highlights investor interest in this promising entity.

Summing It All Up

- Reveal the 4640 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300905

Poly Plastic Masterbatch (SuZhou)Ltd

Engages in the research and development, production, and sale of chemical fiber solution colorings and advanced functional modified materials in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives