- China

- /

- Electrical

- /

- SHSE:601615

Take Care Before Jumping Onto Ming Yang Smart Energy Group Limited (SHSE:601615) Even Though It's 26% Cheaper

Ming Yang Smart Energy Group Limited (SHSE:601615) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The recent drop has obliterated the annual return, with the share price now down 8.9% over that longer period.

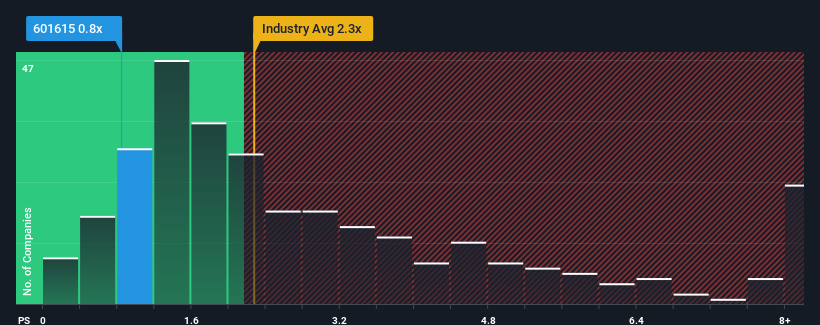

After such a large drop in price, Ming Yang Smart Energy Group may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Electrical industry in China have P/S ratios greater than 2.3x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Ming Yang Smart Energy Group

How Ming Yang Smart Energy Group Has Been Performing

Ming Yang Smart Energy Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Ming Yang Smart Energy Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Ming Yang Smart Energy Group?

In order to justify its P/S ratio, Ming Yang Smart Energy Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 50% during the coming year according to the eight analysts following the company. That's shaping up to be materially higher than the 25% growth forecast for the broader industry.

In light of this, it's peculiar that Ming Yang Smart Energy Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Ming Yang Smart Energy Group's P/S Mean For Investors?

The southerly movements of Ming Yang Smart Energy Group's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Ming Yang Smart Energy Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Ming Yang Smart Energy Group is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601615

Ming Yang Smart Energy Group

Engages in the research and development, design, manufacture, sale, maintenance, and operation of energy equipment, wind turbines, and core components in China.

Reasonable growth potential with slight risk.

Market Insights

Community Narratives