- China

- /

- Semiconductors

- /

- SHSE:603806

3 Global Growth Companies With High Insider Ownership Growing Earnings At 54%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and cautious optimism amid trade discussions, investors are closely monitoring the economic signals from major indices like the S&P 500 and Nasdaq Composite. In this environment of uncertainty, identifying growth companies with high insider ownership can be particularly appealing, as these firms often demonstrate strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.4% | 66.1% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.3% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

We're going to check out a few of the best picks from our screener tool.

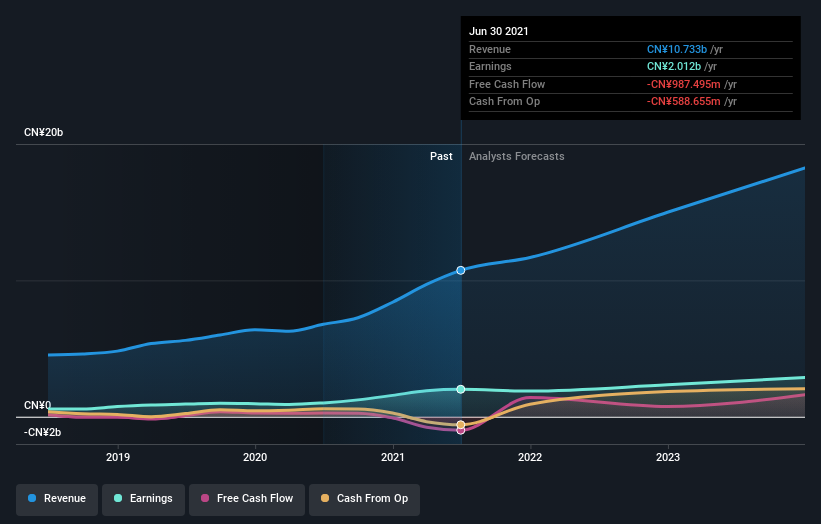

Ming Yang Smart Energy Group (SHSE:601615)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ming Yang Smart Energy Group Limited is involved in the R&D, design, manufacture, sale, maintenance, and operation of energy equipment and wind turbines in China with a market cap of CN¥22.51 billion.

Operations: Ming Yang Smart Energy Group Limited generates revenue through its activities in research and development, design, manufacturing, sales, maintenance, and operation of energy equipment and wind turbines in China.

Insider Ownership: 15.7%

Earnings Growth Forecast: 54.5% p.a.

Ming Yang Smart Energy Group has shown significant revenue growth, with recent Q1 2025 sales reaching CNY 7.70 billion, up from CNY 5.08 billion the previous year. Despite stable net income and earnings per share, the company is expected to become profitable in three years, surpassing market growth rates. Although its forecasted revenue growth of 19.4% annually is slightly below the desired threshold for high-growth companies, it remains above China's market average of 12.5%.

- Dive into the specifics of Ming Yang Smart Energy Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Ming Yang Smart Energy Group's current price could be quite moderate.

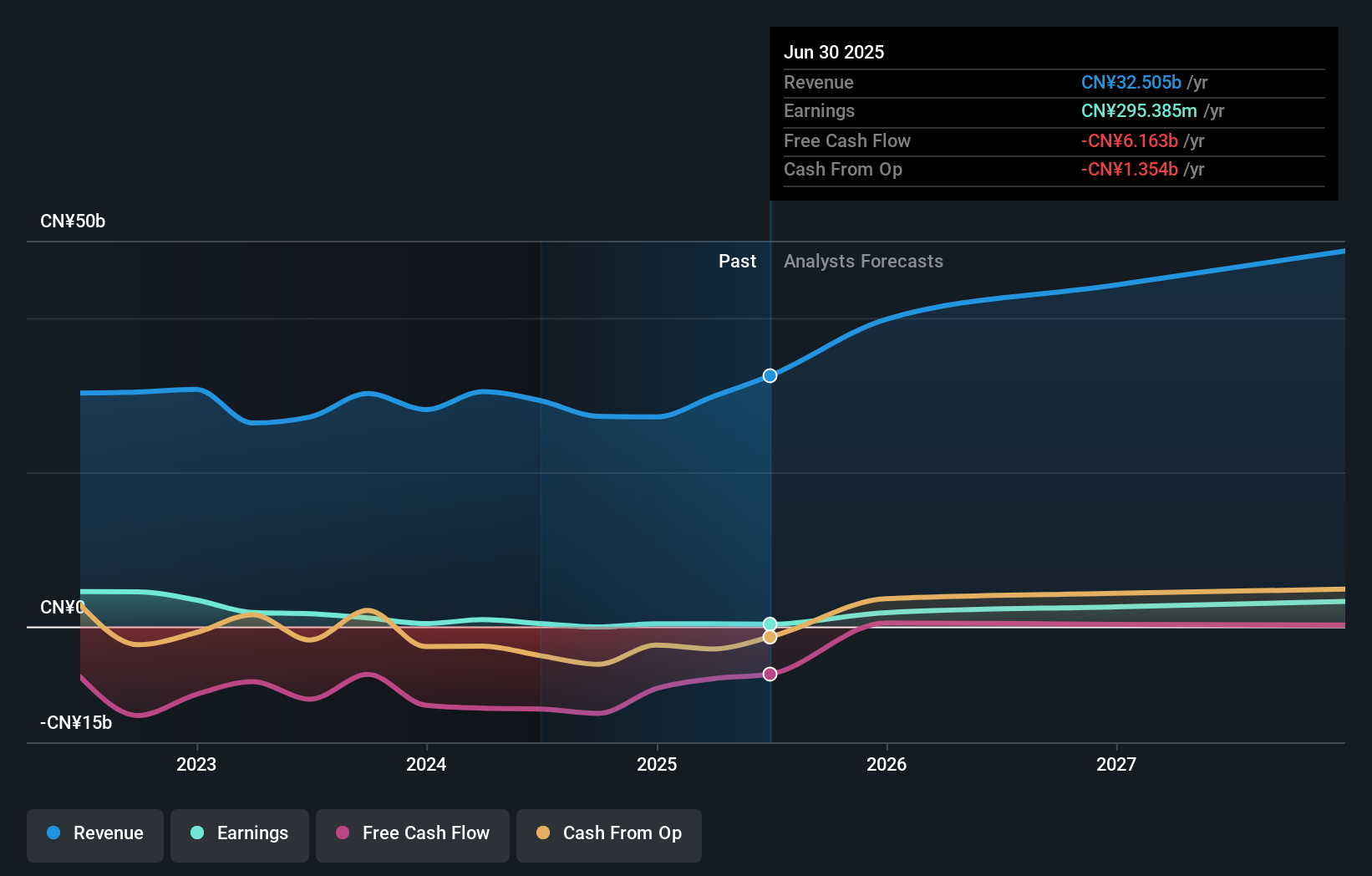

Hangzhou First Applied Material (SHSE:603806)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou First Applied Material Co., Ltd. and its subsidiaries design, develop, manufacture, and sell solar battery encapsulation materials both in China and internationally, with a market cap of CN¥32.29 billion.

Operations: Hangzhou First Applied Material Co., Ltd. generates revenue primarily through the design, development, manufacture, and sale of solar battery encapsulation materials both domestically and internationally.

Insider Ownership: 13.5%

Earnings Growth Forecast: 24% p.a.

Hangzhou First Applied Material has high insider ownership, which can align management's interests with shareholders. Despite a decline in Q1 2025 revenue to CNY 3.62 billion from CNY 5.32 billion a year ago, the company is trading at a favorable price-to-earnings ratio of 27.2x compared to the CN market's 37.6x. Forecasted earnings growth of approximately 24% annually outpaces the Chinese market average, although its return on equity is expected to be modest at 11.5%.

- Click here and access our complete growth analysis report to understand the dynamics of Hangzhou First Applied Material.

- Upon reviewing our latest valuation report, Hangzhou First Applied Material's share price might be too pessimistic.

Sonova Holding (SWX:SOON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sonova Holding AG manufactures and sells hearing care solutions for adults and children across various regions, including the United States, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of CHF15.62 billion.

Operations: The company's revenue is primarily derived from its Hearing Instruments segment, which generated CHF3.56 billion, and its Cochlear Implants segment, contributing CHF303.90 million.

Insider Ownership: 17.4%

Earnings Growth Forecast: 11.4% p.a.

Sonova Holding's insider ownership can foster alignment between management and shareholders. Trading at 22.8% below its estimated fair value, the company is considered a good relative value compared to peers. Despite high debt levels, Sonova's earnings are forecast to grow 11.39% annually, outpacing the Swiss market average of 10.8%. Revenue growth of 5.9% per year is expected to exceed the Swiss market rate of 4.2%. The recent share buyback completed for CHF 421.5 million may signal confidence in future prospects.

- Take a closer look at Sonova Holding's potential here in our earnings growth report.

- The analysis detailed in our Sonova Holding valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Investigate our full lineup of 838 Fast Growing Global Companies With High Insider Ownership right here.

- Interested In Other Possibilities? Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou First Applied Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603806

Hangzhou First Applied Material

Designs, develops, manufactures, and sells solar battery encapsulation materials in China and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives