- China

- /

- Professional Services

- /

- SZSE:300492

Ningbo Sanxing Medical ElectricLtd And 2 Other High Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets reach record highs, driven by China's robust stimulus measures and optimism around artificial intelligence, investors are increasingly looking for growth opportunities. In this favorable market environment, companies with high insider ownership often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Simply Wall St Growth Rating: ★★★★☆☆

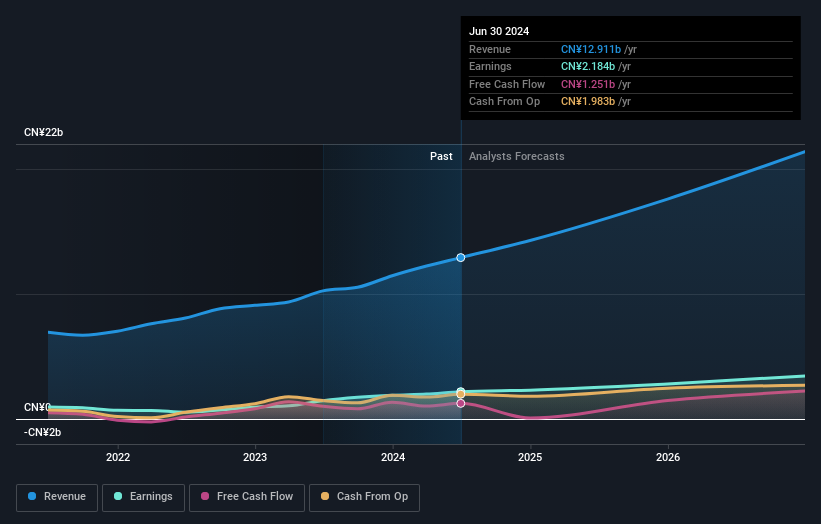

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems in China and internationally, with a market cap of CN¥49.23 billion.

Operations: Ningbo Sanxing Medical Electric Ltd. generates revenue through the manufacture and sale of power distribution and utilization systems both domestically and internationally.

Insider Ownership: 23.8%

Earnings Growth Forecast: 18.8% p.a.

Ningbo Sanxing Medical Electric Ltd. shows strong growth potential with earnings expected to grow 18.78% annually and revenue forecasted to increase by 20.4% per year, outpacing the Chinese market's growth rate of 13.2%. The company reported significant revenue and net income increases in H1 2024, indicating robust performance. Despite trading at a value below its estimated fair value and having an unstable dividend track record, high insider ownership aligns management interests with shareholders.

- Click to explore a detailed breakdown of our findings in Ningbo Sanxing Medical ElectricLtd's earnings growth report.

- Our expertly prepared valuation report Ningbo Sanxing Medical ElectricLtd implies its share price may be lower than expected.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

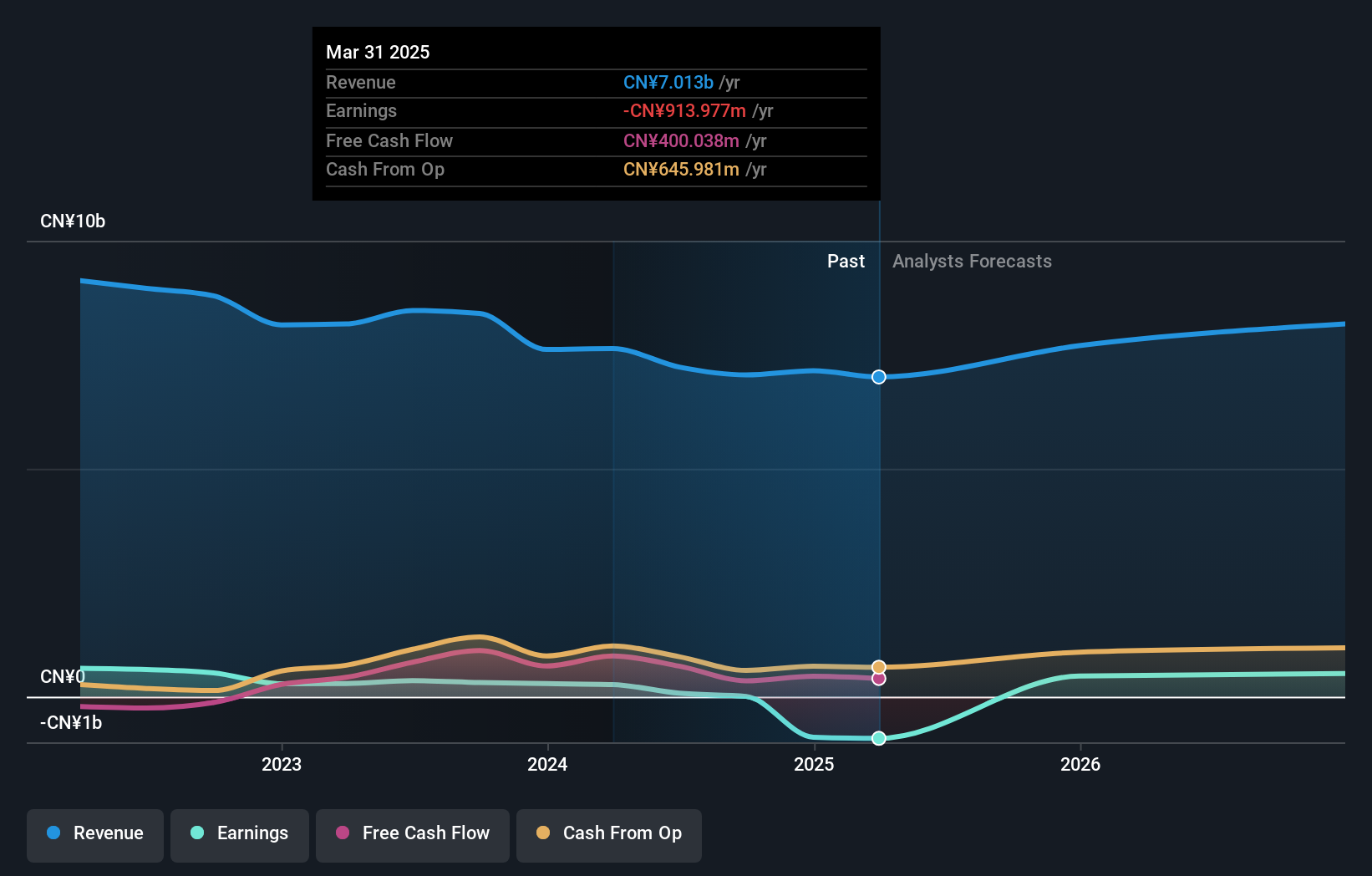

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company operating in China and internationally, with a market cap of CN¥13.27 billion.

Operations: Leyard Optoelectronic Co., Ltd. generates revenue from various segments including audio-visual technology services in China and abroad, amounting to CN¥13.27 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 59.9% p.a.

Leyard Optoelectronic demonstrates considerable growth potential with earnings forecasted to increase by 59.9% annually and revenue by 15.2% per year, outpacing the Chinese market. Despite reporting lower profit margins and net income for H1 2024, the company trades at good value compared to peers. Recent share buybacks indicate confidence in future performance, although the stock has been highly volatile over the past three months. High insider ownership aligns management interests with shareholders' goals.

- Click here and access our complete growth analysis report to understand the dynamics of Leyard Optoelectronic.

- According our valuation report, there's an indication that Leyard Optoelectronic's share price might be on the cheaper side.

Huatu Cendes (SZSE:300492)

Simply Wall St Growth Rating: ★★★★★★

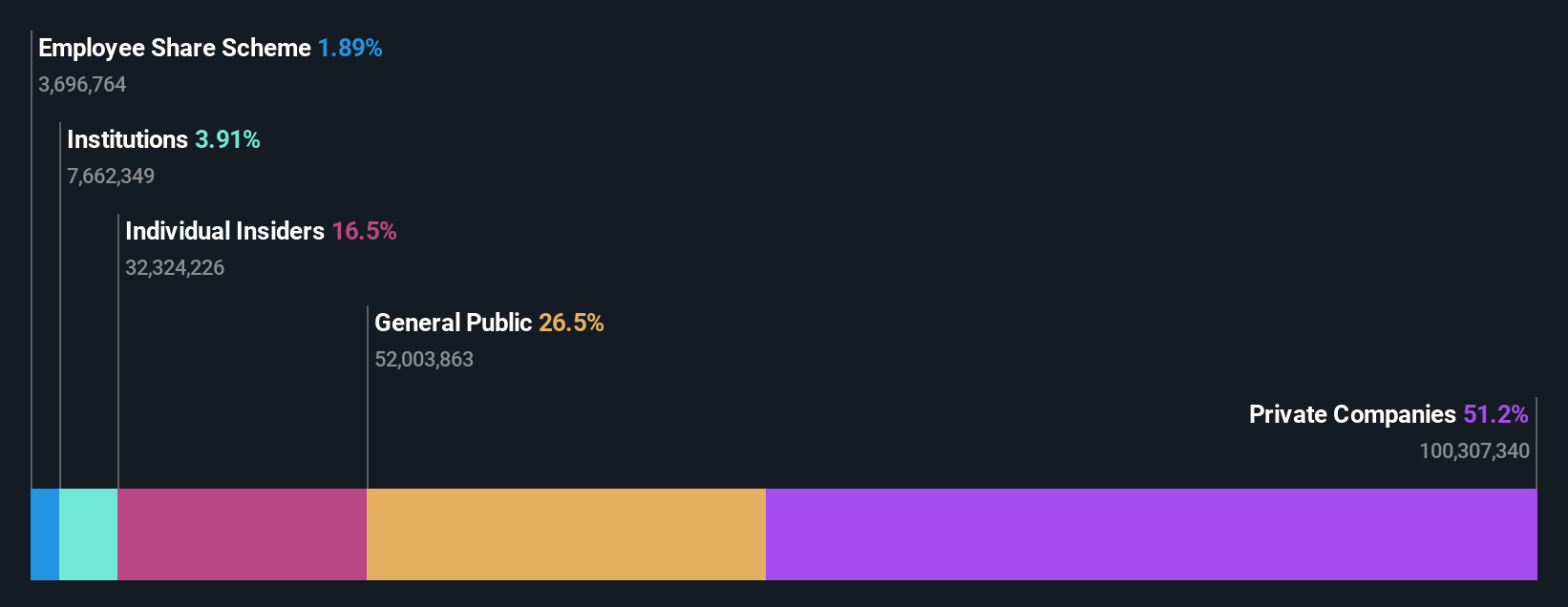

Overview: Huatu Cendes Co., Ltd. (ticker: SZSE:300492) is an architectural design company offering professional design, consulting, and engineering services to various clients in China with a market cap of CN¥12.34 billion.

Operations: The company's revenue segments include professional design, consulting, and engineering services provided to state-owned enterprises, multinational corporations, private companies, and government agencies in China.

Insider Ownership: 22.4%

Earnings Growth Forecast: 60.9% p.a.

Huatu Cendes shows strong growth potential with earnings forecasted to grow 60.86% annually and revenue by 31.3% per year, both exceeding the Chinese market averages. Despite a recent decline in profit margins from 9% to 1.9%, the company reported significant revenue growth for H1 2024, reaching CNY 1.51 billion compared to CNY 32 million a year ago, and turned a net loss into a net income of CNY 121.6 million, highlighting its robust growth trajectory and high insider ownership alignment with shareholder interests.

- Get an in-depth perspective on Huatu Cendes' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Huatu Cendes' shares may be trading at a discount.

Key Takeaways

- Unlock our comprehensive list of 1522 Fast Growing Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Huatu Cendes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300492

Huatu Cendes

Huatu Cendes Co., Ltd., an architectural design company, provides professional, designing, consulting, and engineering services to state-owned enterprises, multinational corporations, private companies, and government agencies in China.

Exceptional growth potential with excellent balance sheet.