- Japan

- /

- Industrials

- /

- TSE:4204

Three Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets continue to reach new heights, with major indices like the Dow Jones Industrial Average and S&P 500 Index hitting record intraday highs, investors are keeping a close eye on economic policies and geopolitical developments that could impact future performance. Amidst this backdrop of growth and uncertainty, dividend stocks offer a compelling opportunity for those looking to enhance their portfolios by providing potential income stability alongside capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.47% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

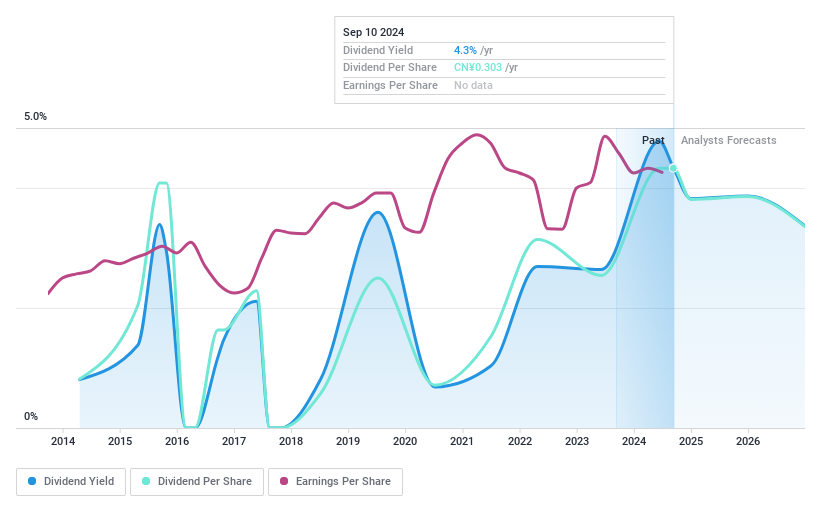

Jiangsu Linyang Energy (SHSE:601222)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Linyang Energy Co., Ltd. is a company that supplies energy meters and system products and accessories both in China and internationally, with a market cap of CN¥15.21 billion.

Operations: Jiangsu Linyang Energy Co., Ltd. generates revenue through the provision of energy meters and system products and accessories across domestic and international markets.

Dividend Yield: 4.1%

Jiangsu Linyang Energy's dividend payments have been volatile over the past decade, with a payout ratio of 56.1% indicating coverage by earnings, yet not well covered by cash flows due to a high cash payout ratio of 390.9%. Despite this instability, its dividend yield is in the top 25% of CN market payers at 4.07%. Recent earnings show growth with net income rising to CNY 910.13 million for nine months ending September 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiangsu Linyang Energy.

- Our valuation report here indicates Jiangsu Linyang Energy may be undervalued.

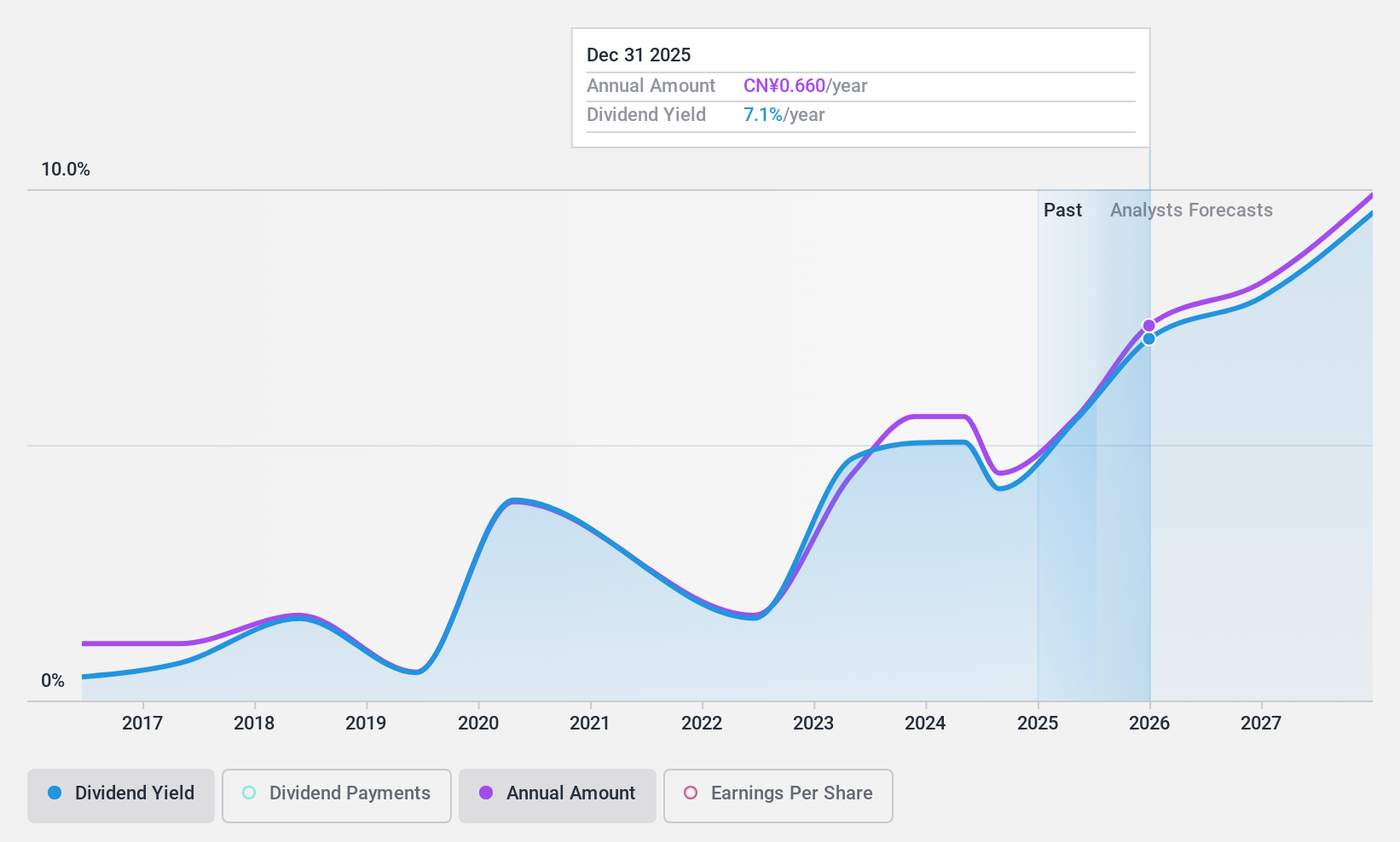

Zhejiang Jasan Holding Group (SHSE:603558)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jasan Holding Group Co., Ltd. is involved in the design, manufacture, and sale of knitted sportswear globally, with a market cap of CN¥3.69 billion.

Operations: Zhejiang Jasan Holding Group Co., Ltd. generates revenue through its international design, manufacturing, and sales operations in the knitted sportswear sector.

Dividend Yield: 3.9%

Zhejiang Jasan Holding Group's dividend yield of 3.89% ranks in the top 25% of CN market payers, though its history has been marked by volatility and unreliability over the past decade. Despite a low payout ratio of 48.8%, dividends aren't covered by free cash flows, indicating potential sustainability issues. Recent earnings growth is notable, with net income reaching CNY 263.2 million for nine months ending September 2024, supported by a share buyback program totaling CNY 100.03 million this year.

- Get an in-depth perspective on Zhejiang Jasan Holding Group's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Zhejiang Jasan Holding Group is priced lower than what may be justified by its financials.

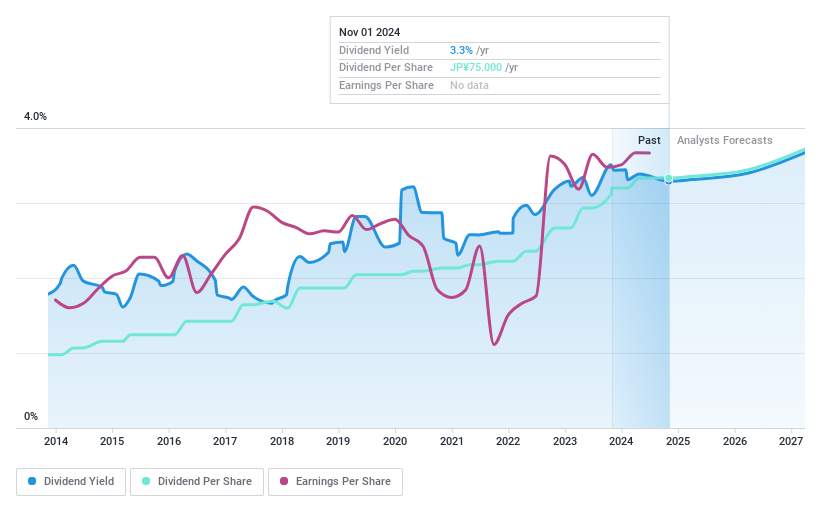

Sekisui Chemical (TSE:4204)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sekisui Chemical Co., Ltd. operates in the housing, urban infrastructure and environmental products, high performance plastics, and medical sectors with a market cap of ¥1.01 trillion.

Operations: Sekisui Chemical Co., Ltd.'s revenue is primarily derived from its Housing segment at ¥518.52 billion, High Performance Plastics at ¥433.73 billion, Environment and Lifelines at ¥238.56 billion, and Medical segment at ¥96.82 billion.

Dividend Yield: 3.1%

Sekisui Chemical's dividend payments are covered by earnings and cash flows, with a payout ratio of 41.9% and a cash payout ratio of 57.9%. However, the dividends have been volatile over the past decade. Recently, Sekisui announced an increase in its quarterly dividend to ¥37 per share from ¥35. The company revised its earnings guidance upward for FY2025, projecting net sales of ¥1.31 trillion and operating profit of ¥105 billion.

- Dive into the specifics of Sekisui Chemical here with our thorough dividend report.

- Our valuation report here indicates Sekisui Chemical may be overvalued.

Turning Ideas Into Actions

- Access the full spectrum of 1963 Top Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4204

Sekisui Chemical

Engages in the housing, urban infrastructure and environmental products, high performance plastics, and medical businesses.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives