- China

- /

- Electronic Equipment and Components

- /

- SZSE:300370

Shaanxi Construction MachineryLtd And 2 Other Global Penny Stocks Worth Watching

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with U.S. stocks experiencing volatility yet ending the week on a positive note, buoyed by easing trade tensions and supportive monetary policy signals from the Federal Reserve. In this context, investors often seek opportunities in various corners of the market, including penny stocks—an investment area that remains relevant despite its seemingly outdated name. These smaller or newer companies can offer unique growth potential when supported by strong financials, making them worth watching for those looking to uncover hidden value.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.50 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.68 | A$407.57M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.58 | MYR294.92M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.18 | SGD478.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.33 | MYR534.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.18 | SGD12.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.54 | $313.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.045 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,590 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Shaanxi Construction MachineryLtd (SHSE:600984)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shaanxi Construction Machinery Co., Ltd is involved in the research, development, manufacture, and leasing of machinery both in China and internationally, with a market cap of CN¥4.78 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for Shaanxi Construction Machinery Co., Ltd.

Market Cap: CN¥4.78B

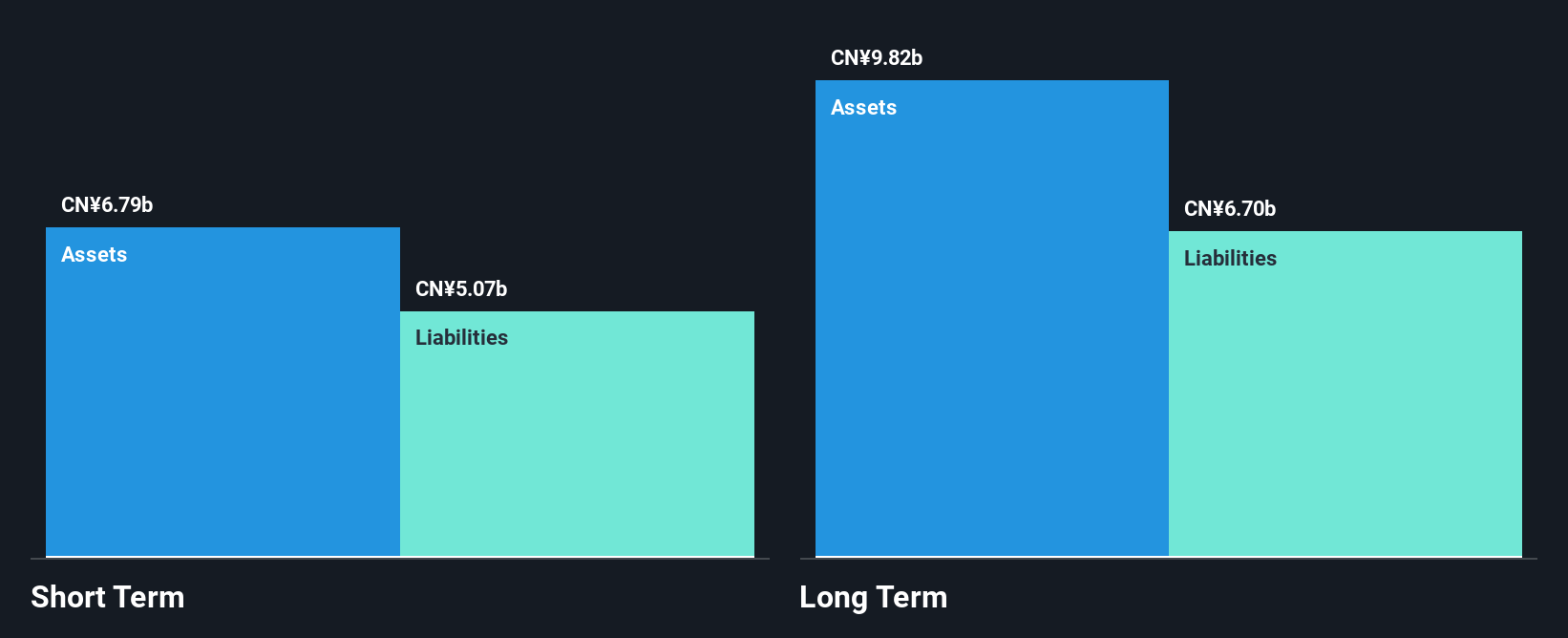

Shaanxi Construction Machinery Co., Ltd, with a market cap of CN¥4.78 billion, has faced challenges as it remains unprofitable, reporting a net loss of CN¥447.44 million for the half-year ending June 2025. Despite this, the company maintains a strong cash position with short-term assets exceeding both its short and long-term liabilities, providing a cash runway exceeding three years if current free cash flow trends continue positively. While revenue is forecasted to grow at nearly 14% annually, high debt levels and increasing losses pose significant risks to investors considering this stock within the volatile penny stock category.

- Click here and access our complete financial health analysis report to understand the dynamics of Shaanxi Construction MachineryLtd.

- Examine Shaanxi Construction MachineryLtd's earnings growth report to understand how analysts expect it to perform.

Zhejiang Yasha DecorationLtd (SZSE:002375)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Yasha Decoration Co., Ltd operates in China, focusing on building and curtain wall decoration as well as intelligent system integration, with a market cap of CN¥5.10 billion.

Operations: The company's revenue is primarily derived from the Building Decoration Industry, which accounts for CN¥10.86 billion, followed by the Manufacturing Industry at CN¥308.68 million.

Market Cap: CN¥5.1B

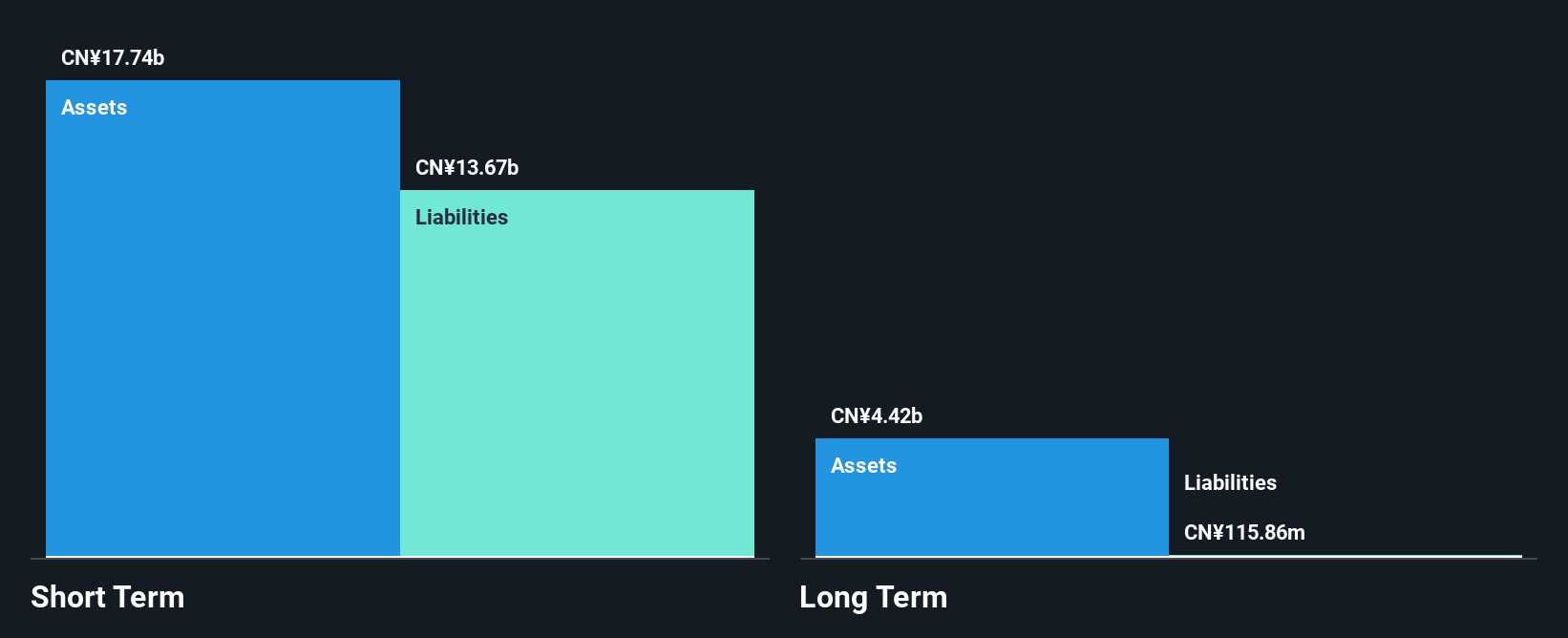

Zhejiang Yasha Decoration Co., Ltd, with a market cap of CN¥5.10 billion, operates primarily in the Building Decoration Industry, generating substantial revenue of CN¥10.86 billion. The company's financial health appears robust with short-term assets (CN¥17.7 billion) comfortably covering both short and long-term liabilities, and its debt well-managed by operating cash flow at 45.3%. Recent earnings growth of 16.2% surpasses industry averages, though Return on Equity remains low at 3.6%. Despite stable weekly volatility and high-quality earnings, the board's average tenure suggests inexperience which could impact strategic direction amidst recent bylaw changes and director elections.

- Jump into the full analysis health report here for a deeper understanding of Zhejiang Yasha DecorationLtd.

- Understand Zhejiang Yasha DecorationLtd's earnings outlook by examining our growth report.

Sichuan Etrol Technologies (SZSE:300370)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sichuan Etrol Technologies Co., Ltd. focuses on the research, development, manufacture, and sale of automation products both in China and internationally, with a market cap of CN¥4.51 billion.

Operations: Revenue Segments: No Revenue Segments Reported

Market Cap: CN¥4.51B

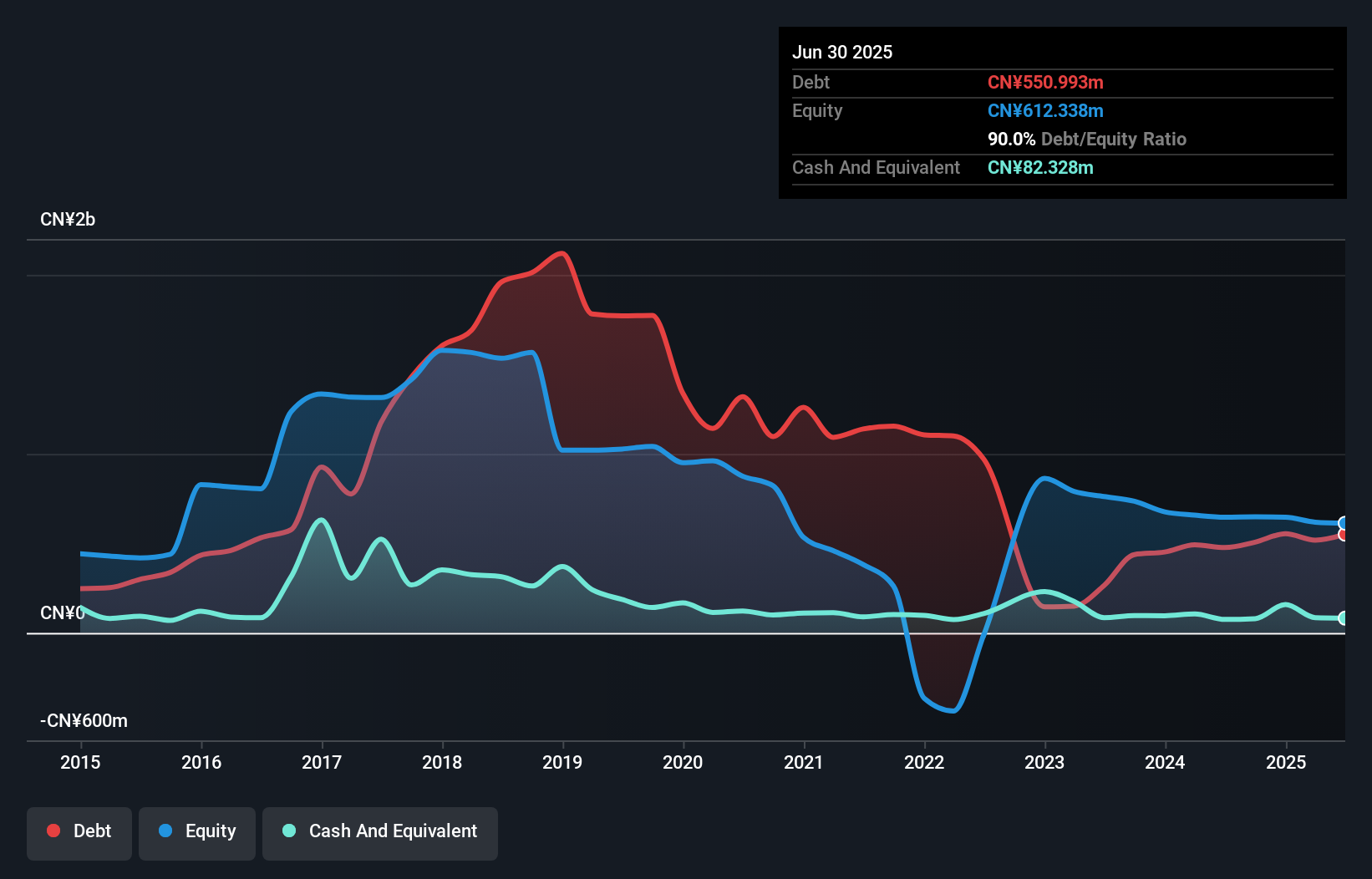

Sichuan Etrol Technologies, with a market cap of CN¥4.51 billion, has shown revenue growth, reporting CN¥137.29 million for the half year ending June 2025. Despite being unprofitable with a net loss of CN¥32.88 million, losses have decreased by 20.8% annually over five years. The company maintains more than a year's cash runway if free cash flow remains stable but faces challenges if it declines at historical rates. Short-term assets exceed liabilities, yet high net debt to equity at 76.5% raises concerns about financial leverage amidst management's inexperience and upcoming amendments to its articles of association.

- Dive into the specifics of Sichuan Etrol Technologies here with our thorough balance sheet health report.

- Evaluate Sichuan Etrol Technologies' historical performance by accessing our past performance report.

Taking Advantage

- Discover the full array of 3,590 Global Penny Stocks right here.

- Seeking Other Investments? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300370

Sichuan Etrol Technologies

Engages in the research, development, manufacture, and sale of automation products in China and internationally.

Adequate balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives