Anhui Heli Co.,Ltd. (SHSE:600761) Stock Catapults 32% Though Its Price And Business Still Lag The Market

Anhui Heli Co.,Ltd. (SHSE:600761) shareholders have had their patience rewarded with a 32% share price jump in the last month. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

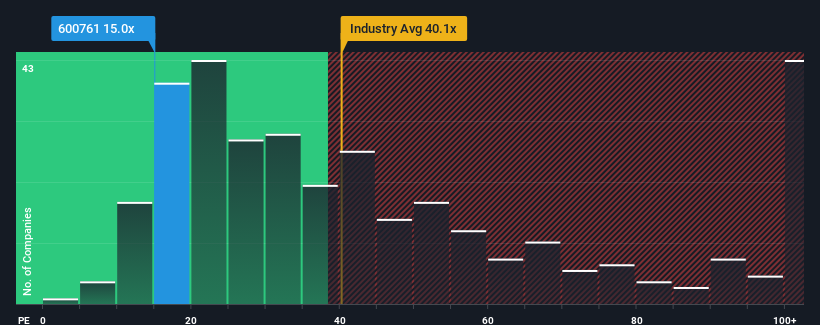

Even after such a large jump in price, Anhui HeliLtd's price-to-earnings (or "P/E") ratio of 15x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 39x and even P/E's above 75x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Anhui HeliLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Anhui HeliLtd

Is There Any Growth For Anhui HeliLtd?

The only time you'd be truly comfortable seeing a P/E as depressed as Anhui HeliLtd's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 8.1%. The latest three year period has also seen an excellent 78% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 6.1% during the coming year according to the ten analysts following the company. That's shaping up to be materially lower than the 37% growth forecast for the broader market.

With this information, we can see why Anhui HeliLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Anhui HeliLtd's P/E?

Even after such a strong price move, Anhui HeliLtd's P/E still trails the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Anhui HeliLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Anhui HeliLtd (1 doesn't sit too well with us) you should be aware of.

If you're unsure about the strength of Anhui HeliLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600761

Anhui HeliLtd

Engages in the manufacture and sale of industrial vehicles in the People’s Republic of China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives