- China

- /

- Electrical

- /

- SHSE:600580

Wolong Electric Group Co.,Ltd.'s (SHSE:600580) 57% Share Price Surge Not Quite Adding Up

The Wolong Electric Group Co.,Ltd. (SHSE:600580) share price has done very well over the last month, posting an excellent gain of 57%. The last month tops off a massive increase of 153% in the last year.

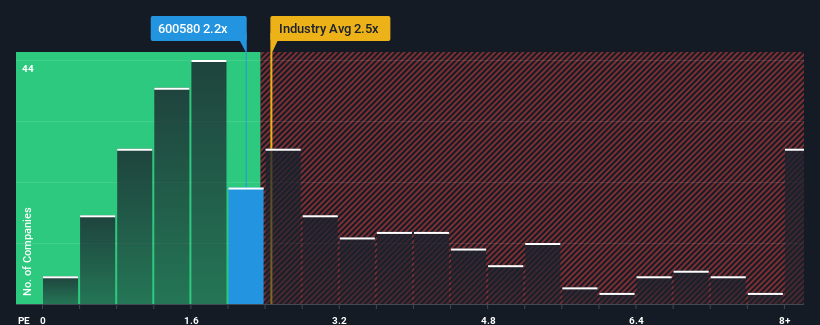

Even after such a large jump in price, it's still not a stretch to say that Wolong Electric GroupLtd's price-to-sales (or "P/S") ratio of 2.2x right now seems quite "middle-of-the-road" compared to the Electrical industry in China, where the median P/S ratio is around 2.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Wolong Electric GroupLtd

How Wolong Electric GroupLtd Has Been Performing

While the industry has experienced revenue growth lately, Wolong Electric GroupLtd's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wolong Electric GroupLtd.How Is Wolong Electric GroupLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Wolong Electric GroupLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 14% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 15% as estimated by the two analysts watching the company. With the industry predicted to deliver 24% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that Wolong Electric GroupLtd's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now Wolong Electric GroupLtd's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Wolong Electric GroupLtd's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Wolong Electric GroupLtd has 3 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Wolong Electric GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wolong Electric GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600580

Wolong Electric GroupLtd

Manufactures and sells motors and drives worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives