- China

- /

- Electrical

- /

- SHSE:600580

Can Mixed Fundamentals Have A Negative Impact on Wolong Electric Group Co.,Ltd. (SHSE:600580) Current Share Price Momentum?

Wolong Electric GroupLtd's (SHSE:600580) stock is up by a considerable 53% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. In this article, we decided to focus on Wolong Electric GroupLtd's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Wolong Electric GroupLtd

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Wolong Electric GroupLtd is:

2.4% = CN¥267m ÷ CN¥11b (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every CN¥1 of its shareholder's investments, the company generates a profit of CN¥0.02.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Wolong Electric GroupLtd's Earnings Growth And 2.4% ROE

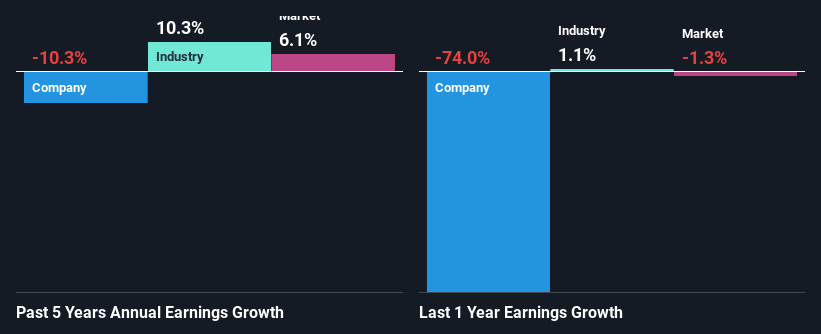

It is quite clear that Wolong Electric GroupLtd's ROE is rather low. Not just that, even compared to the industry average of 6.4%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 10% seen by Wolong Electric GroupLtd over the last five years is not surprising. We reckon that there could also be other factors at play here. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

So, as a next step, we compared Wolong Electric GroupLtd's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 10% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Wolong Electric GroupLtd's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Wolong Electric GroupLtd Efficiently Re-investing Its Profits?

Wolong Electric GroupLtd's low three-year median payout ratio of 22% (implying that it retains the remaining 78% of its profits) comes as a surprise when you pair it with the shrinking earnings. The low payout should mean that the company is retaining most of its earnings and consequently, should see some growth. So there could be some other explanations in that regard. For example, the company's business may be deteriorating.

Moreover, Wolong Electric GroupLtd has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

In total, we're a bit ambivalent about Wolong Electric GroupLtd's performance. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Wolong Electric GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600580

Wolong Electric GroupLtd

Manufactures and sells motors and drives worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026